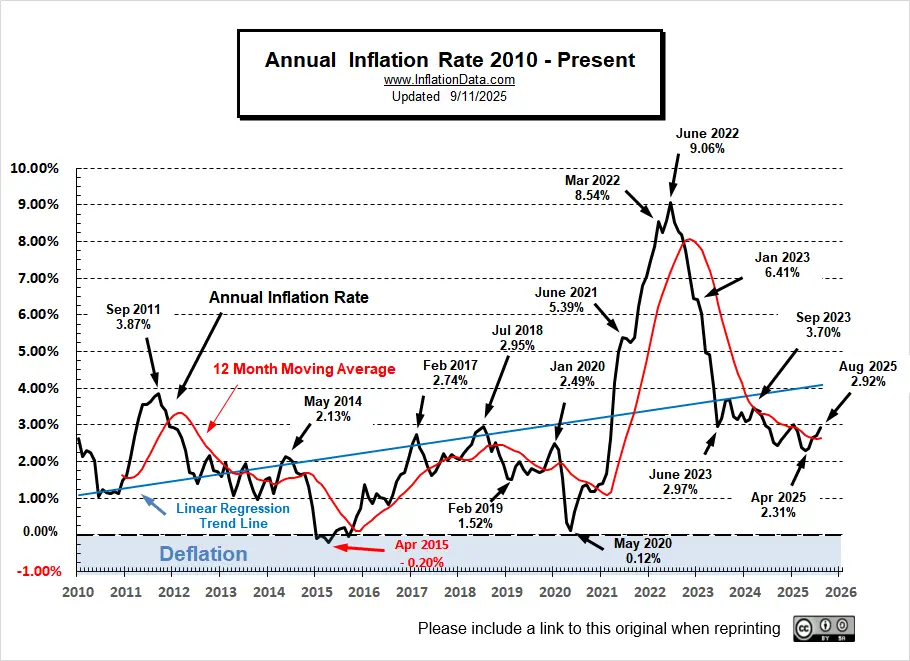

The U.S. Bureau of Labor Statistics released its August 2025 Inflation report on September 11th, 2025. The report showed that Annual Inflation was up at 2.9%.

Calculated to two digits, it was 2.70% in July and 2.92% in August. The market is 90% certain that the FED will lower rates on September 17th despite rising inflation.

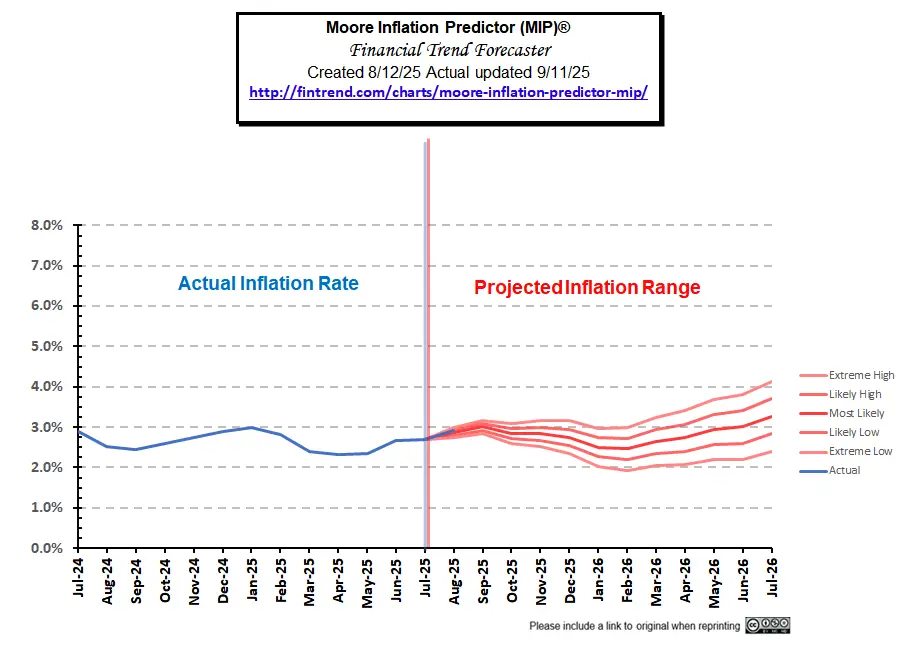

August’s Inflation Prediction:

At 2.92%, August’s inflation numbers came at our “likely high”. Most economists had projected 2.9% as well.

