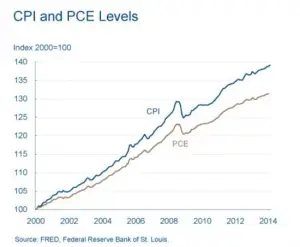

The consumer price index, personal consumption expenditures, and producer price index point to cooling inflation, but no one can say for certain what the economy will do next. High inflation rates have a devastating effect on economies and the people within them, so a slower rate of inflation over the next few months and years could make everyone breathe a little easier. However, with so many factors up in the air — the U.S. presidential election and ongoing geopolitical conflicts, among others — you might not want to make any drastic moves with your personal finances. If inflation rates slow down and the economy returns to a more normal healthy state, you should adjust your financial … [Read more...]

How to Prepare for Inflation

With inflation reaching heights not seen in many years, people are wondering... How to prepare for inflation? And What effects will inflation have on our investments? Between 2020 and 2021, inflation steadily increased from a minuscule 0.12% in May of 2020 to just under 5.4% in June and July of 2021. Although 5+% may not seem like much, it means that prices are 5% higher than they were a year ago. If inflation stays at 5%, you might think it has stabilized, but unfortunately, inflation compounds. So if the inflation rate is still at 5%, next year's prices are now more than 10% higher than last year. So, for instance, after 1 year at 5% inflation, a $100 item now costs $105, but after another … [Read more...]

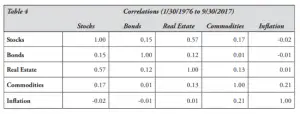

A Stock Pickers Guide To Thinking About Inflation

Stock investors sitting on cash and watching the stock market soar to new highs shouldn’t be faulted for missing out on above-average historical returns in 2020. Inflation, along with increasing signs of a market bubble, is a growing area of concern so the prospect of investing in tech giants valued at more than $1 trillion isn’t as appealing as it once was. But investors know that sitting on a portfolio near 100% in cash will see their net worth suffer as a result of inflation. To protect against inflation, investors should consider some of the most popular stocks as of April 2021 as some of them double as a hedge against inflation. Commodity Stocks Offer A Hedge… And A … [Read more...]

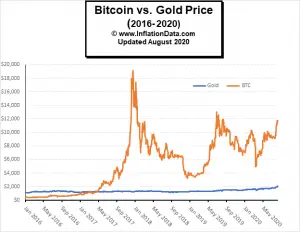

Gold vs. Dollar vs. BitCoin Revisited

Back in 2016, we compared the properties of three types of currency, i.e. Gold, Dollars (Cash), and Bitcoin. Today we'd like to look at how each has fared since then. Back then, we said that there are 10 factors that make up a good store of value. They are: 1. Scarcity- For something to be considered valuable it can’t be too readily available. 2. Fungibility- Things have to be equal. Rare paintings aren’t fungible a Picasso isn’t exactly the same as a Monet. As a matter of fact, one Picasso isn’t even the same as another Picasso. Artwork isn’t fungible. One dollar bill is pretty much the same as another, one ounce of 24 karat gold is the same as another, one bitcoin is the same as … [Read more...]

5 Reasons to Invest In Gold

Gold has a long history that goes back to thousands of years. As we said here, "Gold came in common use in 3000 B.C. when Egyptians started making it into jewelry. It wasn’t until years later that gold began being used as a medium of exchange." It has cultural significance in most parts of the world. Throughout most of this time, gold was money. Paper or "fiat currency" did not exist until fairly recently. However, today the investment trends in gold have changed. Now, people invest in gold mostly for economic reasons. Investors all around the world buy it because they see gold as an inflation hedge. Here, in this blog, we'll discuss five important reasons to invest in gold right … [Read more...]

What Does 8% Inflation Really Mean?

By Dennis Miller Eight percent is not good news. In my latest article I shared some reader feedback from our inflation survey, and in case you missed it, the Money Forever Reader Poll Inflation Rate is 8%. But what does that number really mean for us – seniors and savers trying to protect our buying power? It's time to read the tea leaves and find out. Up to Your Ass in Alligators You may remember the old poster that read, "When you are up to your ass in alligators, it's tough to remember the goal was to drain the swamp." You may have felt overwhelmed during the last few years, as the investment options for your retirement portfolio changed. You might read about the benefits of gold … [Read more...]

Popular Free Resources

Video Crash course- Why Use the Wave Principle, What is the Wave Principle and How to Trade the Wave Principle Learn the Basics of the Wave Principle in 10 Valuable Lessons Learn to Invest Independently – Get Your 118-Page Independent Investor eBook Download The Ultimate Technical Analysis Handbook to Discover EWI Analysts’ Favorite Technical Indicators Is Your Bank Safe? Discover the Top 100 Safest U.S. Banks Now Survive and Prosper – Download the 60-Page Guide to Understanding Deflation Now Free e-Mail Trading Course … [Read more...]

Inflation and Financial Services

I recently received the following question from Zimbabwe. Question: What is the Impact of Inflation on Financial Services Performance? B. Sibanda Zimbabwe Dear Mr. Sibanda , The most obvious effect of inflation on financial services is that an investment has to perform that much better just to remain even. For instance, under normal circumstances 10% is considered a good rate of return. However, if inflation is 100% and you only earn 10% you have not made any money you have actually lost 45% of your purchasing power. The calculations are as follows: … [Read more...]