The FED's target yearly inflation rate in the U.S. is about 2%, but the long term average is more like 3% and depending on ongoing economic conditions, this rate can significantly increase, affecting the financial health of individuals across the country. Though keeping an eye on the economy can help you make decisions to brace against the impact of inflation, developing sound investments can help you protect your wealth no matter the rate. Take a look below for a few central items to consider when preserving your finances against inflation. Diversify your Portfolio Portfolio diversification is crucial for maintaining optimal financial health. Your investments should vary in asset class … [Read more...]

Navigating Economic Turbulence: How Inflationary Pressures Drive Payment Fraud Trends

This article is a bit beyond the scope of our typical article but is presented for those who want to delve into the murky waters of this issue. For a lighter look at scams and modern solutions, you might enjoy The Modern Day Wild West: Crypto Scams And Opportunities. ~Tim McMahon, editor. In an era of perpetually shifting economic landscapes, it is important for businesses and consumers alike to understand the nuances of inflationary pressures. As inflation distorts purchasing power, various vulnerabilities emerge and so fraudsters can exploit the emerging vulnerabilities, leading to sophisticated scams. Navigating these turbulent waters requires a keen understanding of the evolving … [Read more...]

Hyperinflation- How a Trickle Can Turn into a Flood

In 1903, a lawyer in Germany took out an insurance policy and made payments on it faithfully. When the policy came due in twenty years, he cashed it in and bought a single loaf of bread with the proceeds. He was fortunate. If he had waited a few days longer, the money he received would have bought no more than a few crumbs. Germany had been on the usual fractional reserve gold standard prior to World War I, with the Reichsbank—its central bank—expanding the money supply at a “mild” 1–2 percent inflation rate. When war broke out in 1914, the government followed the standard policy of deficit spending rather than attempting to raise taxes. The Reichsbank’s role was to monetize the … [Read more...]

Industries Most Affected by Inflation: Insights from the Global Supply Chain

Inflation has rocked the world in recent years. The pandemic, global conflict, and dramatic changes in consumer spending caused inflation to spike to 11.1% worldwide before retreating. High inflation rates are, of course, bad for consumers. However, unpredictable inflationary pressures can also have a devastating effect on businesses. Entire industries suffered significant setbacks due to the supply-side issues that drove up costs and squeezed firms’ profit margins. Supply Chain and Inflation Understanding the link between the global supply chain and inflation is easy: when supply chains are distributed, supplier’s costs increase. As long as demand remains constant or grows, these … [Read more...]

Inflation and its Impact on Marketing Budgets

Inflation refers to the general increase in prices of goods and services over time. It is measured by the Consumer Price Index (CPI) which tracks changes in the prices of common consumer goods and services like food, housing, transportation, medical care, recreation, etc. High inflation reduces the purchasing power of money. So, with the same amount of money, people can buy fewer goods and services. This impacts businesses and consumers in multiple ways. For marketers, inflation directly impacts marketing budgets and strategies. Here’s a look at some of the key effects. Rising Media Costs During periods of high inflation, the costs of advertising and marketing channels tend to rise. … [Read more...]

Does Inflation Increase Economic Output?

Keynesian economists would have you believe that inflation is beneficial because it encourages spending which boosts demand and consequently stimulates the economy. But "Austrian" economists disagree citing the fact that inflation deludes the public into saving less than they would have normally creating malinvestment. In today's article, we are reprinting an excellent response by Paul Vitols to a Quora question on this very topic. ~Tim McMahon, editor Does Inflation Increase Economic Output? By Paul Vitols The word inflation is used by different people to point to different things. The best definition of it, in my opinion, is “a general and continuous loss of the … [Read more...]

Increasing Inflation Now Shifting Insurance Rates

Inflation is making everything more expensive, and insurance is no exception. As prices rise for goods and services, insurance companies have to adjust as well. They factor in a variety of elements, including the average cost per claim made and the rising costs involved in repairing cars or homes. When these costs go up, insurance companies must pass it on by raising the price of premiums. Understanding Insurance Inflation Insurance inflation means the cost of your car, home, health, or life insurance is going up. What’s driving these increases? For starters, healthcare expenses are rising, so health insurance gets more expensive. Natural disasters like floods and fires can also make home … [Read more...]

Can the FED Engineer a “Soft Landing”?

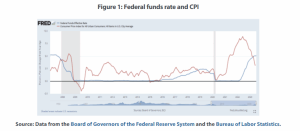

The ultimate dream of the Federal Reserve and those who believe in the FED's omniscience is for them to engineer a soft landing, i.e., curbing inflation without sending the economy into a deep recession. The idea is that if they raise rates just enough, but not too much, they can find the "Goldilocks" middle ground that will magically cool inflation just enough. In today's article, Mihai Macovei explains why that is more of a fairytale than Goldilocks herself. ~Tim McMahon, editor. There Is No Fed Magic Trick to Achieve a Soft Landing Economic growth in the United States accelerated to a 2.4 percent annualized rate in the second quarter of 2023, picking up from 2.0 percent in the first … [Read more...]

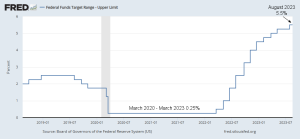

When Can We Expect Lower FED Rates?

Why Has The FED Been Raising Interest Rates? The Federal Reserve (Fed) started raising interest rates in March 2022 in an effort to combat inflation. As of the end of July 2023, the Fed's target rate limit is 5.5%, the highest level in 15 years. There are a few reasons why the Fed is raising interest rates so aggressively. First, inflation was at a 40-year high. In June 2022, the Consumer Price Index (CPI) rose 9.06% year-over-year, the fastest pace since December 1981. This means that the cost of goods and services was rising rapidly, which was eroding the purchasing power of consumers and businesses. Second, the economy is still strong. The unemployment rate posted a 50-year … [Read more...]

Everything They Tell You About Inflation is Wrong

In today's article, J.R. MacLeod looks at the effects of inflation, the fraud it perpetrates on the population, and who benefits and who loses from inflation. He also shows that "Inflation is not necessary for real wealth and real growth... inflation is completely unnecessary for a growing and prosperous economy". ~Tim McMahon, editor Inflation, the Price Level, and Economic Growth: Everything the Elites Tell You about It Is Wrong Fundamentally, inflation is fraud. The central government or bank printing more money lessens the value of the money already in circulation. A truckload of sand isn’t particularly valuable in Saudi Arabia. An increased supply of money means that ultimately prices … [Read more...]