By Nico Isaac Up until recently, the mainstream experts put the likelihood of deflation transpiring in the United States at whatever the current odds are of Mel Gibson finding a date; i.e. nill to none. Their catchphrase for the rare and unexpected nature of a deflationary event was "Black Swan." And as the following news items from 2008-2010 show, very few imagined this "bird" migrating onto the economic shore: Oct. 20, 2008: "Central banks of the world know how to stop deflation. You just print enough money." (Reuters) Jan. 19, 2009: "US Deflation Unlikely. The tremendous stimulus from the US administration... should prevent the recession from dragging on long enough for deflation … [Read more...]

A Deflationary Double-Dip?

Bring Out Your Dead Last week, the price of gold again broke below its new base at $1,200, and the U.S. stock market was again under strong pressure, due to a confluence of fears, most of which point to a deflationary double-dip. The fears were fanned by disappointment in the just-released early quarterly results, by the latest CPI reports that show inflation continuing to moderate, and by yet another poll revealing faltering consumer confidence. The market is also spooked, no doubt, by notes from the latest Fed Beige Book that make it clear that the Fed is (finally) beginning to understand the entrenched and endemic nature of this crisis. While the notes are written in shamanic … [Read more...]

The Bear Market and Depression: How Close to the Bottom?

By Elliott Wave International While many people spend time yearning for the financial markets to turn back up, a rare few have looked back in time to compare historical markets with the current situation -- and then delivered a clear-eyed view of the future informed by knowledge of the past. One who has is Robert Prechter. When he thinks about markets and wave patterns, he goes back to the 1700s, the 1800s, and -- most tellingly for our time now -- the early 1900s when the Great Depression weighed down the United States in the late 1920s and early 1930s. With this large wash of history in mind, he is able to explain why he thinks we have a long way to go to get to the bottom of this bear … [Read more...]

20 Questions with Robert Prechter: Long Decline Ahead

Long Decline Ahead July 2, 2010 By Elliott Wave International The following article is an excerpt from Elliott Wave International’s free report, 20 Questions With Deflationist Robert Prechter. It has been adapted from Prechter’s June 19 appearance on Jim Puplava’s Financial Sense Newshour. Jim Puplava: I want to come back to government spending, but first I want to move onto the stock market. In your last two Elliott Wave Theorist issues, you laid out a scenario that would put the Dow and S&P, which in your opinion may have peaked on April 26, as the top from here. You feel that this top is the biggest top formation of all time, a multi-century top and we could head straight down … [Read more...]

The Primary Precondition of Deflation

By Robert Prechter, CMT Elliott Wave International The following was adapted from Bob Prechter’s 2002 New York Times and Amazon best seller, Conquer the Crash – You Can Survive and Prosper in a Deflationary Depression. Deflation requires a precondition: a major societal buildup in the extension of credit (and its flip side, the assumption of debt). Austrian economists Ludwig von Mises and Friedrich Hayek warned of the consequences of credit expansion, as have a handful of other economists, who today are mostly ignored. Bank credit and Elliott wave expert Hamilton Bolton, in a 1957 letter, summarized his observations this way: In reading a history of major depressions in the U.S. … [Read more...]

Deflation or Inflation – Which is it?

By Tim McMahon, Editor It seems the debate on whether we will be facing inflation or deflation is heating up. This week I received emails from two different subscribers insisting that I was wrong. Well that is always a possibility but we will see... The first letter I received was from Jeff L. it said, "Your current "Annual Inflation" chart, graph, and commentary are very helpful. Thanks very much. The data would appear to contradict a recent article on your own site predicting a long period of deflation." My response was, "Personally, I think we are in for inflation. Robert Prechter (who is much smarter than I am) believes it will be deflation. At this point we are on a “knife … [Read more...]

Deflation: Micro vs. Macro

Deflation By Joshua Burnett If you’re anything like me, one of the problems you run into when trying to convince someone that the hyperinflation scenario will occur is an argument that revolves around us currently being in a deflationary period. People (and those involved with the economy and stock market especially) have a hard time seeing looming hyperinflation (that might occur as soon as a year and a half away) when what they’re currently seeing is… deflation. But wait a second; how in the wide world of sports are we seeing deflation when we’ve been printing money like our lives depend on it? Let’s return to market fundamentals, and the ever-present difference between macro and … [Read more...]

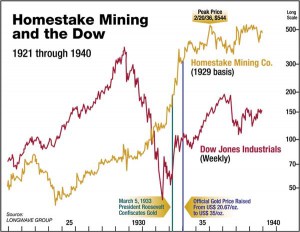

How do Gold Stocks Perform in a Depression?

Traditional wisdom has it that Gold performs well in times of financial distress. Also Gold is considered an inflation hedge... but what if Deflation wins? In this insightful article Jeff Clark answers exactly that question. ~ Tim McMahon, editor Gold Stocks in a Depression By Jeff Clark, Editor, BIG GOLD What if deflation wins? While we think the odds are strongly stacked against it, particularly given the government’s furious pace of money printing, the prudent investor understands – and respects – the time-tested adage, “Nothing is guaranteed.” So while our chips sit squarely on the spot marked “inflation,” what will happen to gold stocks if we’re wrong? … [Read more...]

Can the Federal Government Really Stop a Deflation?

The Last Bastion Against Deflation: The Federal Government This article is part of a syndicated series about deflation from market analyst Robert Prechter, the world’s foremost expert on and proponent of the deflationary scenario. For more on deflation and how you can survive it, download Prechter’s FREE 60-page Deflation Survival eBook, part of Prechter’s NEW Deflation Survival Guide. The following article was adapted from Robert Prechter’s NEW Deflation Survival eBook, a free 60-page compilation of Prechter’s most important teachings and warnings about deflation. By Robert Prechter, CMT Now that the downward portion of the credit cycle is firmly in force, further inflation is … [Read more...]

What is so bad about Deflation?

By Tim McMahon The average annual inflation rate dropped again this month. At a monthly rate of -1.01% October's drop was touted as "the largest monthly drop on a seasonally adjusted basis since 1947 when the Bureau of Labor Statistics first started tracking seasonal adjustments" and it brought the annual inflation rate off its highs and down to a more reasonable 3.66%. November's monthly rate was almost twice as large at but it was hardly mentioned in the news. This month the annual inflation rate has dropped down virtually zero-- 0.09% with a monthly drop slightly larger than the one two months ago. Just a few months ago the annual inflation rate was 5.6% and now it is … [Read more...]