June 10, 2022 Update: AAA says the national average is now almost $5.00 a gallon (and much higher in places like California). That moves the blue dot on the chart below up and prices are now well above inflation-adjusted peaks! June 2, 2022 It's no secret that gasoline prices are skyrocketing. However, a couple of months ago we said that although gas prices were high and rising, they still weren't at record levels when looked at in inflation-adjusted terms. But all that has changed now as gasoline prices continue to climb upward. Today the AAA reported the highest national gas prices they have recorded. Although this is a significant development, all sorts of … [Read more...]

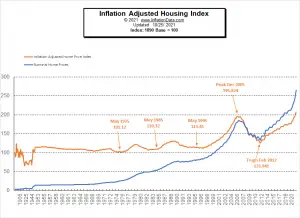

Do Housing Prices Always Go Up?

In the last few years, housing prices have skyrocketed, and investors are once again jumping on the housing bandwagon as an excellent way to make money. The same sentiment existed in the early 2000s as housing prices were rising rapidly then as well. These periods both created the impression that “housing prices always go up”. But is that actually true? If we look at the “nominal” prices of houses, i.e., the cost in dollars BEFORE adjusting for inflation, it does appear that housing prices go up fairly consistently. In the following chart, we see housing prices since 1890. The blue line is the nominal housing price, and we can see a very gradual increase up through the early 1970s. Prices … [Read more...]

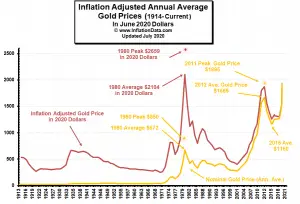

3 Factors Causing the Current Gold Rally

A variety of factors affect the price of gold. Currently, many of them are combining to drive the price of gold to all-time record highs. Let's look at a few of the factors that affect the price of gold. 1) Uncertainty- Gold is a Crisis Hedge We have said this many times over the years but it bears repeating again gold is more of a crisis hedge than an inflation hedge. When uncertainty rears its ugly head... gold does well. That uncertainty can take many forms and one of them is "monetary uncertainty". So if people don't know what the value of their money is going to be in the future (i.e. inflation) they will shift some of their assets to gold (driving up the price of gold). So as far as … [Read more...]

U.K. Historical Price Converter Added

This month as a service for our friends in the U.K. we have added a U.K. Historical Price Converter. This handy little calculator will tell you the equivalent value of any prices from 1751 to the present. It is based on the "Retail Prices Index" which was instituted in Great Britain in 1947 in an effort to determine how much the war was affecting prices. The data was later "backdated" to include prices back to 1751 by Jim O’Donoghue, Louise Goulding, and Grahame Allen in a paper entitled ‘Consumer Price Inflation Since 1750’. In it they state that, their article presents: "a composite price index covering the period since 1750 which can be used for analysis of consumer price … [Read more...]