Despite Bernanke's famous helicopter speech the FED's powers really are not unlimited. There is only so much they can do to stimulate the economy. After all they can't force people who are concerned about their future to borrow money. Just like a turtle people naturally recoil and pull back when times are uncertain. And even if they wanted to borrow bankers are reluctant to lend in uncertain times. This results in a phenomenon called Pushing on a String where no matter how hard the FED tries very little force is exerted on the economy. Robert Prechter believes that this is exactly what has been happening over the last few years where the FED has been trying to stimulate the economy but the … [Read more...]

Deflation Warning: Money Manager Startles Global Conference

History shows that the U.S. should pay attention to economies in Europe The economy has been sluggish for five years. There's no shortage of chatter about "why," yet few observers mention deflation. One exception is a hedge fund manager who spoke up at the recent Milken Institute Global Conference. The presentation by Dan Arbess, a partner at Perella Weinberg and chief investment officer at PWP Xerion Funds, was startling because of how deeply it broke from the standard narrative. We've been wrong to assume that the economic crisis is over, Arbess said. ... The threat of deflation is once again rearing its head. "The persistent risk in our economy is deflation not inflation," Arbess … [Read more...]

Deflation Not Over?

The majority of the inflation from 2012 occurred in the first quarter with extremely high monthly rates of inflation. Overall in 2012 there were 6 very inflationary months (on a monthly basis), 5 slightly deflationary months and 1 very deflationary month (November). The first month of 2013 started out pretty inflationary but the first quarter of the year generally shows the most inflation for the entire year. See Table … [Read more...]

The World Is in the Grip of a Bear Market–Have You Noticed?

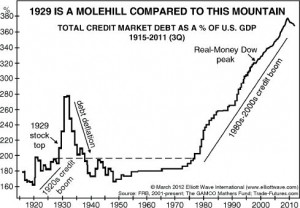

Global Markets, Economies Mired in Early Stages of Biggest Disaster Ever By Elliott Wave International The following is a sample from Elliott Wave International's new 40-page report, The State of the Global Markets -- 2013 Edition: The Most Important Investment Report You'll Read This Year. This article was originally published in Robert Prechter's September 2012 Elliott Wave Theorist. Global markets and economies are mired in the early stages of the biggest disaster ever. Most people think both areas are in the early stages of a prolonged recovery, but in fact they are on the cusp of the second downturn, which will be of epic proportion. The world is in the grip of a bear market. … [Read more...]

The Secret Word: Deflation – And the Next Five Years of Financial Turmoil

The following is a sample from Elliott Wave International's new 40-page report, The State of the Global Markets - 2013 Edition: The Most Important Investment Report You'll Read This Year. This article was originally published in Robert Prechter's July 2012 Elliott Wave Theorist. In the first five months of 2012, there were 20 times as many Google searches on "inflation" as there were on "deflation." This is down from a ratio of 50 times in June 2008. If any theme has been overdone over the past six years, it is the theme of inevitable inflation if not hyperinflation. Inflation reigned for 75 years, from 1933 to 2008. People are so used to it that they cannot imagine the opposite … [Read more...]

Gargantuan and Growing: The US Debt Figure You’ve Probably Never Heard Of

The widely reported $16.1 trillion federal US debt is a drop in the bucket Financial transparency is a must for U.S. publicly traded companies. But if the federal government had to abide by those same regulations, more Americans would know that the often-reported $16.1 trillion federal US debt doesn't come close to the truth about the nation's liabilities. In a Nov. 26 Wall Street Journal opinion piece, a former chairman of the Securities and Exchange Commission and a former chairman of the House Ways & Means Committee write: The actual liabilities of the federal government -- including Social Security, Medicare, and federal employees' future retirement benefits -- already exceed … [Read more...]

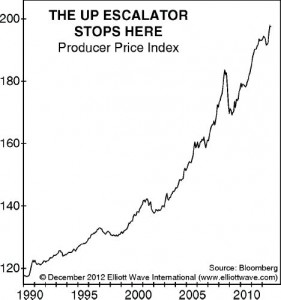

Producer Price Index (PPI) and Consumer Sentiment Index Point to Deflation

Two Signs That Deflation is Far From Over Producer Price Index (PPI) turns south The federal government defines the Producer Price Index (PPI) as "the average change over time in the selling prices received by domestic producers for their output." With help from the Federal Reserve's massive inflationary policies, the PPI has climbed even as the economy began to fall in 2008-09. All the while, the financial media persisted with stories of an economic recovery. EWI analysts offer an independent perspective. The New York Times declares, "Economic Gloom Starting to Lift." Corporate America, however, is not so sure. This chart of producer prices [wave labels removed] probably … [Read more...]

In 1929, Deflation Started in Europe Before Overtaking the U.S.

Marcus Aurelius was the last of the "Five Good" Roman emperors and is also considered one of the most important members of the Stoic philosophers. He ruled Rome from 161 to 180 AD. He brilliantly said, "Look back over the past, with its changing empires that rose and fell, and you can foresee the future, too." Today we may be seeing the beginning of the end of the American Empire. As Americans we don't like to think of ourselves as having an empire but according to Daniel Larison, The U.S. treats several key regions of the world as privileged space where it is supposed to have military and political supremacy, and regional challengers to that supremacy are treated as potential … [Read more...]

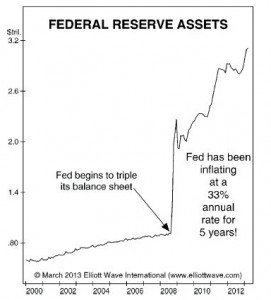

Bernanke’s Bigger Bubble: QE-3 and the Coming Economic Crash

Why monetarist theory is flawed Federal Reserve Chairman Ben Bernanke really means it this time. He will rescue the economy. Ben S. Bernanke for the first time pledged that the Federal Reserve will buy bonds until the economy gets closer to his goals ... . The central bank yesterday announced its third round of large-scale asset purchases since 2008, with the difference that it didn't set any limit on the ultimate amount it would buy or the duration of the program. ... Bernanke is "going to fight and fight until he sees a real improvement in the economy," said a co-head of global economics research at [a major bank]." He believes quantitative easing can help the economy, so he'll just … [Read more...]

Stocks Typically Fall Faster Than They Rise

Online stock market investing is a risky prospect these days. For a limited time you can download a free copy of the May issue of Elliott Wave Financial Forecast to help you decide how you should proceed for the rest of 2012 and beyond ~editor The Smell of Fear: Detecting the Dow's Scent Stocks typically fall faster than they rise Rising stock prices vs. investor fear: When one is present, the other is usually absent. Yet the two were actually in each other's company around the time of the most recent high in the Dow Industrials (May 1): This week the Dow carried to a new recovery high without generating a corresponding new low in the VIX. This suggests a sudden hesitancy compared … [Read more...]