Go here to view our current MIP projection.

Go here to view our current MIP projection.

August 2025 Inflation Summary:

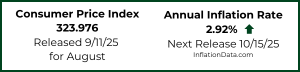

Annual Inflation… 2.92% in August 2025

- Annual Inflation rose from 2.70% to 2.92%

- CPI Index rose from 323.048 to 323.976

- Monthly Inflation for August 2024 was 0.08% and August 2025 was much higher at 0.29%.

- Next release October 15th, 2025

Annual Inflation Table

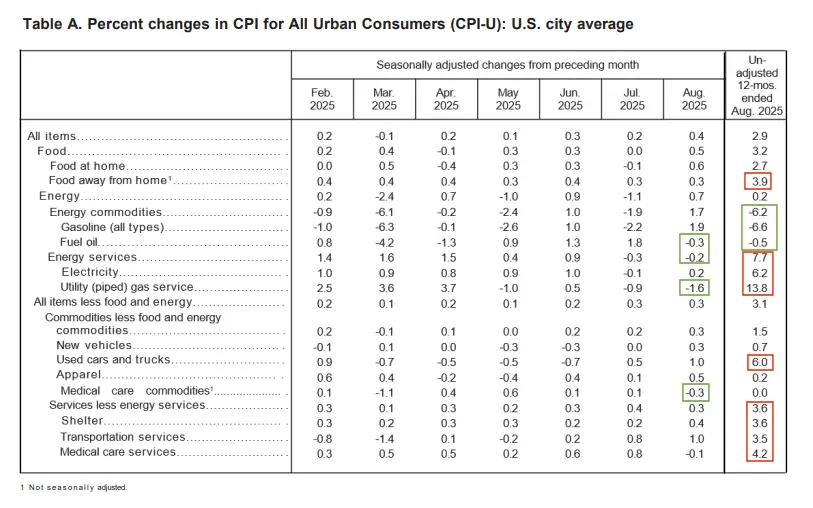

BLS Commentary:

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent on a seasonally adjusted basis in August, after rising 0.2 percent in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment. The index for shelter rose 0.4 percent in August and was the largest factor in the all items monthly increase. The food index increased 0.5 percent over the month as the food at home index rose 0.6 percent and the food away from home index increased 0.3 percent. The index for energy rose 0.7 percent in August as the index for gasoline increased 1.9 percent over the month.

Looking at table A below, the best performers are in green boxes, and the worst are in red boxes. Thus, we can see that on an annual basis, energy commodities like gasoline are still down, but energy services are up fairly significantly.

The biggest gainers are primarily services such as “Food away from home”, “Shelter”, and “Transportation services”, plus one commodity, i.e., “Used vehicles”.

