Deflation or Inflation?

By John Mauldin

I am frequently asked in meetings or after a speech whether I think we will have inflation or deflation. “Yes,” I readily reply, trying hard not to smirk, as the questioner tries to digest the answer. And while my answer is flippant, it’s also the truth, as I do expect both outcomes. Following the obligatory chuckle from the rest of the group comes a follow-up request for a few more specifics. And they are that I expect we will first see deflation and then inflation, but the key is the timing.

Recessions are Deflationary

Recessions are Deflationary

Recessions are by definition deflationary. Deleveraging events are also deflationary. A recession accompanied by deleveraging is deflationary in spades. That is why central banks worldwide have been able to print money in amounts that in prior periods would have sent inflation spiraling out of control. This drives gold bugs nuts, but they are not factoring in the velocity of money. If velocity were flat, inflation would be quite significant by now. But velocity has been falling and is going to fall further. The US Fed and the ECB are going to be able to print more money than we can imagine without stoking inflation … at least for a while.

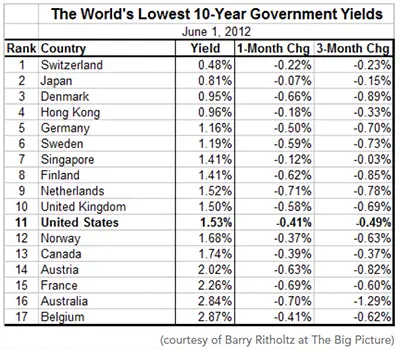

One of the longtime champions of the deflationary outlook has been my friend David Rosenberg (formerly chief economist at Merrill and now with Gluskin Sheff in Toronto). He has been talking for years about a target of 1.5% for the 10-year US bond. Today, as I’m writing this, we got down to 1.5% and did not even pause, ending the day at 1.47%. I will also note that I spoke with Rich Yamarone, the chief economist at Bloomberg, and he said he believes we will scare 50 basis points (the 10-year T-bill hits 0.50%) before we are through. To which Rosenberg replied in a later conversation, “He’s nuts!”

Look at this table of 10-year bond yields:

Since I was thinking about bond yields, I called Dr. Lacy Hunt (one of the more brilliant economists in the country, and not just in my opinion). He has been forecasting interest rates for a long time and been the guiding light at Hoisington Asset Management, which has established perhaps the best track record I know of on bond returns. They have been long bonds for quite some time, which has been the correct position if a difficult and lonely one. Most bond managers think rates are set to rise.

Not Lacy. He thinks we will get close to 2% on the 30-year bond and has said so for decades.

Dr. Gary Shilling wrote his first book in 1998, called simply Deflation, and followed it up recently with another great work, titled The Age of Deleveraging. He first went long bonds in 1982, which has been one of the great trades of the last 30 years. He lists a whole host of reasons for a deflationary period over the next few years.

The “Muddle-Through” Economy is Deflationary

The argument for deflation is rather straightforward. The boom in the US and much of the world from 1982 until 2008 was partially the result of financial innovations and massive leveraging. That process has come to an end, and the private sector is deleveraging and will do so even further as the economy softens and we slip into the next recession.

Governments are approaching the end of their ability to borrow money at reasonable rates in Europe, and soon in Japan, and eventually in the US (and that time is not as far off as we would like). I described the whole process in my book Endgame. Assuming the US government deals with its coming deficit crisis in a realistic manner, the results will be deflationary – a big assumption, I grant you!

The next big deflationary force is the slowing of the velocity of money. Very simply, money velocity is the rate at which money moves through the economy from one transaction to another and is a good barometer of economic vitality. It has been falling for five years, pretty much as I wrote it would back in 2006. We are now close to the historical average velocity of money; but, since velocity is mean-reverting, it will continue to fall until it bottoms well below the historical average. This cycle takes years, not months, by the way.

A slow-growth, muddle-through economy is deflationary. High and persistent unemployment is deflationary.

Absent some new piece of data that I just don’t see right now, rates in the US are going lower and are going to stay low for longer than any of us can afford to bet against them.

I think the Fed will respond if the government does finally act in a fiscally responsible manner (which would be inherently deflationary), by fighting that deflation with the only tool it has left: the outright monetization of debt.

They will call it something else, of course, but that will not alter the bottom line: the money presses will run day and night. They will be able to monetize more debt than you can shake a stick at, and do so without causing a repeat of the 1970s Great Inflation. Yes, it will eventually catch up with us – there is no free lunch – but they are betting on keeping the lid on actual price inflation by raising rates and cutting back on the money supply. We are some years away from that, but we had better listen when The Inflationator says, “I’ll be back.”

