Approximately every 50 to 80 years the world experiences an economic meltdown of catastrophic proportions. The one most people think of is the “Great Depression” of the 1930s. But the more recent example is the 2008 Financial Crisis. This crisis had the potential to be as bad as the Great Depression but Government action i.e. Unemployment Insurance and massive liquidity pumping was able to mitigate the effects somewhat. However, even with those actions, U-3 unemployment reached 10.6% and U-6 unemployment which is more like the measurement used in the 1930s reached 18%. What Caused the 2008 Crisis? The 2008 crisis is the culmination of a series of missteps and failed legislation. … [Read more...]

How Wealth Can Simply Evaporate

In the following article Bob Stokes of Elliottwave explains why in times of credit expansion money is created out of thin air and in times of credit contraction money can simply disappear... no matter how much the government prints out of thin air. This results in a negative "money multiplier" as more money disappears than is created. See my article on Velocity of Money and the Money Multiplier for more information.~Tim McMahon, Editor Evaporation of Wealth on a Vast Scale How $1-million can disappear By Bob Stokes The bursting of the "debt bubble" which started in 2008 is far from over. It's the financial story of our age and it's happening before our eyes. The full scope is hard to … [Read more...]

US Economic Situation “Intractable”

Over the last few years we've often mentioned the situation that the government has gotten itself into and wondered how it was ever going to be able to get itself out. The speculation has been that a period of hyperinflation might be the only option. In today's article David Galland editor of the Casey report discusses the economic bind the government is in and just what options it has. ~Tim McMahon, editor By David Galland, The Casey Report In describing the current situation in these United States, and in many of the world’s other superpowers, we here at Casey Research have often used the word “intractable”… as in, “impossible to resolve.” While that may not be technically … [Read more...]

Deflation: The Elephant in the Room

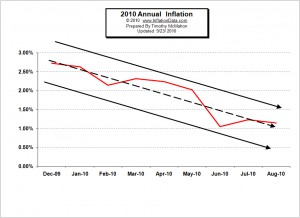

We've had almost a Trillion dollars in "stimulus" and/or "Quantitative Easing" or whatever you want to call it and as of the end of August 2010 we still only have 1.15% annual inflation... Down from 1.24% last month. And the trend has been steadily decreasing for all of 2010. Back in 2009 we had a period of deflation bottoming at -2.10% in July of 2009 and the stimulus kicked the inflation rate from its deflationary moorings all the way up to 2.72% in December of 2009. But as we can see from the chart below the effect didn't last long... and the inflation rate has steadily declined for all of 2010 so far. In the light of all that stimulus, the biggest credit bubble in history is … [Read more...]

Worldwide Economic Recovery Slowing

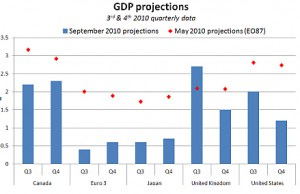

By Tim McMahon, editor The effects of the Trillion Dollar economic stimulus are wearing off and the "recovery" is looking pale and thin. So it may be time to crank up the printing presses again... According the OECD’s latest Interim Economic Assessment, the world economic recovery may be slowing faster than previously anticipated. Growth in the the seven largest developed countries of France, Germany, Italy, Japan, United Kingdom, United States and Canada is expected to be around 1½ per cent on an annualized basis in the second half of 2010 down from the OECD’s previous estimate of around 1¾ per cent in May. … [Read more...]

6 Questions about the Financial Crisis

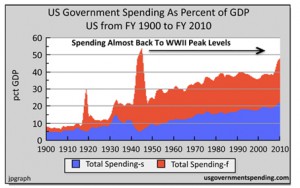

March 11, 2009 Elliott Wave International, receives thousands of questions every year from web site visitors and subscribers on their free Message Board. Here the company shares 6 of the recent critical questions on the financial crisis and 6 answers provided by their professional analysts. For more free questions and answers or to submit your own question, visit Elliott Wave International’s Message Board. Q: Can increased government spending help stop the crisis? What do you think about the new mortgage bailout plan – or bailouts and proposals for additional government spending in general? The opinions on whether or not this will ultimately work seem so divided... … [Read more...]

Why the Bailout Won’t Work

By Andrew Gordon The economy is now staring eyeball-to-eyeball with an activist U.S. government. It will legislate, reform, supervise, bully, give out money like cotton candy and get concessions in return. It will encourage technological development in environmental and other “future” industries. It will seek sources of energy other than the oil and gas we get from Mexico, Canada and OPEC. And it will put generous sums of money behind these initiatives. The Obama government emphatically does not want banks to sit on the money they get from the government. Nor do they want it to go to shareholders in the form of dividend payments. This is why I look for more companies to cut their … [Read more...]