When people go the the grocery store and see ever higher prices they know how inflation affects them. But when they are feeling more philosophical they might reason that if all wages and prices increased at the same rate it would all balance out in the end right? Well theoretically yes but in reality it never works that way. Prices of various items all increase at different rates so some people are benefiting while others suffer. Those on fixed incomes suffer the most because the cost of things they are buying increases but their income stays the same. This is where COLA or "Cost Of Living Allowance" comes in it is an adjustment that is made to compensate for the increase in prices due … [Read more...]

Wanna Beat Inflation?

In a recent article entitled Is Gold really a good Inflation Hedge? I showed the history of Gold and how it really was a fear hedge rather than an inflation hedge. Interestingly, I just read an article entitled "Wanna Beat inflation? Forget Commodities!" by newsletter author Dan Ferris. It seems almost like heresy to hear that statement from Dan since he writes commodity and oil-based newsletters. But some of the statistics he presented were very interesting so I thought I would pass them along to you. … [Read more...]

It’s All the Same Market in a Deflationary Environment

On September 22, the Dow and S&P opened down over 2.5%. Oil was down, copper was down, and even GOLD was down sharply. Watch this video excerpt from Robert Prechter's special video issue of the August Elliott Wave Theorist where he explains what is causing diverse markets such as these to move together in today's environment. Free Report: Stocks -- Buying Opportunity or Another "Free Fall" Ahead?Find out what these market moves mean to your investments with current analysis from Elliott Wave International. Bob Prechter has just released a FREE report -- with urgent analysis from his August and September 2011 Elliott Wave Theorist market letters, including another video … [Read more...]

The Way Out of Our Economic Mess

By Terry Coxon, Casey Research "A rock and a hard place" is a long-running theme of Casey Research publications. It refers to the dilemma the US government has wandered into with its continued policy of rescue inflation. The "rock" is what will happen if the Fed pauses for long in printing still more money – the collapse of an economy burdened by an accumulation of mistakes that rescue inflation has been keeping at bay. The "hard place" is the disruptive price inflation that becomes more likely (and likely more severe) with every new dollar the Fed prints to keep the effects of those mistakes suppressed. When the dollar was cut loose from the gold standard in 1971, the Federal Reserve … [Read more...]

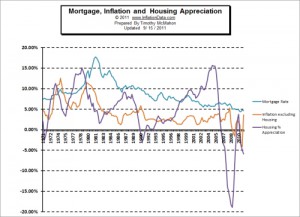

Real Mortgage Rates

What is the Real Mortgage Rate? At InflationData we are constantly talking about "real rates" typically by that we mean the inflation adjusted price. For instance we publish the inflation adjusted price of Oil, the inflation adjusted price of Gold, inflation adjusted stock prices and even the inflation adjusted cost of getting an education. But today when we are talking about Real Mortgage Rates we are not talking simply about the inflation adjusted price of a mortgage. To calculate the real cost of your mortgage you must also take the appreciation of your house into account. So for example if your mortgage rate is 5% but your house appreciates 5% your real mortgage rate is zero. The … [Read more...]

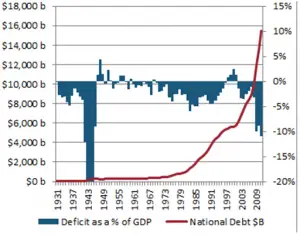

Is the US Monetary System on the Verge of Collapse?

By David Galland, Casey Research Tune into CNBC or click onto any of the dozens of mainstream financial news sites, and you’ll find an endless array of opinions on the latest wiggle in equity, bond and commodities markets. As often as not, you'll find those opinions nestled side by side with authoritative analysis on the outlook for the economy, complete with the author’s carefully studied judgment on the best way forward. Lost in all the noise, however, is any recognition that the US monetary system – and by extension, that of much of the developed world – may very well be on the verge of collapse. Falling back on metaphor, while the world’s many financial experts and economists sit … [Read more...]

Is a Stock Market Crash Inflationary or Deflationary?

Recently a subscriber asked me the question above, he gave quite correct arguments about how the stock market is "a zero sum game" in other words for every buyer there is a seller, so overall everything should stay in balance. But as I'm sure you know there are at least 3 ways to measure money supply M1, M2 and M3. Each one includes increasingly broad definitions. From just cash equivalents up to including all sorts of time deposits and Government debts. But what they don't include is stock valuations, however if the price of your stocks increases you feel richer and are more likely to spend money from your other accounts because you know if you need the money you can always sell your … [Read more...]

Money Multiplier

What is the Money Multiplier? In a fractional reserve system like we have here in the United States, money is loaned out by banks and by law they are only required to have a fraction of the amount they loan out. For example, they might be required to keep 10% in reserves. In other words, they may have $10 million dollars in deposits but because not everyone will come in to claim their dollars at once the bank may loan out $9 million dollars. But the multiplication doesn't end there. The $9 million will be deposited at another bank and that bank can loan out 90% of that or $8.1 million. And that will be deposited in another bank, who can loan out another 90% and so on. In our article, How … [Read more...]

Velocity of Money

What is the velocity of money? Simply defined, the velocity of money is the turnover in the money supply. A shop owner can measure how fast his inventory is selling by calculating "inventory turnover." To do that, he simply calculates Total Sales ÷ Average Inventory for the period in question. See: Inventory TurnOver for more information. But if you expand the idea of turnover to the entire country, you get the "Velocity of Money". Strictly speaking all the velocity of money tells us is how long people hold onto their money. But from that we can infer their motives and perceptions of the economy in general... The Velocity of Money Calculation To Calculate the Velocity of Money, you … [Read more...]

How Wealth Can Simply Evaporate

In the following article Bob Stokes of Elliottwave explains why in times of credit expansion money is created out of thin air and in times of credit contraction money can simply disappear... no matter how much the government prints out of thin air. This results in a negative "money multiplier" as more money disappears than is created. See my article on Velocity of Money and the Money Multiplier for more information.~Tim McMahon, Editor Evaporation of Wealth on a Vast Scale How $1-million can disappear By Bob Stokes The bursting of the "debt bubble" which started in 2008 is far from over. It's the financial story of our age and it's happening before our eyes. The full scope is hard to … [Read more...]