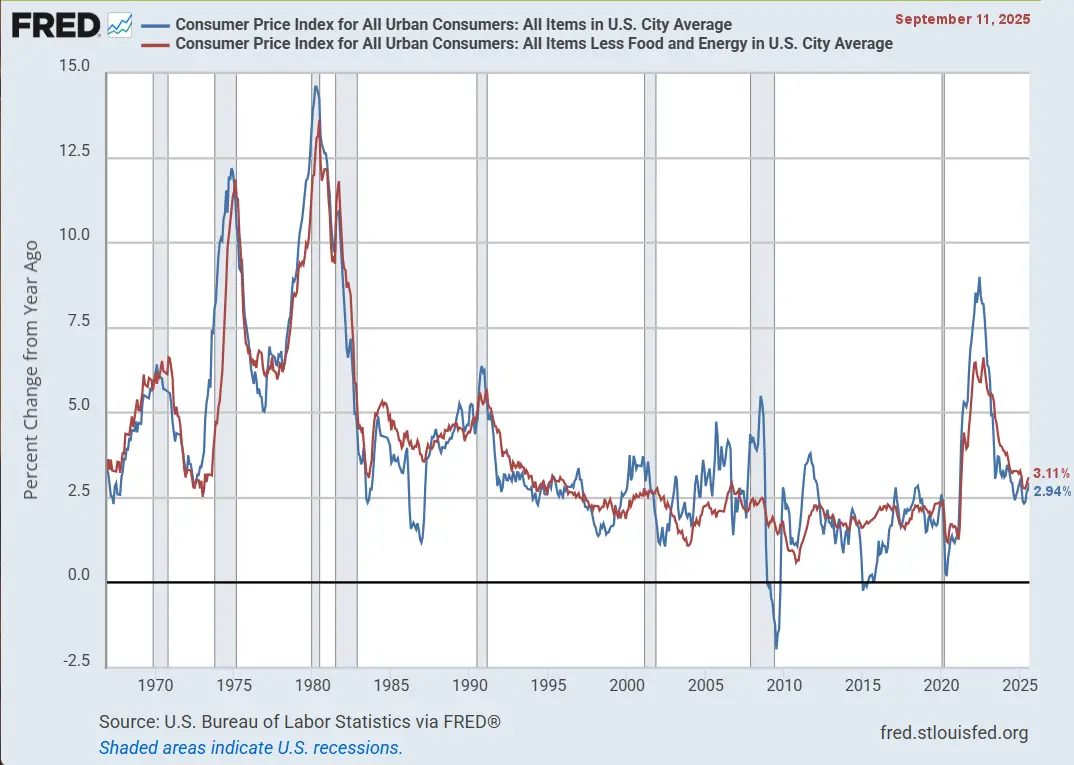

All Items vs. Less Food and Energy

Although these “Seasonally Adjusted” numbers are slightly different than those typically presented by the BLS, the following chart from the Federal Reserve shows the gap between inflation with and without Food and Energy. So, we can see how much food and energy contribute to overall inflation.

Energy prices continue to pull overall inflation down (i.e., the blue line is below the red line). Without food and energy, inflation would be 3.11%. But due to the downward pressure of Energy, total inflation, according to the FED, is 2.94%.

Source: St. Louis FED

FED Monetary Policy

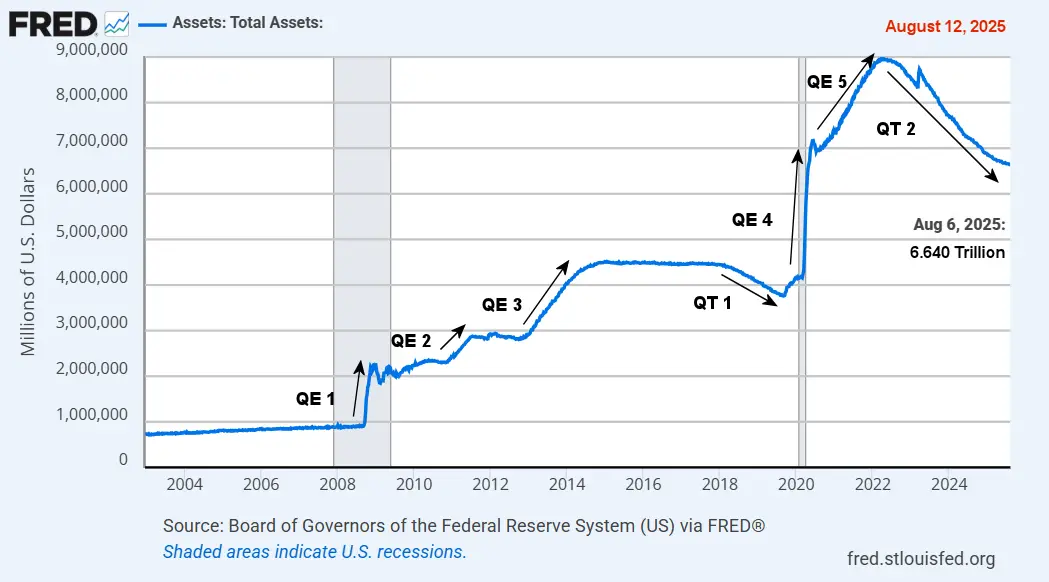

August 2025 Summary:

