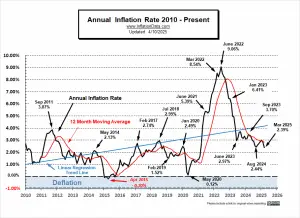

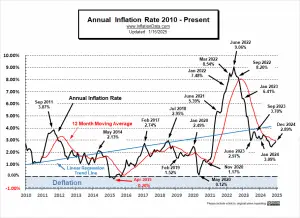

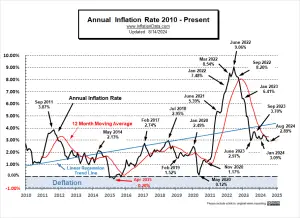

The U.S. Bureau of Labor Statistics released its March 2025 Inflation report on April 10th, 2025. The report showed that Annual Inflation was down from 2.8% in February to 2.4% in March. Calculated to two digits, it was 2.82% in February and 2.39% in March. Although this month's numbers look very good there is a surprise hidden in the monthly numbers. (See this month's MIP). Inflation Prediction: This is the second month in a row that actual inflation came in slightly below our "extreme low" projection. We had projected an "extreme low" of 2.42% for March, but it came in at 2.39%. Of course, had we been rounding to one digit as the BLS does, it would have been right on the nose of … [Read more...]

Which is Worse, Inflation or Deflation?

It all depends on the type of Deflation. There are actually two types. The deflation that most people are familiar with is the result of a market collapse such as we saw in 2008. Prices of assets (like stocks) fall because of some sort of “accident,” such as the mispricing of mortgage-backed securities and derivatives. When assets lose value quickly, panic sets in, leverage must be liquidated, causing other assets to be sold, creating a "snowball effect" causing a "risk-off" mindset. Consumers cut back on unnecessary purchases, businesses lay-off workers, unemployment skyrockets, and the economy stagnates, etc. But looking even deeper, we find that the “mispricing’ was caused by too much … [Read more...]

The Correlation Between Job Market Turnover and Inflation

Inflation, the rate at which the general level of prices for goods and services rises, erodes purchasing power and poses significant challenges for economies. During periods of high inflation, individuals face increased living costs, prompting many to reassess their employment situations. Further, inflation influences job market turnover rates, as workers seek better opportunities to maintain their financial stability. We will explore the correlation between rising prices and employee mobility, the psychological factors driving job changes during inflationary periods, and the implications for employers navigating this turbulent landscape. By understanding these dynamics, we can gain … [Read more...]

BLS releases its December 2024 Inflation report

The U.S. Bureau of Labor Statistics released its December 2024 Inflation report on Wednesday January 15th 2025, showing Annual Inflation was up from 2.7% in November to 2.9% in December. This looks like a 0.2% increase. (But since we calculate it to two digits, it was 2.75% in November and 2.89% in December, which means the actual increase was 0.14%.) On a non-seasonally adjusted basis, monthly inflation was 0.04% in December but annual inflation rose because December 2023 was a negative -0.10%. Inflation Prediction: As you can see from our MIP projection from last month, December's Annual inflation at 2.89% is just a hair below our predicted Extreme High of 2.90%. … [Read more...]

How Inflation Destroys Civilization

The following article by Jörg Guido Hűlsmann was originally published in 2004. Dr. Hűlsmann is a professor of economics at the University of Angers, where he directs the Master in Law and Finance and codirects the double bachelor program in Law and Economics. He teaches classes on macroeconomics, money, banking, and finance. He is the author of Abundance, Generosity, and the State (2023), Krise der Inflationskultur (2013), The Ethics of Money Production (2008), and Mises: The Last Knight of Liberalism (2007). His books and articles have been translated into twenty languages. His current research focuses on the political economy of financial markets, as well as on the theory of money … [Read more...]

November 2024 Inflation Up Slightly

The U.S. Bureau of Labor Statistics released its November Inflation report on Wednesday December 11th showing Annual Inflation was up from 2.6% in October to 2.7% in November. (But since we calculate it to two digits, it was actually 2.60% in October and 2.75% in November but for some reason they rounded down rather than rounding up.) On a non-seasonally adjusted basis, monthly inflation was -0.05% in November but annual inflation rose because November 2023 was a negative -0.20%. Inflation Prediction: For a change, the "experts" were right this month with their prediction of 2.7% Inflation for November maybe that is because they agreed with our Mip "Most Likely" prediction for a … [Read more...]

Inflation and Retirees

Inflation presents significant financial challenges for retirees living on fixed incomes, as rising costs strain budgets. Although Social Security has a Cost of Living Adjustment (COLA) built in, Social Security was never meant to be your only source of income after retirement, but rather it was intended to supplement your other retirement income. This article will explore key areas most affected by inflation, such as food, energy, healthcare, and discretionary spending, and provide practical tips to help you adapt. For those planning to retire in 2024 or the next few years, identifying and managing everyday expenses is more important than ever to maintain financial stability. #1 Keeping … [Read more...]

Inflation-Proofing Your Family Budget

After a sustained period of post-COVID inflation, prices for household goods and food have begun to stabilize between two and three percent. However, if you happen to have dug out an old receipt from a pre-COVID food shop, you may be shocked to see how much more you pay for everyday items and ingredients. This is because the effects of inflation are cumulative and compounding. So, three consecutive years of 2% inflation results in more than 6% cumulative inflation and if you throw in one year of 9% inflation prices really soar. The rapid change in food prices is largely driven by a 2022 spike in inflation, which saw the average grocery bill rise by 9.9% in a single year. While a few … [Read more...]

July 2024 Annual Inflation Falls Again

The U.S. Bureau of Labor Statistics released its July Inflation report on Wednesday August 14th showing Annual Inflation was down from 3% in June to 2.9%. (But since we calculate it to two digits, it was actually 2.97% in June and 2.89% in July.) On a non-seasonally adjusted basis, monthly inflation in June was 0.03% and 0.12% in July. So despite monthly inflation being slightly higher in July 2024 than in June, it was lower than July 2023 (@0.19%) so Annual Inflation fell. Economists had been predicting that the inflation rate would come in at 3.0% so inflation was lower than expectations, but Mr. Market didn't celebrate much (only increasing about 1/2%) but the rally continued upward on … [Read more...]

Navigating High Inflation: Should You Buy, Sell, or Hold Off on Real Estate?

It’s no secret that inflation is high nowadays. While the rate of inflation is significantly lower today than it was in 2022, it’s still sitting at about 3%; which is higher than the FED’s stated goal of 2%. Although, FED Chairman Jerome Powell has hinted that he now considers the range of 2% to 3% acceptable... so he might consider lowering interest rates. But currently, interest rates are considerably higher than they have been over the last decade, which causes higher costs for those interested in buying property. For homebuyers, real estate investors, and brokers inflation is lower than 2022’s record of 9.1% but it is still concerning. Inflation affects various aspects of the real … [Read more...]