The U.S. Bureau of Labor Statistics (BLS) released their monthly Consumer Price Index report on January 11th 2019, for January 1 through December 31, 2018.

Annual Inflation is Down

- Annual inflation in December was 1.91% down from November’s 2.18%.

- December’s CPI was 251.233 which was below November’s 252.038, below October, September and even below the 251.588 in May.

- Monthly Inflation for December was -0.32% virtually identical to November’s -0.33%.

- Next release February 13th

Monthly Inflation:

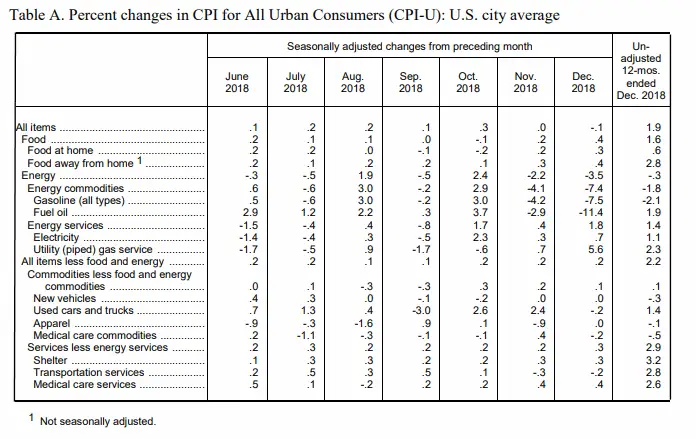

According to the BLS commissioner’s report, “In December, the Consumer Price Index for All Urban Consumers fell 0.1 percent on a seasonally adjusted basis; rising 1.9 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy rose 0.2 percent in December (SA); up 2.2 percent over the year (NSA).”

When we have a negative monthly inflation rate that is deflationary on a monthly basis but disinflationary on an annual basis until the annual number turns negative as well then it becomes deflationary on an annual basis as well. So what happened this year (and frequently happens in the 4th quarter) is that the last two months of the year (i.e. November and December) were negative, i.e. disinflationary, thus the disinflationary months of November and December wiped out all the inflation back through somewhere between April and May.

Since the CPI is an index, it measures price levels. Generally as prices creep up the index goes up. If the index goes down it means that overall prices are going down (not necessarily all prices just the weighted average of all prices). The CPI-U index was 250.546 in April and prices increased so that the index was 251.588 in May and then increased incrementally up to 252.885 in October. In November the index fell to 252.038. And it fell again in December to 251.233. That means that actual prices at the end of December were somewhere between the April and May levels. But compared to year ago levels they are still 1.91% higher.

The commissioner also reported that “Real average hourly earnings increased 1.1 percent, seasonally adjusted, from December 2017 to December 2018. The change in real average hourly earnings combined with no change in the average workweek resulted in a 1.2-percent increase in real average weekly earnings over this period.”

“Real earnings” are not the actual dollars earned but are instead dollars earned adjusted for inflation. So what this is saying is that in spite of inflation actual earning are buying 1.1% more stuff this year than last year so the average consumer is better off than they were a year ago.

