Printing Money, Quantitative Easing, Money Supply and Currency in Circulation--- how do they relate? Today we are looking at an excellent explanation on the FED's money printing process by James Hamilton, economist of the University of California, San Diego. Did the Federal Reserve really print a Trillion dollars in their Quantitative Easing program? Did that increase the money supply by a Trillion dollars? He presents some interesting charts on currency in circulation versus currency reserves. Tim McMahon, editor … [Read more...]

Why Quantitative Easing Has NOT Brought Back Inflation

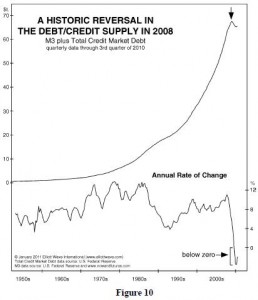

When the FED began quantitative easing to halt the deflationary crash of 2008, almost everyone was convinced that it would result in massive inflation. The lone voice proclaiming that it wouldn't stop the deflationary express train wreck was Robert Prechter. In the following article Prechter explains why inflation never materialized. It is an excerpt from Prechter's, Independent Investor eBook 2011. I hope you enjoy this short excerpt. See below for details on how to get the eBook in its entirety for free. ~ Tim McMahon, editor … [Read more...]

Understanding the FED

Protect yourself from the common and misleading myths about the U.S. Federal Reserve Over the years, occasionally I have received comments from subscribers about the SHAM of the FED and how U.S. Taxpayers are being swindled. And although I knew the truth of it, I was unable to shed any new light on the subject. Today our friends at Elliottwave have provided a new resource that will teach you everything you wanted to know – plus some things you might wish you didn't – about the U.S. Federal Reserve Bank. Since the Federal Reserve Act of 1913, the Federal Reserve Bank has been a secret, quasi-government agency. It's time to pull back the curtain on the Federal Reserve system. In … [Read more...]

Deflation or Inflation: Can Helicopter Ben Come to the Rescue?

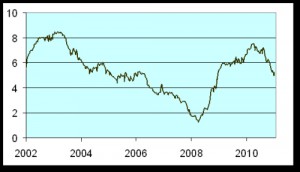

Why the Fed Cannot Stop Deflation Countless people say that deflation is impossible because the Federal Reserve Bank can just print money to stave off deflation. If the Fed’s main jobs were simply establishing new checking accounts and grinding out banknotes, that’s what it might do. But in terms of volume, that has not been the Fed’s primary function, which for 89 years has been in fact to foster the expansion of credit. Printed fiat currency depends almost entirely upon the whims of the issuer, but credit is another matter entirely. What the Fed does is to set or influence certain very short-term interbank loan rates. It sets the discount rate, which is the Fed’s nominal near-term … [Read more...]