Alan Greenspan was appointed Fed chairman by Ronald Reagan in August 1987, he was reappointed by Bush and Clinton, at successive four-year intervals until retiring after a record-setting tenure on January 31, 2006. During that time period he was one of the most powerful men in the world. The stock markets literally hung on his every word. People made it their full time job to try and decipher what cryptic meaning might be obtained from his press releases. At times his words boosted the market as he dealt with issues like the Black Monday stock market crash that occurred shortly after he first became chairman. At other times he tried to talk the market down and he referred to the … [Read more...]

Why the System is Coming Unglued

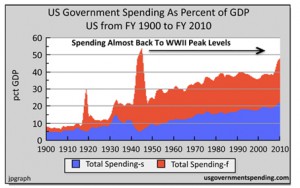

It is ironic that a country that was built on a system of checks and balances now has a monetary system that is accountable to no one... the way our monetary system is structured, the government can literally print money and spend it on anything, no matter how foolish ... it has no checks and balances. And so according to many estimates the unfunded liabilities run $75 to $100 trillion... these can never be paid off. It has grown to this level because there are no real operating principles other than buying the votes needed to get re-elected and to stay in office for as long as they can. If you would have asked anybody on this planet five, six years ago, if the US government could run a … [Read more...]

Five Things You Need to Know About the Economy

By David Galland, Managing Director, Casey Research At any point during the recent negotiations in Washington over the debt, did you seriously think for even a second that the U.S. was about to default? Of course, in time the U.S. government (along with many others) will default. However, they are highly unlikely to do so by decree or even through the sort of legislative inaction recently on display. Rather, it will come about through the time-honored tradition of screwing debtors via the slow-roasting method of monetary inflation. Yet most people still bought into the latest drama put on by the Congressional Players – a troupe of actors whose skills at pretense and artifice might … [Read more...]

US Economic Situation “Intractable”

Over the last few years we've often mentioned the situation that the government has gotten itself into and wondered how it was ever going to be able to get itself out. The speculation has been that a period of hyperinflation might be the only option. In today's article David Galland editor of the Casey report discusses the economic bind the government is in and just what options it has. ~Tim McMahon, editor By David Galland, The Casey Report In describing the current situation in these United States, and in many of the world’s other superpowers, we here at Casey Research have often used the word “intractable”… as in, “impossible to resolve.” While that may not be technically … [Read more...]

What Most People Don’t Realize About The Fed’s Superpowers

Since its creation in 1913, the primary intended role of the U.S. Federal Reserve Bank has been that of protector. In theory, the central bank was bestowed with the power to shape monetary policy in a way that would keep both booms and busts in check. The two main tools at its disposal -- interest rates and money creation -- would provide a "ceiling of normalcy" above expansions AND a "net of safety" below contractions. To this day, the financial mainstream holds great faith in the Fed's ability to fulfill its save-the-day duties -- as these recent news items make plain: "Why Raising Fed Funds Rate Is Positive For Equities." (Seeking Alpha) "Fed's Moves Lift All Asset Classes." … [Read more...]

Understanding the Federal Reserve Bank

What's a greater threat to the U.S. economy -- inflation or deflation? To decide that... it helps to understand what role the U.S. Federal Reserve plays. Despite so much focus on the policies of the Fed, its operations remain somewhat of a mystery to most investors -- in no smaller measure, due to their complexity. Here's an excerpt of a 35-page report that explains the Fed, its goals and, very importantly, its limitations in layman's terms. … [Read more...]

The Long Swim – How the Fed Could Become Insolvent

By Terry Coxon, Editor, The Casey ReportYou’ve seen the proof in real time. Once-dominant industrial companies, e.g., General Motors, can run out of money. The biggest banks, e.g., Bank of America, can run out of money. Even sovereign governments, e.g., Greece, can run out of money. Yes, all those organizations are still limping along, but only after being rescued by other giant institutions, such as the U.S. government, the less unhealthy European governments, the European Central Bank, and the International Monetary Fund. So far, it’s been easy to get rescued. The people who run giant institutions seem to shudder at the thought of other giant institutions being shown up as anything less … [Read more...]

U.S. Tax Burden Good News?

The Organisation for Economic Co-operation and Development (OECD) released its revenue statistics today and it contained some good news for residents of the United States. Well, maybe not "Good News" but "Less Bad" news. It seems that the tax burden in the United States is not as bad as it is in the majority of the other developed countries in the world. The OECD statistics show that as a percentage of GDP Denmark has the highest tax burden with the Danish government absorbing almost half of their GDP (48.2%). Sweden was a close second at 46.4%. Other European countries … [Read more...]

Bernanke Is Making the Crisis Worse

By Bud Conrad, Chief Economist, Casey Research The Fed is a corrupt and powerful institution, and Chairman Bernanke is making the global crisis worse. His new speech given last week in Europe was terribly misguided and will upset markets as the Chinese and Germans won't ignore his challenges. Bernanke’s interpretations of the markets have been wrong since before he was appointed to head the Fed, and his actions are doing nothing but aggravating the situation. In this seminal speech, titled “Rebalancing the Global Recovery,” Bernanke not only defended QE II as the right policy, but also attacked the monetary policy of China, the biggest holder of U.S. debt, an action that must be … [Read more...]

What is the Federal Reserve – Part 3

Money, Credit and the Federal Reserve Banking System Conquer the Crash, Chapter 10 By Robert Prechter How the Federal Reserve Has Encouraged the Growth of Credit Congress authorized the Fed not only to create money for the government but also to “smooth out” the economy by manipulating credit (which also happens to be a re-election tool for incumbents). Politics being what they are, this manipulation has been almost exclusively in the direction of making credit easy to obtain. The Fed used to make more credit available to the banking system by monetizing federal debt, that is, by creating money. Under the structure of our “fractional reserve” system, banks were authorized to employ … [Read more...]