By Nico Isaac Up until recently, the mainstream experts put the likelihood of deflation transpiring in the United States at whatever the current odds are of Mel Gibson finding a date; i.e. nill to none. Their catchphrase for the rare and unexpected nature of a deflationary event was "Black Swan." And as the following news items from 2008-2010 show, very few imagined this "bird" migrating onto the economic shore: Oct. 20, 2008: "Central banks of the world know how to stop deflation. You just print enough money." (Reuters) Jan. 19, 2009: "US Deflation Unlikely. The tremendous stimulus from the US administration... should prevent the recession from dragging on long enough for deflation … [Read more...]

Quadrillion Dollar Debt: ‘Day of Reckoning’ Looms

What Will Happen as $1,000,000,000,000,000 in Global Debt Winds Down? By Elliott Wave International The biggest balloon in the world is deflating. This balloon had been inflated with a quadrillion (1015) dollars, which is to say: This balloon was filled not with air but with debt from around the globe. What will happen as this global debt winds down? In two words: Deflationary Depression -- the likes of which could be unprecedented in history. A thousand trillion in debt can't be wished away or swept under the rug. No one can "forgive" the debt. The consequences of unwinding this debt could be as massive as the dollar figure itself. … [Read more...]

A Deflationary Double-Dip?

Bring Out Your Dead Last week, the price of gold again broke below its new base at $1,200, and the U.S. stock market was again under strong pressure, due to a confluence of fears, most of which point to a deflationary double-dip. The fears were fanned by disappointment in the just-released early quarterly results, by the latest CPI reports that show inflation continuing to moderate, and by yet another poll revealing faltering consumer confidence. The market is also spooked, no doubt, by notes from the latest Fed Beige Book that make it clear that the Fed is (finally) beginning to understand the entrenched and endemic nature of this crisis. While the notes are written in shamanic … [Read more...]

20 Questions with Robert Prechter: Signs Point to Deflation

June 30, 2010 Signs point to Deflation By Elliott Wave International The following article is an excerpt from Elliott Wave International’s free report, 20 Questions With Deflationist Robert Prechter. It has been adapted from Prechter’s June 19 appearance on Jim Puplava’s Financial Sense Newshour. Jim Puplava: Bob, I want to pick up from last September. Since then we've had several quarters of positive economic growth. Asset classes rose substantially, CPI turned positive, gold has hit a new record, oil is close to $80 a barrel. I guess a lot of our listeners would like to know, have these events altered your views on deflation? … [Read more...]

The Primary Precondition of Deflation

By Robert Prechter, CMT Elliott Wave International The following was adapted from Bob Prechter’s 2002 New York Times and Amazon best seller, Conquer the Crash – You Can Survive and Prosper in a Deflationary Depression. Deflation requires a precondition: a major societal buildup in the extension of credit (and its flip side, the assumption of debt). Austrian economists Ludwig von Mises and Friedrich Hayek warned of the consequences of credit expansion, as have a handful of other economists, who today are mostly ignored. Bank credit and Elliott wave expert Hamilton Bolton, in a 1957 letter, summarized his observations this way: In reading a history of major depressions in the U.S. … [Read more...]

Hidden Signs of Deflation

Inflation is like a roaring lion-- pretty hard to miss. Deflation is more like a New Orleans levy holding back millions of gallons of water. You don't really know it's there until the dam breaks and unleashes its destruction. In the following article the editors of Elliott Wave International give us a look behind the curtain at all the pent up deflationary power just waiting to be unleashed.~ Tim McMahon, editor Signs of Deflation That You Might Not See Clearly By Editorial Staff, Elliott Wave International The following market analysis is courtesy of Bob Prechter's Elliott Wave International. Elliott Wave International is currently offering Bob's recent Elliott Wave Theorist, … [Read more...]

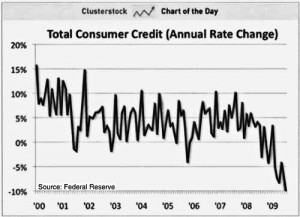

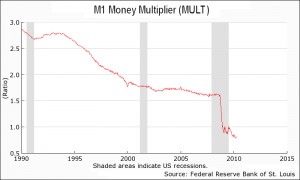

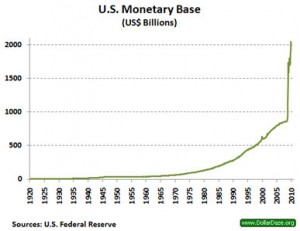

Velocity of Money and Money Multiplier- Why Deflation is Possible

By Tim McMahon Back in 1924, John Maynard Keynes called gold a barbarous relic. There is a thought prevalent these days that deflation is the new barbarous relic. In a speech in November of 2002, Federal Reserve chairman Ben Bernanke said, “I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small… I am confident that the Fed would take whatever means necessary to prevent significant deflation… the effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities.” He went on to say, “the U.S. government has a technology, called a printing press (or, today, its … [Read more...]

What the Deflationists Are Missing

by David Galland, Managing Editor, The Casey Report An interesting article by Ambrose Evans-Pritchard came my way the other day. It’s worth a read, if for no other reason than that he paints an appropriately dark picture of the current state of the U.S. economy. You can read it here. While I very much share Mr. Evans-Pritchard’s view that the global economy is far from out of the woods, our views diverge in that he sees devastating deflation speeding our way down the tunnel. Casey Research readers of any duration know that we see devastating inflation. While we could both be right, with deflation first and inflation later, I’m not so convinced. For starters, there is already a … [Read more...]

Which is Better: High or Low Inflation?

It would seem intuitively obvious that low inflation is good for consumers, because costs are not rising faster than their paychecks. The problem with high inflation is that even with "cost of living" increases there is a time lag between when the cost of goods increases and when you get your raise. But recently commentators have been saying that "Low inflation introduces uncertainty". This is nonsense. During the high inflation "Eighties" I remember commentators saying "High Inflation introduces uncertainty". This is not quite true either. The truth is that steady inflation, whatever its level, if it can be relied upon to remain steady, does not introduce uncertainty. Changing … [Read more...]

The Calm Before the Inflationary Storm

I must be getting old. Things seem to change awfully quickly. It seems like just yesterday that gasoline was well over $4.00 a gallon and inflation was 5.6%. It was July 2008 and inflation was the hot topic, everyone was worried about costs climbing exponentially. It seemed like every time I went to the store things cost more. Oil was a speculator’s dream and a car owner’s nightmare. And then came the crash. Oil prices came crashing down along with the stock market and the banks. The big news was deflation. The media was beating the drum about how bad deflation was and how this was the first deflationary period since 1950. Funny, I didn’t hear anyone at the gas station or the … [Read more...]