By Ryan McMaken It is not uncommon to encounter political theorists and pundits who insist that political centralization is a boon to economic growth. In both cases, it is claimed the presence of a unifying central regime—whether in Brussels or in Washington, DC, for example—is essential in ensuring the efficient and free flow of goods throughout a large jurisdiction. This, we are told, will greatly accelerate economic growth. In many ways, the model is the United States, inside of which there are virtually no barriers to trade or migration at all between member states. In the EU, barriers have been falling in recent decades. The historical evidence, however, suggests that … [Read more...]

Can the Dollar Retain Its Ultimate Currency Status?”

The following article by Ryan McMaken, author of Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities and Commie Cowboys: The Bourgeoisie and the Nation-State in the Western Genre, looks at what makes a global reserve currency and if the U.S. Dollar has what it takes to keep that position. ~Tim McMahon, editor How the Dollar Became the World's Top Global Currency By Ryan McMaken In March 2009, in the midst of a recession, then Treasury Secretary Timothy Geithner was pressed to respond on the question of whether or not another currency—possibly the IMF’s special drawing rights (SDRs)—might displace the US Dollar as the dominant global reserve currency. … [Read more...]

Food and Shelter Prices Keep Climbing as CPI Growth Hits a Three-Month High

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, [i.e., February 14th], and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in sixteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.4 percent year over year in January before seasonal adjustment. That’s down very slightly from December’s year-over-year increase of 6.5 percent, and January is the twenty-third month in a row with inflation above the Fed’s arbitrary 2 percent inflation target. Price inflation has now been above 6.0 percent for sixteen months in a row. [Editor's note: … [Read more...]

Is The Fed Flashing Signs It’s Done Raising Rates?

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday raised the target policy interest rate (the federal funds rate) to 4.75 percent, an increase of 25 basis points. With this latest increase, the target has increased by 4.5 percent since February 2022, although this latest increase of 25 basis points is the smallest increase since March of last year. Indeed, the FOMC has slowed its rate of increase over the past three months. After four 75 basis point increases in 2022, the committee approved a 50-point increase in December, followed by the 25-point increase this week. In other words, the FOMC has been slowed down in its monetary tightening. The committee was … [Read more...]

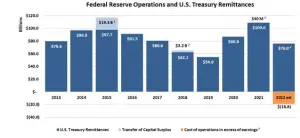

Why the Fed Is Bankrupt and Why That Means More Inflation

In 2011, the Federal Reserve invented new accounting methods for itself so that it could never legally go bankrupt. As explained by Robert Murphy, the Federal Reserve redefined its losses so as to ensure its balance sheet never shows insolvency. As Bank of America’s Priya Misra put it at the time: As a result, any future losses the Fed may incur will now show up as a negative liability (negative interest due to Treasury) as opposed to a reduction in Fed capital, thereby making a negative capital situation technically impossible. That was twelve years ago, and it was all academic at the time. But in 2023, the Fed really is insolvent, although its fake post-2011 account doesn’t show this. … [Read more...]