- FED Assets are still declining (i.e. Quantitative Tightening)

- M2 Money supply is rising

- FED Funds Rate 4.33% unchanged from January

- Possible Rate Cut September 17th

FED Assets and M2 Money Supply

M2 Money Supply

BUT… rather than continuing to decline in 2023 through 2025 as FED assets do, M2 (#5) returns to roughly the same slope of increase as from 2012-2020 (#1), despite FED assets declining. This could be the reason for the rebound in the stock market, beginning at about the same time as this uptick in M2. The more money sloshing around in the system, the more that finds its way into the stock market.

Global M2

The Global M2 Money Supply is the composite of all the major countries’ money supplies. Generally, an increase in the money supply will result in a rising stock market with a 2 to 4-month delay. Starting at just over 100 in January 2024, it is now above 114, or a 14% increase in about 19 months. Although it only rose slightly during the first half of 2024 it rose sharply in the 3rd quarter but then fell sharply in the 4th quarter of 2024. Then, in 2025, global M2 has skyrocketed. It peaked at 115.2 in early July, and fell to a low of 113.35 before climbing again to 115.1. The overall trend is up sharply for 2025, which is a good indicator that global inflation is rising rapidly.

FED Funds Rate

The chart below shows the rapid increase in interest rates from February 2022, when they were just 0.08% to a year later, when they were at 4.57%. From August 2023 through August 2024, the FED maintained a stable Funds Rate at 5.33%. Then, in September, the FED announced a 1/2% reduction in the range. October numbers show the rate at 4.83%. At its November meeting, the Fed lowered the federal funds target range by 25 basis points to 4.5%-4.75%, with the actual rate coming in at 4.48% in December. On December 19, 2024, they lowered the target range to 4.25 – 4.50%. Since then, the FED held its Funds rate steady from January through August 2025 at 4.33%. At the most recent FED meeting, Chairman Powell hinted that Unemployment may take precedence over Inflation, leading the market to believe with 99.4% conviction that the FED will cut rates in September, that conviction has since fallen to around 90% after the inflation increase was reported.

Inflation Chart

Monthly Inflation Compared to Previous Years:

The monthly inflation rate for August 2025 was 0.29%. A year earlier, in August 2024, monthly inflation was a low 0.08%. So, anything above that would cause annual inflation to rise. Monthly inflation for August 2025 was much higher, so annual inflation increased from 2.70% to 2.92%.

See: Monthly Inflation Rate for more information and a complete table of Unadjusted Monthly Rates.

