By David Galland, Managing Director, Casey Research At any point during the recent negotiations in Washington over the debt, did you seriously think for even a second that the U.S. was about to default? Of course, in time the U.S. government (along with many others) will default. However, they are highly unlikely to do so by decree or even through the sort of legislative inaction recently on display. Rather, it will come about through the time-honored tradition of screwing debtors via the slow-roasting method of monetary inflation. Yet most people still bought into the latest drama put on by the Congressional Players – a troupe of actors whose skills at pretense and artifice might … [Read more...]

The Buzz Around Gold Is Growing Louder

By Jeff Clark, Casey Research BIG GOLD I outlined last week the increasingly bullish consensus among analysts about gold stocks. The same pattern exists with gold itself; growing numbers of analysts have either joined the movement or have upped their bullish outlook. The following comments and developments have all been reported just this month. It presents quite a convincing case when one strings them together like this. Keep in mind that this is what these analysts and managers are telling their clients. … [Read more...]

A Thousand Pictures Is Worth One Word

By Jeff Clark, BIG GOLD In spite of constant headlines about debts and deficits, most Americans don’t really believe the U.S. dollar will collapse. From knowledgeable investors who study the markets to those seemingly too busy to worry about such things, most dismiss the idea of the dollar actually going to zero. History has a message for us: No fiat currency has lasted forever. Eventually, they all fail. BMG BullionBars recently published a poster featuring pictures of numerous currencies that have gone bust. Some got there quickly, while others took a century or more. Regardless of how long it took, though, the seductive temptations allowed under a fiat monetary system eventually … [Read more...]

Credential Inflation: Bachelor’s Degree Not Enough

In today's tumultuous economic climate, when we hear the term "inflation" we think money and a failing economy our minds immediately turn to expenses, debt, and money woes. Rarely, however, do our minds turn to college degrees and job prospects. On July 22, 2011 Laura Pappano from The New York Times published an article titled The Master's as the New Bachelor's. Introducing into the public mindset the concept of "credential inflation" and "degree inflation", this article has caused quite the hoopla in the academic world and many a panic attack among 20 somethings throughout the country. Pappano suggests that there is a certain amount of credential inflation occurring throughout the job … [Read more...]

Free Resources

Free Resources for Investors. (Limit 1 Per Person) Learn to think for yourself Make your own decisions and be your own person. Change the way you invest forever. Download the information the FED doesn't want you to read. Discover the trade set-ups of a lifetime just waiting for you to snag them. Check it out … [Read more...]

The Long Road to Inflation Perdition

Today David Galland interviews Terry Coxon. Terry has worked hand in hand with the legendary best selling author Harry Browne together they wrote Inflation-Proofing Your Investments published in 1981 . Terry also wrote Keep What You Earn and is an expert in monetary systems and first started writing about inflation during the last major inflationary period of the 1970's. David Galland is editor of The Casey Report. How the Federal Reserve is Locking Up Inflation David Galland: You were involved with Harry Browne during the last great inflation in the U.S. How does the increase in the money supply that kicked off in 2007-2008 compare in terms of scale to what went on leading up to the … [Read more...]

Home Prices vs. Home Values

By Charles Vollum, BIG GOLD On June 3, Standard and Poor’s issued the latest update to its Case-Shiller Home Price series. The press release begins, “Data through March 2011 ... show that the U.S. National Home Price Index declined by 4.2% in the first quarter of 2011, after having fallen 3.6% in the fourth quarter of 2010. The National Index hit a new recession low with the first quarter’s data and posted an annual decline of 5.1% versus the first quarter of 2010.” Then comes the key statement: “Nationally, home prices are back to their mid-2002 levels.” This means that on the average, a home in the U.S. that was purchased for $200,000 in mid-2002 would have sold for about the … [Read more...]

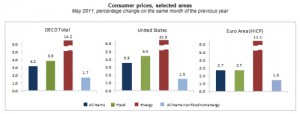

May Inflation Surges to 3.2% in OECD Countries

The Organization for Economic Co-operation and Development (OECD) has finished aggregating the May inflation data provided by its member countries and has released the results. Energy prices were up a whopping 14.2% for the 12 months ending in May while food prices were up by 3.9%. The overall average for all products in all the OECD countries was 3.2% in May. This was up from the 2.9% reported in April. The major components of this increase were mainly a sharp acceleration of inflation in Canada (to 3.7% in May, up from 3.3% in April) and the United States (to 3.6%, up from 3.2%) with high food and energy prices being the main drivers. The following chart breaks the components down by … [Read more...]

The Great Nugget Scam

By Doug Hornig, Casey Research You know an asset class is hot when the scam artists start coming out of the woodwork. Such was the case during the real estate bubble of this century’s first decade, as those selling mortgages packaged them in ever more complex vehicles, many of which are now known to have been utterly fraudulent. Is gold where real estate was? No, not quite. But the notion that we are approaching the same ballpark seems borne out by one of the more creative scams we’ve seen recently. And we’re not talking about all those hucksters now trying to separate you from your old jewelry for a fraction of its value. We’re talking about the great nugget scam. … [Read more...]

Its Weight in Gold: The Real Prices of Things

Fiat currencies By Charles Vollum, Casey Research Fiat currencies the world over are being manipulated by central banks, which is distorting asset and commodity prices. Successful investing requires that investors have a good idea of what things cost and what they are really worth – and using the world's oldest and most stable form of money, gold, to compare prices is one way to get that insight. To that end, below is a sampling of current prices measured in grams or milligrams of gold. Price comparisons are against prices as of June 10. Fiat Currency Watch: Change from: Price in Gold Week ago Year ago USD 20.3 mg 0.7% -20.4% CAD 20.8 … [Read more...]