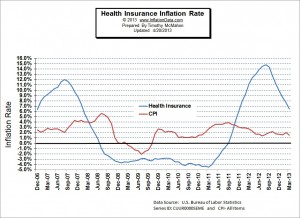

Since the beginning of 2012, health insurance costs have skyrocketed significantly above the rate of overall inflation. As you can see from the chart below, health insurance inflation peaked at almost 15% per year in 2012 and at 12% in 2007 while overall inflation hovered around 2%. When people focus in on one single item, this is why many people don't believe the overall inflation rate. They say, "Oh, my health insurance went up 15% how can inflation be only 2%?". But what they fail to take into consideration is that in September of 2008 when the overall inflation rate was 5% health insurance was falling 2%. Yes, according to the U.S. Bureau of Labor Statistics, health insurance costs … [Read more...]

Stimulate the Economy? Please Don’t!

Personally, I would love to see the inflation rate stay between 1 and 2% or better yet between 0% and 1%. Why? In the long run low inflation rates benefit everyone, as people can accurately judge their future costs and make sound business (or family management) decisions. In addition to making planning easier it also promotes saving because people know that the money they put away will be worth the same amount (plus interest) as that which they saved in the first place. High savings results in stability in times of need, and it provides capital for industry which generates wealth as new things are produced. But why save if the value of the money you are putting away is eroding? In a … [Read more...]

What are Derivatives and How do they Work?

Derivatives Defined According to Dictionary.com the term "derivative" means 1. derived. or 2. not original; secondary. In the financial arena derivatives are derived from a basic commodity and can be a portion of that original commodity. They are essentially contracts between two or more people. You can think of derivatives as ways of "slicing and dicing" financial contracts. For instance, a normal bond could be broken into two parts. The first part would be the underlying asset itself and any appreciation thereon. The second part could be all the interest due on that bond. This way one investor would get more leverage on the appreciation of the bond while the other investor would … [Read more...]

What is Biflation?

Biflation is a relatively new term coined by Dr. F. Osborne Brown, a Senior Financial Analyst for the Phoenix Investment Group in 2003. It is sometimes referred to as "mixed inflation" but it basically refers to a condition where both inflation and deflation occur at the same time. This seemingly contradictory situation is not a real a paradox but simply appears to be one as a result of faulty logic. The problem results from thinking that all prices rise in lock-step in times of inflation but this is clearly not the case. It is quite common for electronics to be declining in price (deflation) while oil and gas are increasing in price. Thus we have "mixed inflation" or "biflation" however … [Read more...]

Food Price Inflation Since 1913

On March 4, 1913, the last day of his presidency, President William Howard Taft signed a bill promoting the Department of Labor to a Cabinet-level Department. That same year they began tracking consumer prices. This is also the same year that the Federal Reserve was formed to manage the money supply. Perhaps Taft worried that putting a bunch of bankers in charge of the money supply was like putting the fox in charge of the hen house and so the country needed a cabinet level department to keep an eye on them? Whatever the reason, that the Consumer Price Index was formed, a gauge, or measuring stick now exists to compare prices across the ages. Although some people believe that the … [Read more...]

International Inflation and Deflation Trends over the Past 5 Years

International Inflation Rates Had Ups and Downs Over Past 5 Years. The global economy has suffered some serious setbacks since late 2007, with some economists and experts going so far as to call it the "Great Recession," after the 1920s-era Great Depression. And that certainly is an apt term for it, as the spread of the crisis has not been limited to a few countries. Nearly every country in the world has been affected in some way, which is a telling sign of the modern international economy. Inflation is one of the key indicators as to the health of the economy, but it needs to be looked at in context in order to have any value. Economists often use stretches of five years of … [Read more...]

The Impact of Inflation on Savings

The obvious impact of inflation on your savings is that the purchasing power is erroded. This means that if you stash $100 under the mattress today and inflation is 3% per year when you come back a year from now your $100 will buy 3% less stuff. Put another way you would need $103 to buy the same amount of goods a year later. When you extend this to 10 years you might think that it would mean that you would need $130 to buy the same amount of goods but because of the effects of compounding you would actually need $134.39. You can use the Retirement Planning Calculator to calculate the impact of inflation on your savings. As time goes on the impact of "only" 3% inflation compounds making … [Read more...]

The Impact of Inflation on Retirement Planning

Planning for retirement is difficult enough without having to worry about inflation. There is a lot to consider when you stop working a regular job. Do you plan on living where you are now. Do you want a change of scenery? Would you prefer a place with less maintenance or a place where you can have a big garden or a workshop where you can build things? There of course the financial aspects to consider as well. Will your retirement savings be adequate to provide the type of lifestyle you desire? There are a variety of Retirement Planning Calculators that can help you try to figure out how much you will need to save to have a happy retirement. You need to estimate your expenses once you are … [Read more...]

Cost of Living – Fish and Chips

Cost of Living Fish and Chips Fish and chips still remains the favorite take away meal in the UK despite fierce competition. The exact origins are unknown but it has been established that chips arrived from France during the 18th Century. There was also mention of fried fish and bread in ‘Oliver Twist’ by Dickens, published in the 1830s. The Oxford English Dictionary claims the earliest usage of "chips" in this sense was in Charles Dickens' A Tale of Two Cities (published in 1859). Fish and chips became standard fare among the working classes in Great Britain due to the efficiency of trawl fishing in the North Sea, and the development of railways which allowed fresh fish to be rapidly … [Read more...]

Cost of Living

The cost of living or (COL) varies from state to state and city to city and even from neighborhood to neighborhood. Some areas have seen housing costs decrease dramatically in the years since the housing bubble popped in 2008, while others have only fallen slightly. But the Cost of living is more than just housing costs it is the amount of money it will take to maintain the same standard of living in various places. Changes in the COL over time are often calculated via an index such as the CPI index that sets costs at a certain date at 100 and then recalculates costs at intervals. COL calculations are also used to compare the cost of maintaining a certain standard of living in different … [Read more...]