Federal Reserve Actions

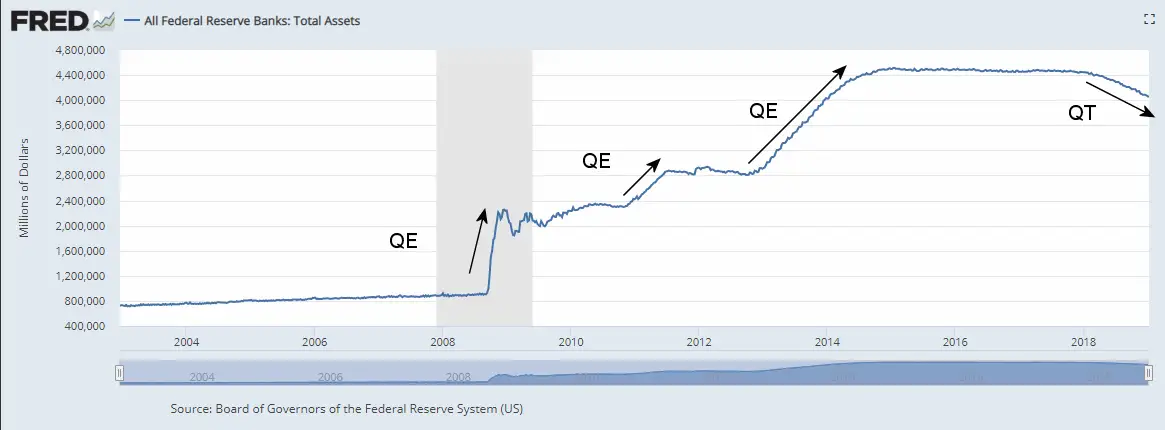

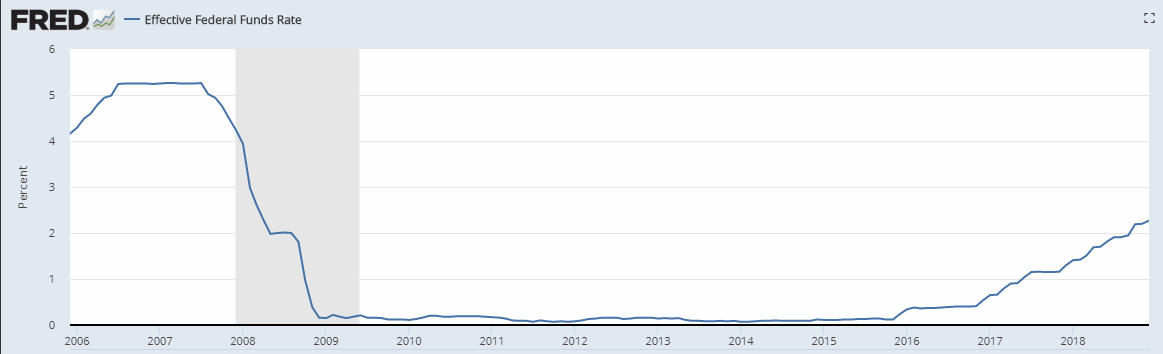

The Federal Reserve has taken a more active part in 2018 than it has in recent years both in raising interest rates and in Quantitative Tightening (QT).

Quantitative Tightening (QT) Begins

Rising Interest Rates

For more info See NYSE ROC and MIP.

Seasonally Adjusted Inflation Table

From the table we can see that on a monthly Seasonally adjusted basis the biggest gainer is Piped Gas (i.e. Natural Gas) while Fuel Oil was actually down -11.4% Energy overall down -3.5% and Gasoline down -7.5%.

Typically the monthly inflation rate is highest during the first quarter (January through March) with April and May often being among the high months but not always.

The lowest monthly inflation is typically during the last quarter (October through December) with June through September typically being moderate. Surprisingly, July came in negative in both 2016 and 2017. There was not a single negative July from 1950 through 2000 but there have been several since.

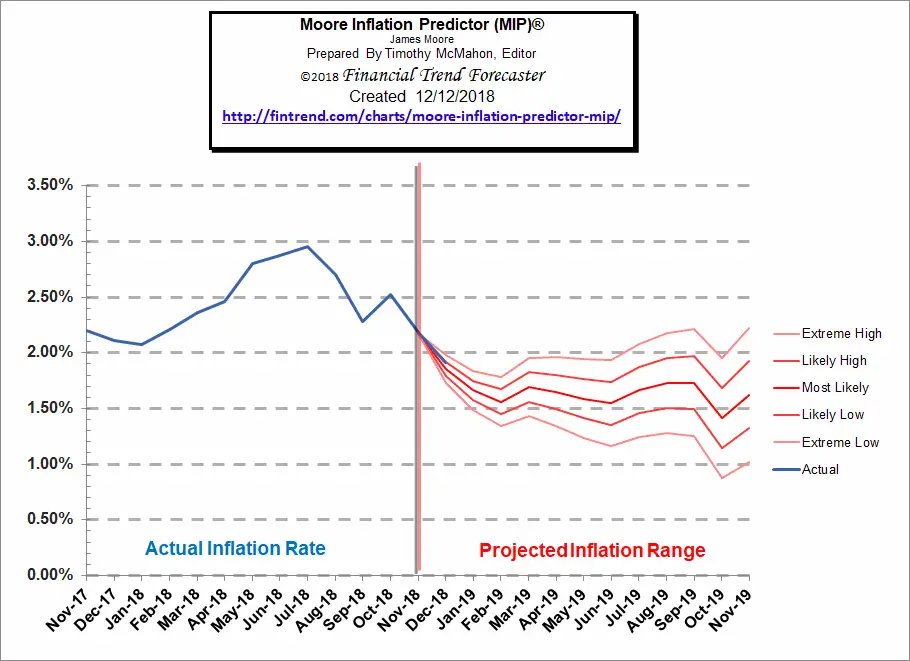

Inflation Forecast

Last month we projected a falling inflation rate and we were exactly on target.

See our Moore Inflation Predictor to see our current projections.

