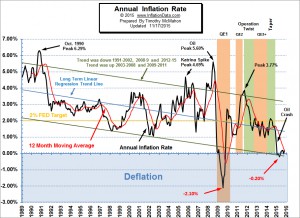

The Bureau of Labor Statistics (BLS) released their inflation numbers for the year ending October 31st on November 17, 2015. Although Annual inflation was positive at 0.17% monthly inflation was negative (disinflationary) for the third month in a row. This is the result of the CPI index falling consistently from a high in July 2015 of 238.654. In August it was 238.316 resulting in a monthly inflation for August of -0.14%. September 2015 was 237.945 for a monthly inflation rate of -0.16 and then October 2015 was 237.832 resulting in monthly -0.04%. However, Annual Inflation was still positive in two of the three months, i.e. August through October were 0.20%, -0.04% and 0.17% respectively. … [Read more...]

Hyperinflation and Government Debt

By Doug Casey The over-leveraging of the U.S. federal, state, and local governments, some corporations, and consumers is well known. This has long been the case, and most people are bored by the topic. If debt is a problem, it has been manageable for so long that it no longer seems like a problem. U.S. government debt has become an abstraction; it has no more meaning to the average investor than the prospect of a comet smacking into the earth in the next hundred millennia. Many financial commentators believe that debt doesn’t matter. We still hear ridiculous sound bites, like “We owe it to ourselves,” that trivialize the topic. Actually, some people owe it to other people. There … [Read more...]

June- First Annual Inflation for 2015

The Bureau of Labor Statistics (BLS) released their monthly Consumer Price Index (CPI-U) and Inflation report for the year ending in June on July 17th. This resulted in 0.12% Annual Inflation. The BLS rounded this to .1% which of course is so small that almost any one of the deflationary months last year would cancel out all the inflation we've seen over the previous 12 months. The CPI-U index a year ago was 238.343 and is currently an almost identical 238.638. January through May 2015 saw deflation on an annual basis although each month was inflationary in and of itself. But due to the massive deflation of the fourth quarter of 2014, all the monthly inflation was cancelled out. However, … [Read more...]

Inflation Down Again

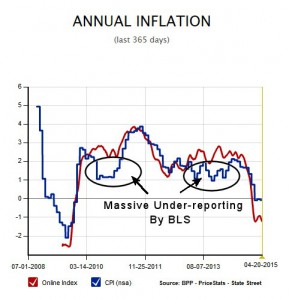

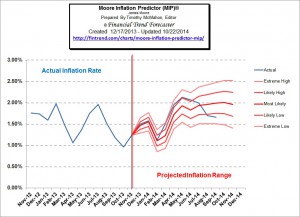

The Bureau of Labor Statistics (BLS) released the September inflation numbers on October 22nd and inflation is lower for the fourth month in a row. Annual inflation in May was 2.13% in June it was down to 2.07% (although the BLS rounded both to 2.1%). In July inflation fell to 1.99% and in August it was down to 1.70% and in September it was 1.66%. Once again the BLS rounded both August and September to 1.7%. The last few months are a perfect reason why it is important to use our two decimal place inflation calculations. So although we have seen a steady decline, using the BLS numbers you would see 2.1%, 2.1%, 2.0%, 1.7%, 1.7% and so the decline is not so obvious. As the inflation rate … [Read more...]

More Quantitative Easing in the Cards?

For some time we've been saying that the FED is addicted to Quantitative Easing (QE) and that it wouldn't be so easy to kick the habit. Then last week we told you that there are signs that the Deflationary roots go deep and the only thing keeping the economy on a steady keel is all the money being created by the FED. But all that funny money is eroding the foundations and the FED can't keep it up forever. Up until now every crisis required a bigger and bigger entity to step up to the plate and assume the debt. At this point the only entity bigger than the FED left to step up is the World Bank. So when the FED runs out of bullets it will be the last round of musical chairs. But at this … [Read more...]

Cost of Living- Infographic

Over the years prices have changed (generally getting higher except possibly for technology devices). But it is difficult to track the changes if the length of the ruler is constantly changing. You need to compare it to a constant measurement. When that comes to calculating the cost of things, in order to get an idea of how prices are doing you need to adjust them for inflation. That is called measuring "constant dollars". Typically the calculation is based on the CPI or Consumer Price Index. In today's infographic created by our friends at Vouchercloud we will look at how things are doing in the ten years since 2003. … [Read more...]

Why Gold is a Good Investment for Inflationary Times

The Impact of Inflation on Savings If you keep your money in the bank or in money market funds, inflation can eat away at their value. Inflation can be deceiving because your account balances won’t go down. However, when you take your money out to buy something, you might notice that you won’t be able to buy as much as you used to. Therefore, if you don’t put your money into something that keeps up with inflation, you’ll soon find your savings won't buy as much. As an investor, you need to be prepared for the risk of inflation. It happens when there is too much money chasing too few goods, so prices have to go up (because of an increase in the money supply). When the economy is facing … [Read more...]

Australia- How to Beat the Health Cover Cut

Health fund members have discovered that the best way to avoid means-testing of the nation’s $5 billion private health insurance rebate is to prepay their premiums. After the means test on private health fund subsidies was approved by the Senate, almost 2 and a half million health fund members will start paying up to $1300 more each year for health cover starting July 1. Health insurers all across Australia braced for a huge increase of members choosing to prepay premiums after the Australian Taxation Office sent out letters warning consumers about the changes. … [Read more...]

Zimbabwe-hyperinflation-and-the-u-s-dollar (moved)

This page has moved if you are not redirected please click here: http://inflationdata.com/articles/2009/02/26/zimbabwe-hyperinflation-us-dollar/ … [Read more...]