Does debt cause inflation? If so what kind of debt? Personal debt? Government debt? Corporate debt? And what exactly is inflation? In this article, we will look at all these issues.

Price Inflation occurs when the cost of a representative basket of goods and services is rising. The key factor is the general trend that takes place in an economy, it is possible that individual items such as foreign automobiles, the price of coffee, or corn could rise while other items that require a larger portion of your disposable income are falling (or vice versa). So the Bureau of Labor Statistics uses a “weighted basket of goods” i.e. they calculate what percentage of an average person’s salary goes toward food, and what percentage goes toward gas and housing, etc.

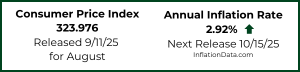

An index known as the CPI (Consumer Price Index) is used to track inflationary pressures. An estimated 24,000 people are surveyed to help compile a listing of products and services that they purchase (along with what percentage of their total consumption each item entails) which is then used to calculate the basket of consumer goods and services.

When the price of these items rises, inflationary pressures are evident. The Consumer Price Index (CPI) includes both tangible and intangible items providing a more accurate reading for inflation. According to the BLS (Bureau of Labor Statistics), people purchase items across 200+ categories. These categories are comprised of 8 major groups including goods & services, communication & education, recreation, medical care, apparel, transportation, housing, food & beverages. Once a month the BLS releases their CPI calculations, which includes the total and various breakdowns based on category. One category that causes the most confusion is “Core Inflation” i.e. all items except food and energy. This category is primarily used by economists to determine the effect government debt and money printing is having on the inflation rate because it removes the effects of highly volatile energy and food, which often are moved by extrinsic factors like weather and OPEC rather than things like government manipulation.

Does Inflation Cause Debt?

Consumer Debt

When prices start rising, it is possible that households will run into money shortages. Of course, it all depends on whether earnings are keeping pace with inflationary pressures. Generally, there is a lag between the time prices increase and any raises in wages so the worker must suffer through the price increase for a year or more before they see an increase in income. Thus if the inflation rate is high they could suffer a significant loss of purchasing power. This shortfall can cause personal consumer debt to mount. Compounding this problem is that often during an inflationary cycle unemployment begins rising as people get laid off. Businesses can no longer afford to pay higher wages, pay higher prices, or pay for the extraneous costs associated with full-time employees. When this happens, pink slips may be handed out, exacerbating the finances of US households. Debt is often associated with rising inflation, although it is not a linear correlation.

Government Debt

The connection between debt and inflation has been the subject of intensive economic research and activity for decades. The general consensus is that high levels of government debt cause inflationary pressures. Consider what happened in Germany from 1919-1923. After World War I, every nation which fought was broke because of the war’s cost. No country had enough gold assets to repay the billions of dollars they owed. Loans that were due were called in and Germany – desperate to repay that debt – started printing money en masse. Near the end, it took an entire wheelbarrow full of money to pay for a day’s labor. This massive inflation – hyperinflation – exacerbated debt and eventually resulted in Hitler’s rise to power. Hyperinflation is an extreme example of how inflationary pressures and debt can have tag-team effects on an economy. More recent examples include Zimbabwe, Syria, and currently Venezuela.

The US Predicament

Currently, the US owes an estimated $21 trillion. This amounts to a debt per citizen figure of $64,485 and a debt per taxpayer of $174,029. Consider that US federal tax revenue is $3,371,025,229 +/-, or $27,746 revenue per taxpayer – there is a significant shortfall of around $17.8 trillion. It was not always this way in the US economy, as evidenced by an in-depth report produced by leading debt management resource, DebtConsolidation.com. Their research indicates that Ronald Reagan was the US president who raised the debt ceiling most often. With all this debt in the economy, it appears that the US is 5% short on what it brings in every year.

On a personal level, few households would endorse a debt ceiling anywhere near the levels that the US government allows. Indeed, the US economy still enjoys an AAA rating from S&P Global – surprising given the deficit. The US economy, like many households, has an elevated debt: income ratio, but it is clearly not the worst in the world. Countries like Japan have the highest debt/GDP ratio at 234.7%, thanks largely to an aging population and weak productivity. Other countries include Greece at 181.6%, Lebanon at 132.5%, Italy at 132.5%, Jamaica at 130.1%, and Portugal at 126.2%. The US debt to GDP ratio was 104.17% in 2015 according to the US Bureau of Public Debt.

Debt and Inflation: A Lesson in Complexity

Consider the case of a mortgage loan with a fixed interest rate. Now, throw in geopolitical uncertainty and a steadily rising rate of inflation. At a low-interest rate for 30 years, a homeowner is likely to enjoy low household repayments on the principal + interest, while he/she will also likely receive a higher salary owing to inflationary pressures. Clearly, inflation has not increased debt – it has made him/her richer. However, if you don’t have a mortgage, and you have money in the bank, inflation will rapidly erode the value of that money, and you will soon find your years of savings worth nothing. This can increase debt. As one can imagine there are multiple possibilities to determine what effect inflation and debt can have on one another, and on your personal finances.

Other Articles you might like:

Leave a Reply