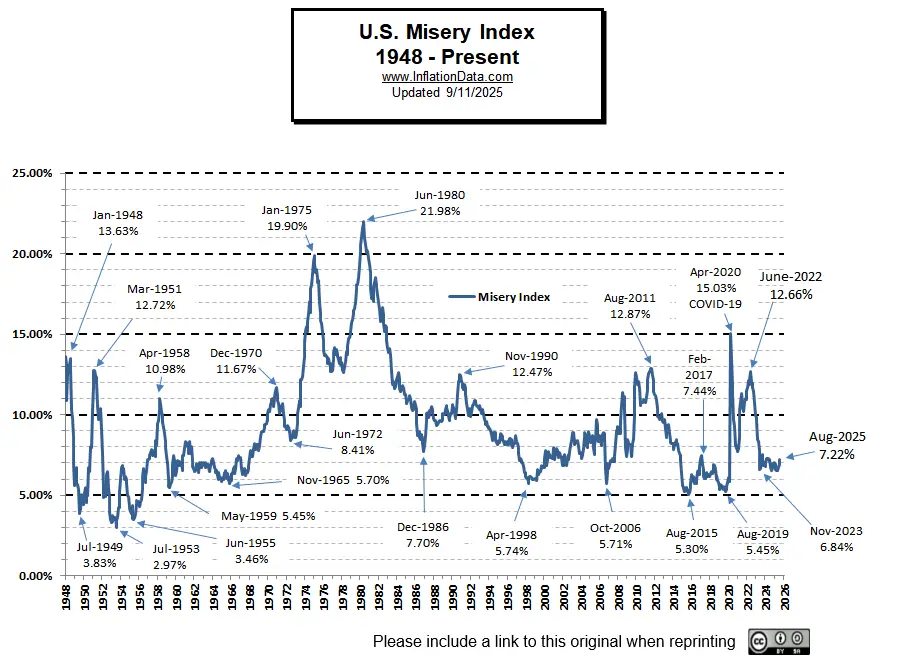

Misery Index

Unemployment 4.30% + Inflation 2.92% = 7.22%

This month, inflation is up slightly, as is unemployment, and so the misery index is up from 6.90% to 7.22%. For the first half of 2024, the Misery index hovered around 7% before falling to the high 6s. It finished the year at 6.99% and moved up very slightly to 7.00% in January 2025, from there it has inched down before rebounding.

In this chart, we can see the peaks and valleys of the index, with most of the low points occurring above 5%, with only a couple in the 1940s and 1950s that are below 5%. Those were generally during times of war when unemployment was extremely low. Only twice in the current millennium has the misery index fallen close to 5%. Even in the boom of 2006, it was 5.71%.

Read More on the Misery Index…

Crypto Rate of Change

ETH is on a tear after generating a buy signal a couple of months ago. BTC generated a tentative “Sell”. On August 16, 2025, the BTC ROC generated a Sell signal as BTC ROC crossed below its dotted average line. Bitcoin lore has it that September (aka. “Rektember” or “Septembear”) is known to generally be a bear month with an average performance of between –3.5% to –3.8%, depending on the source. Of course, “hoddlers” (long-term BTC holders) will just use it as a buying opportunity.

For more information see, Crypto ROC.

Here are some articles you might enjoy in case you missed them:

Read more on UnemploymentData.com.

- August 2025 Employment Situation

- BLS Data Controversy

- Early Warning Signs of a Weakening Economy in July 2025

- June Seasonally Adjusted Unemployment Down

- Blue-Collar Wages Surge in 2025

From InflationData.com

- AI Is Deflationary But Its Energy Demand Could Fuel Inflation

- FED’s Semiannual Monetary Policy Report

- What Is the Trimmed Mean CPI and What Is It Good For?

- The Truth About Why Gold Is Surging

- FED Holds Steady at May Meeting

- How To Recalculate Retirement for Today’s Economy

From Financial Trend Forecaster

- Moore Inflation Predictor

- NYSE ROC

- NASDAQ ROC

- ETH and BTC Buy Signal

- Pirates of the Crypto-ribbean

- Overcoming Power Grid Demand Problems- Then and Now

- Is the Crypto Pull-Back Serious?

- The Truth About AI and Electricity Capacity

- 3 Big Crypto Bills in Congress

- Big New Tax Deductions for Seniors and Others in 2025

From Elliott Wave University

- This Forecasting Tool Nailed the S&P Turns

- Warren Buffett isn’t buying — and that says a lot.

- Debt Ceiling Drama

- Stock Market Signal: Only 3 Times in 47 Years!

- Tesla’s Troubles — Is it Musk or is it More?

From OptioMoney

- What is a “Haircut” in Financial Terminology

- How To Protect Your Wallet When You’re Just Starting Out

- Consumer Culture Contrasting Spending Habits in the US and Europe

- Financial Considerations When Moving to Florida

From Your Family Finances

- YFF has a new editor, so we won’t be posting new links anymore.

Read more on InflationData.com.

Leave a Reply