Printing Money:

The process of “printing” money is always a kind of mystery to most people since only about 10% of the total money supply is actually in physical currency. Technically most of the money isn’t printed so the term should be “money creation” or “money supply expansion” but “printing money” is used euphemistically to include all forms of expanding the money supply.

The monetary base (or money supply) is typically controlled by adjusting monetary policy. This is usually done by the central bank (in the U.S. this is the Federal Reserve Bank or FED). The FED changes the monetary base through “open market transactions” (i.e., buying and selling of government bonds). The FED also has the ability to influence banking activities by manipulating interest rates and changing bank reserve requirements (the percentage of money banks must keep on hand instead of loaning out to borrowers).

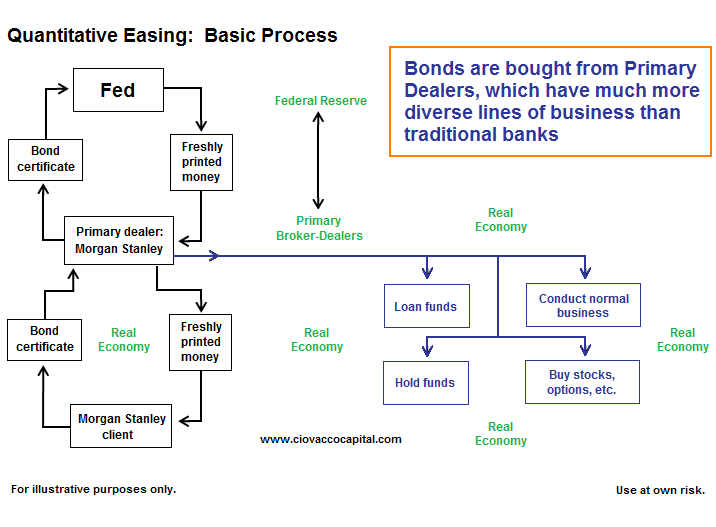

The new government speak for the process of printing money is “Quantitative Easing” which involves the creation of a significant amount of new base money by a central bank buying assets that it typically does not buy (like Commercial Loans and Mortgage backed securities).

In this video Chris Ciovacco explains the process of creating money out of thin air. ~editor.

Video: Quantitative Easing Targets Asset Prices, Not Bank Reserves

With markets coming off of overbought levels, bullish sentiment high, and gold backing off a vertical ascent, we believe investors need to be ready for a quantitative easing (QE) disappointment pullback. A “buy the QE rumor, sell the QE news” event needs to be considered from a portfolio management perspective. Having said that we also believe most investors and many financial professionals do not fully understand how QE works in the real world and that one of QE’s primary objectives is to inflate asset prices.

After hearing “QE won’t matter, the money will just sit at banks as excess reserves” from talking heads several times over the past three months, we decided to put together a series of brief videos describing how quantitative easing will be implemented by the Fed and the eighteen primary broker dealers in the coming weeks and months. You may be surprised to learn the Fed is encouraging the clients of primary dealers, including hedge funds and sovereign wealth funds, to participate in the QE2 process. We have studied the quantitative easing concept in detail in order to improve the odds of producing successful outcomes for CCM clients.

Common sense tells us money printing is probably not the path to long-term prosperity and low unemployment, but common sense also tells us after a possible QE disappointment pullback, newly printed U.S. dollars will be finding their way into the global stock, commodity, and currency markets. The big questions are (a) how much QE is coming in terms of a dollar amount, and (b) how much of that money will find its way into the financial markets.

After watching the video below, you may decide quantitative easing is more about inflating the money supply and asset prices, and less about bank reserves and interest rates. We will post five additional videos on quantitative easing over the next week or so, expanding on the concepts presented in the first video, “Quantitative Easing — How Does it Work in the Real World?” A larger version of the flow chart in the video is available below the video player.

(FED money creation Video Loading… Please be patient)

Click on image below to view large version of flow chart shown in video (opens new window).

Leave a Reply