In this article Jeff Clark shows us how to think about prices and purchasing power in a different way. The true measure of inflation is in relation to how much stuff your money can buy and in reality it is also related to the return you can get on your investment. If you can get 10% on your money a 5% inflation rate isn't so bad. But if you own any assets and they are only appreciating at 1% (or worse yet depreciating) and prices are increasing at a 5% rate the value of your assets are declining (i.e. they are being insidiously and secretly being stolen by the government printing presses). In this article Jeff will give you another way to look at the issue of prices and perhaps open your … [Read more...]

The US’s Education Bubble

By Doug Hornig and Alex Daley, Casey Research In the world of finance, there is always talk of bubbles – mortgage bubbles, tech stock bubbles, junk bond bubbles. But bubbles don’t develop only in financial markets. In recent years, there's been another one quietly inflating, not capturing the attention of most observers. It's an education bubble – just not the one of student debt that has graced the pages of the New York Times and so many other publications in recent months. The problem is not that we are overeducating ourselves as many would have you believe. Rather, it’s that we are spending a fortune to undereducate ourselves. The United States has always been a very educated … [Read more...]

Adam Fergusson: “Inflating your economy means playing with fire”

GoldMoney founder James Turk interviews When Money Dies author Adam Fergusson, who discusses the parallels and differences between the Weimar inflation and the situation in the US and Europe today. "I don't see how any of these [Western] economies can grow their way out of the extraordinary debts that they have." … [Read more...]

Rick Rule: “Bet against the dollar as a store of value”

In this excerpt from the Casey Summit When Money Dies, seasoned resource investor/broker Rick Rule discusses risk management and explains why the greatest risk you face as an investor is located to the left of your right ear and to the right of your left ear. Listen to Rick's complete summit speech – plus those of nearly 30 other renowned financial experts – from the comfort of your home. More than 20 hours of audio recordings on CD or MP3, including the experts’ top stock picks. Learn more. … [Read more...]

The Way Out of Our Economic Mess

By Terry Coxon, Casey Research "A rock and a hard place" is a long-running theme of Casey Research publications. It refers to the dilemma the US government has wandered into with its continued policy of rescue inflation. The "rock" is what will happen if the Fed pauses for long in printing still more money – the collapse of an economy burdened by an accumulation of mistakes that rescue inflation has been keeping at bay. The "hard place" is the disruptive price inflation that becomes more likely (and likely more severe) with every new dollar the Fed prints to keep the effects of those mistakes suppressed. When the dollar was cut loose from the gold standard in 1971, the Federal Reserve … [Read more...]

Is the US Monetary System on the Verge of Collapse?

By David Galland, Casey Research Tune into CNBC or click onto any of the dozens of mainstream financial news sites, and you’ll find an endless array of opinions on the latest wiggle in equity, bond and commodities markets. As often as not, you'll find those opinions nestled side by side with authoritative analysis on the outlook for the economy, complete with the author’s carefully studied judgment on the best way forward. Lost in all the noise, however, is any recognition that the US monetary system – and by extension, that of much of the developed world – may very well be on the verge of collapse. Falling back on metaphor, while the world’s many financial experts and economists sit … [Read more...]

Falling Oil Prices: Worrying Trend or Saving Grace?

By Marin Katusa, Casey Energy Team When oil prices start to decline, investors and economists get worried. Oil prices in large part reflect global sentiment towards our economic future – prosperous, growing economies need more oil while slumping, shrinking economies need less, and so the price of crude indicates whether the majority believes we are headed for good times or bad. That explains the worry – those worried investors and economists are using oil prices as an indicator, and falling prices indicate bad times ahead. But oil prices have to correct when economies slow down, or else high energy costs drag things down even further. And the current relationship between oil prices and … [Read more...]

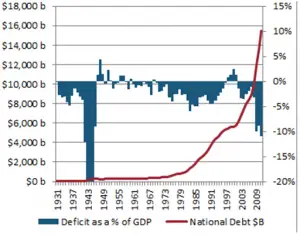

Why the System is Coming Unglued

It is ironic that a country that was built on a system of checks and balances now has a monetary system that is accountable to no one... the way our monetary system is structured, the government can literally print money and spend it on anything, no matter how foolish ... it has no checks and balances. And so according to many estimates the unfunded liabilities run $75 to $100 trillion... these can never be paid off. It has grown to this level because there are no real operating principles other than buying the votes needed to get re-elected and to stay in office for as long as they can. If you would have asked anybody on this planet five, six years ago, if the US government could run a … [Read more...]

Money Essentials for These ChaoticTimes

Trying times are upon us. There are a few essentials you absolutely must understand if you are going to thrive or at least survive financially over the next few years. If you want serious money, you have to get serious about money. You need to understand these fundamentals and never forget them. Here are the fundamentals: Liquidate, Consolidate, Create and Speculate. The key to becoming wealthy is simple to state but totally incomprehensible to modern society. Simply produce more than you consume and save the difference. But we are taught that consumption is the goal. He who dies with the most toys wins... Consumption is the good that will save our country. But is it true or is … [Read more...]

Has the Fed Started QE3?

By Bud Conrad, Casey Research The Fed surprised the market by extending its policy of 0 to 0.25% Fed funds rate to mid-2013. The way the Fed manages to drive rates lower is to buy Treasuries with newly created money – driving the price up and the rates down. The big question is whether the policy will have a sizeable effect on markets. The chart below shows the historical jump in the Fed’s combined policy tools that were used to lower rates and bail out financial institutions through a variety of programs. These include the big purchase of mortgage-backed securities (MBS) called QE1 and the large purchase of Treasuries called QE2. The point of the extrapolation in the chart is just to … [Read more...]