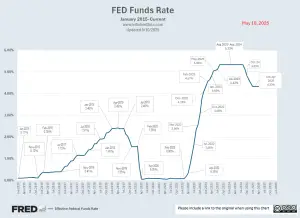

At the conclusion of the Jackson Hole, Wyoming, FED meeting, Chairman Powell indicated that FED policy was changing. Recent FED History The Federal Reserve Act of 1977 modified the original act that established the Federal Reserve in 1913. The new policy gave the FED a “Dual Mandate” so they would no longer be tasked with just keeping inflation low but would simultaneously try to maintain “maximum employment”. Of course, these are sort of mutually exclusive. If the FED pumps a lot of liquidity into the market, unemployment goes down, but simultaneously inflation goes up, and vice versa if the FED gets too restrictive. So, the FED tried to walk a tightrope between the two extremes and set … [Read more...]

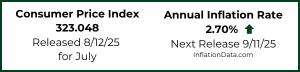

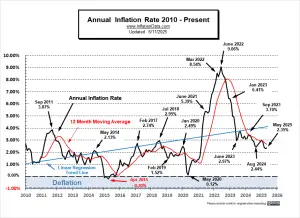

July Inflation Report

The U.S. Bureau of Labor Statistics released its July 2025 Inflation report on August 12th, 2025. The report showed that Annual Inflation was unchanged at 2.7%. Calculated to two digits, it was 2.67% in June and 2.70% in July. So, although the BLS says it was unchanged it was actually up VERY slightly. The market responded positively with the NYSE up 226.57 points. July’s Inflation Prediction: At 2.70%, July inflation numbers came in between last month’s “likely low” and “extreme low” projections, which is about as good as we could hope for. Go here to view our current MIP projection. … [Read more...]

AI Is Deflationary But Its Energy Demand Could Fuel Inflation

Artificial intelligence is being heralded as one of the most transformative technologies of all time, with the potential to radically improve productivity, reduce costs, and drive economic growth. But as the AI revolution unfolds, a paradox is emerging: AI has deep deflationary potential, yet its explosive demand for electricity and infrastructure introduces inflationary pressures. Understanding these contradictory forces is essential to understanding how Artificial Intelligence could shape macroeconomic trends in the coming decade. The Deflationary Power of AI AI’s primary deflationary force lies in its ability to automate tasks across every sector of the economy — from legal document … [Read more...]

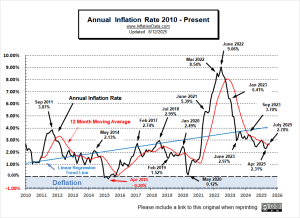

June Inflation Up Again

The U.S. Bureau of Labor Statistics released its June 2025 Inflation report on July 15th, 2025. The report showed that Annual Inflation was up from 2.4% in May to 2.7% in June. Calculated to two digits, it was really 2.35% in May and 2.67% in June. Economists were predicting higher inflation, of 2.6% while our MIP was projecting an "Extreme High" of 2.63%. The NYSE responded by falling about 1% on the day, on fears that this might postpone the FED's rate cuts even further. June's Inflation Prediction: At 2.67%, June's inflation numbers came in slightly above last month's "extreme high" projection. … [Read more...]

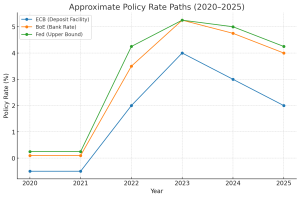

FED’s Semiannual Monetary Policy Report

Federal Reserve Chairman Jerome Powell delivered his semiannual Monetary Policy Report to Congress on June 24th and to the Senate Banking Committee on June 25th. Powell noted that U.S. real GDP expanded roughly 2.5% over the past year, supported by resilient consumer spending and a still-solid labor market. Payroll growth averaged about 124,000 jobs per month in the first five months of 2025—slower than the pace seen during the post-pandemic boom but still consistent with a gradually cooling economy. Inflation, however, remains somewhat above target. The Fed’s preferred gauge, core PCE inflation, is running near 2.6%, with overall personal consumption expenditures (PCE) around 2.3%, … [Read more...]

What Is the Trimmed Mean CPI and What Is It Good For?

Inflation is one of the most important indicators that economists, policymakers, and financial markets monitor to understand the health of the economy. However, inflation data can often be "noisy", with prices for some goods and services swinging wildly from month to month. This can be due to supply shocks, seasonal changes, or temporary anomalies. For instance, a frost in California can drive up the price of Orange Juice, a war in the Middle East can spike the price of oil, or rumors of a new tariff can affect the cost of electronics from China. To address this issue and get a clearer picture of underlying inflation trends, economists have developed alternative measures that strip out this … [Read more...]

May 2025 Inflation Up Slightly

The U.S. Bureau of Labor Statistics released its May 2025 Inflation report on June 11th, 2025. The report showed that Annual Inflation was up from 2.3% in April to 2.4% in May. Calculated to two digits, it was really 2.31% in April, and 2.35% in May (not even 1/10th% up). And still below the 2.39% in March. Economists were predicting higher inflation, so the slight increase was basically a non-event. Economists were predicting higher inflation, so the slight increase was basically a non-event. May's Inflation Prediction: At 2.35%, May inflation numbers came in at last month's "extreme low" projection, indicating that inflation could have been worse. … [Read more...]

The Truth About Why Gold Is Surging

For thousands of years, gold (and to a lesser extent silver) have been mediums of exchange and methods of preserving wealth over time. Throughout 2024 and 2025, gold prices have been surging, driven by a combination of central bank buying, shifts away from U.S. dollar dominance, and a fear of financial exclusion, i.e., “debanking”. Let's examine why gold is surging, the evolving narrative surrounding gold, Central Banks, and cryptocurrencies. Record-Breaking Price Momentum According to the World Gold Council, during the first quarter of 2025, the London PM price of gold averaged US$ $2,860 per ounce, representing a 38 percent annual increase and setting new quarterly records. On May … [Read more...]

April Inflation Down Slightly

The U.S. Bureau of Labor Statistics released its April 2025 Inflation report on May 13th, 2025. The report showed that Annual Inflation was down from 2.4% in March to to 2.3% in April. Calculated to two digits, it was 2.39% in March and 2.31% in April. Although this month's numbers look good, there is a distinct possibility that low inflation won't last. (See this month's MIP). April's Inflation Prediction: At 2.31%, April inflation numbers came in between last month's "likely low" and "extreme low" projections. … [Read more...]

FED Holds Steady at May Meeting

On May 7, 2025, the Federal Open Market Committee held the FED funds target rate at 4.25% to 4.50%, a level unchanged since December 2024. In his statement, Chairman Jerome Powell said that, while economic growth remains solid, uncertainty has risen markedly amid evolving trade policies and global supply-chain strains saying, “If the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth and an increase in unemployment.” Chair Jerome Powell underscored at the post-meeting press conference that the current policy stance is “in a good place” but that the Fed will “await further clarity” before altering … [Read more...]