Not Seasonally Adjusted Monthly Inflation Rates

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2016 | 0.17% | 0.08% | 0.43% | 0.47% | 0.41% | 0.33% | (0.16%) | 0.09% | 0.24% | 0.12% | (0.16%) | 0.03% |

| 2017 | 0.58% | 0.31% | 0.08% | 0.30% | 0.09% | 0.09% | (0.07%) | 0.30% | 0.53% | (0.06%) | 0.00% | (0.06%) |

| 2018 | 0.54% | 0.45% | 0.23% | 0.40% | 0.42% | 0.16% | 0.01% | 0.06% | 0.12% | 0.18% | (0.33%) | (0.32%) |

See: Monthly Inflation Rate for more information and a complete table of Unadjusted Monthly Rates.

Not Seasonally Adjusted Inflation (by Category)

| Category | Annual |

| All Items | 1.91% |

| Food | 1.6% |

| Energy | -0.3% |

| All Items less Food and Energy | 2.2% |

| Apparel | -0.1% |

| New Vehicles | -0.3% |

| Used Cars and Trucks | 1.4% |

| Shelter | 3.2% |

| Medical Services | 2.6% |

| Transportation Services | 2.8% |

Regional Inflation Information

The U.S. Bureau of Labor Statistics also produces regional data. So if you are interested in more localized inflation information you can find it here.

| AL | AK | AR | AZ | CA | CT | CO | DC | DE | FL | GA | GU | HI | IA |

| ID | IL | IN | KS | KY | LA | MA | MD | ME | MI | MN | MO | MS | MT |

| NC | ND | NE | NH | NJ | NM | NV | NY | OH | OK | OR | PA | PR | RI |

| SC | SC | SD | TX | UT | VA | VI | VT | WI | WA | WI | WV |

Food and Energy Breakdown

The BLS publishes an index entitled “All items Less Food and Energy” which often causes people some confusion. It doesn’t mean they stopped including food and energy in the Consumer Price Index. It just means that they have broken them out so you can compare their increase to other components. In this chart we can see the effects of food, energy and all other items on the total index. For more info see What is Core Inflation?

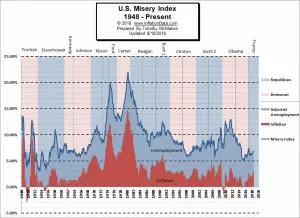

Misery Index

The misery index as of January 2019 (based on the most recent official government inflation and unemployment data for the 12 months ending in December) is at 5.81% down slightly from 5.88% last month and6.22% the previous month and even below the 5.98% in September.

[Read More…]

You Might Also Like:

From InflationData.com

- How Inflation and Interest Rates Relate

- Why Inflation Matters to Small Businesses

- What is Deflation?

- What is Disinflation?

- Cryptocurrencies and Inflation

- Did the Democrats Really Vote Against the Social Security Cost of Living Increase?

- Can Crypto Solve Venezuela’s Hyperinflation Problem?

- Cost of Living: LA and New York vs. The World

- Debt and Inflationary Pressures: A Lesson in Economic Interactivity

- Inflation Risk

Read more on UnemploymentData.com.

- Eat Your Way Into the Job: 5 Dining Tips for a Lunch Interview

- December “Monster” Jobs Report (or is it?)

- European Unemployment Rates Q3- 2018

- Lost Wages? How to Get the Compensation You Deserve

- November Employment Gains Less Than Projected But…

- Valuable Career Benefits of Studying Abroad

- Getting Your Dream Job: Nailing the Interview

From Financial Trend Forecaster

- Move Aside Lithium – Vanadium Is The New Super-Metal

- U.S. Shale Has A Glaring Problem

- How Free is Your State?

- Oil Price Rally Boosts Electric Car Sales

- $100 Oil Is A Distinct Possibility

- Do the FED’s Interest Rates Affect the Stock Market?

- Technological Solution to 100 Year Old Oil Problem

From Elliott Wave University

- Reversals And Counter-trend Moves Typically Take Time To Develop

- Interest Rates Win Again as Fed Follows Market

- Watch This Indicator for Approaching Volatility

- Have Smartphone Sales Peaked?

- Are Falling Oil Prices Really Good for the Stock Market?

- 1987 vs. 2018

- Bitcoin Breakdown May Push Prices Below $5000

- The Psychology of Volatility

From OptioMoney.com

- How to Teach Your Children to Save Money from a Young Age

- Money-Saving Upgrades: 3 Home Investments to Help Your Wallet

- Want to Boost Your FICO Score? 4 Easy Steps to Help Make That Happen

- Big Family Getting Expensive? 4 Ways to Stay in the Green

- Getting a Motorcycle? Things to Cover Before Hitting the Road

From Your Family Finances

- Apps for Home Improvement

- How to Tackle Debt From Your Summer Vacation

- Financial Preparation is Essential to Surviving a Divorce

- Financial Implications of Losing Your Mobility

- How to Develop a Millionaire Mindset

- Avoid being “house poor” by taking these 4 steps

- Productivity Hacks for Working from Home

- Dream Family Vacation: 5 Money Saving Tips That Add Up

Leave a Reply