The FED's target yearly inflation rate in the U.S. is about 2%, but the long term average is more like 3% and depending on ongoing economic conditions, this rate can significantly increase, affecting the financial health of individuals across the country. Though keeping an eye on the economy can help you make decisions to brace against the impact of inflation, developing sound investments can help you protect your wealth no matter the rate. Take a look below for a few central items to consider when preserving your finances against inflation. Diversify your Portfolio Portfolio diversification is crucial for maintaining optimal financial health. Your investments should vary in asset class … [Read more...]

Hyperinflation- How a Trickle Can Turn into a Flood

In 1903, a lawyer in Germany took out an insurance policy and made payments on it faithfully. When the policy came due in twenty years, he cashed it in and bought a single loaf of bread with the proceeds. He was fortunate. If he had waited a few days longer, the money he received would have bought no more than a few crumbs. Germany had been on the usual fractional reserve gold standard prior to World War I, with the Reichsbank—its central bank—expanding the money supply at a “mild” 1–2 percent inflation rate. When war broke out in 1914, the government followed the standard policy of deficit spending rather than attempting to raise taxes. The Reichsbank’s role was to monetize the … [Read more...]

Inflation, High Inflation, and Hyperinflation

The following article was written by Dr. Thorsten Polleit and was originally published in October 2022. Since then, inflation has come down significantly, but his analysis is still valid. Dr. Polleit is Chief Economist of Degussa Bank and an Honorary Professor at the University of Bayreuth. He also acts as an investment advisor. ~Tim McMahon, editor. Inflation, High Inflation, and Hyperinflation The word “inflation” is heard and read everywhere these days. However, since different people sometimes have very different understandings of inflation, here is a definition: Inflation is the sustained rise in the prices of goods across the board. This definition conveys that inflation … [Read more...]

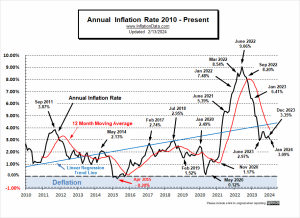

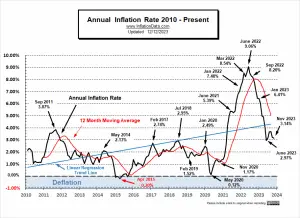

January 2024 Annual Inflation Down Despite High Monthly Inflation

According to the Bureau of Labor Statistics CPI report released on February 13th, Annual Inflation was down to 3.1% in January from 3.4% in December. (but since we calculate it to two digits, it was actually 3.09% in January and 3.35% in December.) Monthly inflation was -0.10% in December and 0.54% in January. But since inflation is highest in the first quarter of the year, these numbers are not unusual. But in January 2023 monthly inflation was 0.80%, so annual inflation is lower in 2024. The BLS's Seasonally adjusted monthly rate for January was 0.30%, the same as December 2023. As you can see from our MIP projection from last month, inflation was at the high end of our range. … [Read more...]

Industries Most Affected by Inflation: Insights from the Global Supply Chain

Inflation has rocked the world in recent years. The pandemic, global conflict, and dramatic changes in consumer spending caused inflation to spike to 11.1% worldwide before retreating. High inflation rates are, of course, bad for consumers. However, unpredictable inflationary pressures can also have a devastating effect on businesses. Entire industries suffered significant setbacks due to the supply-side issues that drove up costs and squeezed firms’ profit margins. Supply Chain and Inflation Understanding the link between the global supply chain and inflation is easy: when supply chains are distributed, supplier’s costs increase. As long as demand remains constant or grows, these … [Read more...]

Inflationary Expectations Do Not Cause Inflation

Many economists believe that inflationary expectations cause general increases in prices. For instance, if there is a sharp increase in oil prices, people will form higher inflationary expectations that set in motion general increases in the prices of other goods and services. According to the former Federal Reserve chairman Ben Bernanke, “Undoubtedly, the state of inflation expectations greatly influences actual inflation and thus the central bank’s ability to achieve price stability.” Economists believe that if expectations could be made less responsive to various shocks, then over time this would mitigate the effects of these shocks on the momentum of the prices of goods and services. … [Read more...]

Inflation and its Impact on Marketing Budgets

Inflation refers to the general increase in prices of goods and services over time. It is measured by the Consumer Price Index (CPI) which tracks changes in the prices of common consumer goods and services like food, housing, transportation, medical care, recreation, etc. High inflation reduces the purchasing power of money. So, with the same amount of money, people can buy fewer goods and services. This impacts businesses and consumers in multiple ways. For marketers, inflation directly impacts marketing budgets and strategies. Here’s a look at some of the key effects. Rising Media Costs During periods of high inflation, the costs of advertising and marketing channels tend to rise. … [Read more...]

Worldwide Inflation by Country in 2023

Click for Larger Image Data Source Even though Argentina is in the news due to its high inflation rate it isn't the only country suffering from hyperinflation. It's not even the highest inflation... with Venezuela and Lebanon even higher. In this article, we will look at global inflation rates by country and inflation around the world as of November 2023. The World Inflation Rate The average inflation rate around the world is 11.1%. The global inflation rate surged from 4.35% in 2021, and 3.18% in 2020. Jump to: Top Hyperinflation Countries Inflation in Europe Countries with Deflation Low inflation Countries without Deflation Inflation in Asia Alphabetical … [Read more...]

November Inflation Mildly Disappoints Stock Market

According to the Bureau of Labor Statistics CPI report released on December 12th, Annual Inflation was down to 3.1% in November. (but since we calculate it to two digits, it was actually down to 3.14%.) Monthly inflation was 0.44% in August, 0.25% in September, -0.04% in October, and -0.20% in November, so it certainly looks like inflation is falling. But inflation is almost always low to negative in the fourth quarter of the year, so it could simply be an illusion. The stock market was expecting another significant drop like last month, so they were mildly disappointed, but the market was able to eke out a point or two of gains. We had been projecting a flat to slight rise for … [Read more...]

Does Inflation Increase Economic Output?

Keynesian economists would have you believe that inflation is beneficial because it encourages spending which boosts demand and consequently stimulates the economy. But "Austrian" economists disagree citing the fact that inflation deludes the public into saving less than they would have normally creating malinvestment. In today's article, we are reprinting an excellent response by Paul Vitols to a Quora question on this very topic. ~Tim McMahon, editor Does Inflation Increase Economic Output? By Paul Vitols The word inflation is used by different people to point to different things. The best definition of it, in my opinion, is “a general and continuous loss of the … [Read more...]