Anybody who says they know the timing is a lot more confident in their crystal ball than I am. But I think I can see out a year or so, and it looks like continued low rates and deflation. By the way, just to appease the gold bugs out there, given my deflationary call, I will note that quality gold stocks were up hugely during the deflationary Great Depression of the 1930s. Even with the dollar on the gold standard. Just saying.

A Quadrillion Here, A Quadrillion There

And speaking of more money than we can imagine, and the wholesale monetization of government debt, I’d like to close with an instructive vignette from the Land of the Rising Yen.

You may remember Everett Dirksen, the Republican Senator from Illinois who, back in the 1960s, was credited with saying, “A billion here, a billion there, and pretty soon you are talking about real money.” Thorough research fails to confirm that he actually used that line, although one reporter claims he asked Dirksen about it and received the reply, “Oh, I never said that. A newspaper fella misquoted me once, and I thought it sounded so good that I never bothered to deny it.”

But that quote has lodged in our collective memory; whether or not he said it, it does make a salient point.

Today we have become rather casual in our use of the word trillion. “A trillion dollars” slips so easily from the tongue, but it’s just too big a number for most of us to even fathom. Estimates of the total stars in our galaxy run between 100 and 400 billion. A trillion barrels of oil would fuel the world for over 30 years. One trillion seconds is almost 32,000 years. The mind boggles.

Yet today we think almost nothing of adding a trillion dollars every year to the already bloated US debt! In fact, economists like Paul Krugman fume that we are not adding more trillions to the debt each year, as if debt carried no consequences. By this thinking, Greece should not be forced to suffer any austerity because it has taken on too much debt. Rather, other nations should be taxed to give Greece the money that will enable them to go even deeper into debt – debt that it cannot and most likely will not repay!

So, I must admit that when I came across this next item, it gave me pause. We turn now to a report published by Bloomberg and authored by my friend Dr. Gary Shilling, talking about the massive debt that has been accumulated by Japan. Gary argues that Japan is reaching a critical point where its debt cannot be financed except by extreme monetization by its central bank because turning to world markets to sell the debt will drive up interest rates to unsustainable levels. I have made similar arguments. Says Gary:

“As Japan’s government debt of 1,085 trillion yen matures over time, it will be subject to … higher refinancing rates. The average maturity of Japanese government debt is six years and 11 months. Yet 17 percent of that debt matures this year, 52 percent in the next five years, and 76 percent in the next decade. Markets anticipate, so Japanese bonds throughout the spectrum will probably plummet in price and leap in yield at the first sign of a current- account deficit, maybe even before.”

One thousand trillion yen. That’s 32,000,000 years’ worth of seconds. Yes, I know the yen has two extra zeros in relation to the dollar, but we are talking about one quadrillion yen.

Are we really ready for the word quadrillion to enter the lexicon in what is supposed to be the developed world? In the case of Japan, we are apparently already there. A hundred years ago, a deficit of US$1 billion would have been unthinkable.

We actually had balanced budgets during most of our first 200 years, except during wars and economic crashes. And now we talk trillions, albeit in the wake of inflation that has made the word trillion less than it was 100 years ago.

Will our grandchildren in the latter half of this century talk quadrillions? Or quintillions? Is that even thinkable? Let’s just hope the word quadrillion doesn’t come into common parlance any time soon.

John Mauldin is chairman of Mauldin Economics, LLC, a publishing company offering both free and paid publications aimed at helping investors do better in today’s challenging economy. He is the author of the recently released The Little Book of Bull’s Eye Investing and co-author of the best-selling book Endgame. John is the president of Millennium Wave Advisors, an investment advisory firm registered with multiple states. He is also a registered representative of Millennium Wave Securities, a FINRA-registered broker- dealer. He is a sought-after contributor to financial publications including The Financial Times, The Daily Reckoning, as well as a regular guest on CNBC, Yahoo Tech Ticker, and Bloomberg TV. Contact: www.MauldinEconomics.com

See Also:

- What is the velocity of money?

- Velocity of Money and Money Multiplier

- Inflation and Velocity of Money

- Falling Prices

- Hidden Signs of Deflation

- Deflation

- Forecasting Inflation or Deflation

About John Mauldin

Each week, well over a million readers turn to John Mauldin to better understand Wall Street, global markets, and the drivers of the world economy. And for good reason. John is a renowned financial expert, a New York Times best-selling author, a pioneering online commentator, and the publisher one of the first publications to provide investors with free, unbiased information and guidance, Thoughts from the Frontline—the most widely read investment newsletter in the world. More...

- Web |

- More Posts(10)

Leave a Reply