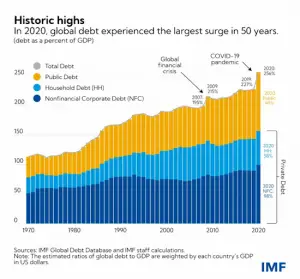

The government and the FED have been making lots of excuses for the current wave of price inflation but it hasn't occurred by accident, because of oil shocks, or Russian invasions. The foundation for the current wave of rising prices was laid brick by brick over a long period of time. And because of this foundation of debt, a severe financial crisis looms not far ahead. The following article by Antony P. Mueller was reprinted by Creative Commons Permission. ~Tim McMahon, editor 05/02/2022 A Deeply Flawed Monetary System A monetary system that allows the creation of money out of thin air is vulnerable to the fits of credit expansion and credit contraction. Periods of credit expansion … [Read more...]

How Families Are Adjusting To The Crazy Inflation Rates

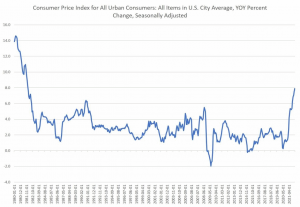

On April 12th of, 2022, the U.S. Bureau of Labor Statistics (BLS) announced that the annual US inflation rate had reached a record high of 8.5%, a level not seen since December 1981. This level of rapid price increase is being felt all over the nation and even in Europe. Those with low incomes are having the hardest time adjusting to the rapidly increasing cost of living, as is often the case. But working families across the nation are also being forced to adapt and change in order to cope with rising prices. This has impacted every corner of our society, from gas to prices at the grocery store. Adjusting to this level of inflation hasn’t been easy, and here is how some families are looking … [Read more...]

How To Invest In Cryptocurrency: 4 Tips For Beginners To Get Started

Despite bouts of volatility that tend to scare away risk-averse investors, cryptocurrency is more popular than ever, with millennials hoping to cash in on its explosive growth. While legacy coins such as Bitcoin and Ethereum are still the most popular currencies in the world of crypto, other emerging altcoins are gaining momentum and popularity. If you have been living under a rock and have no idea where to get started in your crypto journey, keep reading to find four steps to get started: 1. Pay Attention to What You're Investing In In addition to having your finances in order, when investing in crypto, be mindful that, unlike stocks, most cryptocurrencies are not backed by any … [Read more...]

The History of Inflation in the United States

By John Steele Gordon Author, An Empire of Wealth: The Epic History of American Economic Power Money is just another commodity, no different from petroleum, pork bellies, or pig iron. So money, like all commodities, can rise and fall in price, depending on supply and demand. But because money is, by definition, the one commodity that is universally accepted in exchange for every other commodity, we have a special term for a fall in the price of money: we call it inflation. As the price of money falls, the price of every other commodity must go up. And what causes the price of money to fall? The answer is very simple: an increase in the supply of money relative to other goods and … [Read more...]

How Inflation Helps Some and Hurts Others

Inflation is NOT monolithic i.e. it doesn't affect everyone equally. This has been known since the 1700s when Richard Cantillon, an Irish-French economist, author, and banker, wrote a treatise explaining the Missippi Bubble and the Tulip Mania. We first discussed this issue in an article entitled Who Does Inflation Hurt Most? In the following article, Mark Thornton looks at the effects first postulated by Richard Cantillon and how inflation helps some and hurts others. ~Tim McMahon, editor. Cantillon Effects: Why Inflation Helps Some and Hurts Others By Mark Thornton We now turn our attention to what happens with an increase in the money supply rather than an increase in savings. … [Read more...]

Don’t Blame Putin for High U.S. Inflation… Yet

With Annual Inflation reaching 40-year highs in February, the current administration is frantically searching for a scapegoat... any scapegoat no matter how absurd... to deflect responsibility for the current high inflation rate. First, inflation was "transitory"... then when it was obvious it wasn't... it was supply chain disruptions, and when that narrative fell apart, along comes Putin... Well, inflation was a problem long before Putin invaded Ukraine. So although the "Putin Effect" might result in HIGHER inflation soon, it hasn't been the cause of inflation in the February 2022 inflation numbers. In today's article, Ryan McMaken looks at this issue. ~Tim McMahon, editor Price Inflation … [Read more...]

When Is Inflation Good for the Economy?

Typically inflation and higher prices are considered bad, but occasionally they may be good for the economy... Inflation is one of the oldest concepts in economic theory, but experts still struggle to decipher its actual role in the market. It is often seen as a financial plague, which can ruin entire nations if it gets out of control. Price inflation means that prices have increased in the economy, usually due to monetary inflation, i.e., an increase in the money supply. Some of the most inglorious examples of hyperinflation are Germany in 1923, Greece in 1944, Hungary in 1946, Zimbabwe in 2008, and surprisingly the U.S. Confederacy during the Civil War. But proponents of inflation … [Read more...]

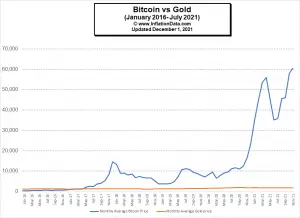

Is Bitcoin a Better Inflation Hedge Than Gold?

Proponents of the digital cryptocurrency Bitcoin are touting it as the latest Inflation hedge... perhaps better than gold... but is it? Although gold may fluctuate significantly in the short run, this precious metal has fared relatively well as a hedge against inflation over the long term. One of gold's significant benefits is that it is a commodity that if held in physical form is neither paper, nor government-controlled, nor another person's liability. Gold's other major advantage is its limited supply (i.e., requiring quite a bit of effort and energy to mine). Recently, Bitcoin has arrived on the scene and become a "digital commodity" independent of the government, which has gained … [Read more...]

Inflation: The New Normal?

After decades of low inflation and even fears of deflation, inflation concerns are once again dominating the headlines in the contemporary financial media. As the global economy grappled with the fallout of the coronavirus pandemic, major central banks embarked on an unprecedented monetary easing program. This was an attempt to shore up the flagging economic growth by increasing the money supply. This resulted in the shortest recession in economic history but also created problems of its own. With widespread shortages spooking consumers and investors alike, central banks are now having to contend with persistent supply chain disruptions, decaying consumer confidence, and the looming … [Read more...]

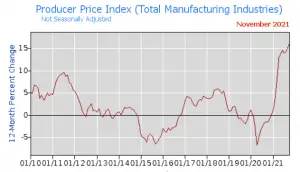

How Businesses Cope With Inflation

With the Producer Price Index for manufacturing industries increasing by over 15% on a not seasonally adjusted annual basis for the last couple of months, businesses are facing rapidly increasing costs. To remain profitable, companies only have two options, either raise prices or cut costs. In the short run, larger corporations can postpone the inevitable by taking a 3rd option, i.e., “to squeeze margins to maintain volumes” (which is just a fancy way of saying “eat the increased costs”. Small businesses are generally in a weaker position to adjust themselves when inflation knocks at their doors. It is more difficult for Small and Mid-size Enterprises (SMEs) to cope with the situation … [Read more...]