It’s no secret that inflation is high nowadays. While the rate of inflation is significantly lower today than it was in 2022, it’s still sitting at about 3%; which is higher than the FED’s stated goal of 2%. Although, FED Chairman Jerome Powell has hinted that he now considers the range of 2% to 3% acceptable... so he might consider lowering interest rates. But currently, interest rates are considerably higher than they have been over the last decade, which causes higher costs for those interested in buying property. For homebuyers, real estate investors, and brokers inflation is lower than 2022’s record of 9.1% but it is still concerning. Inflation affects various aspects of the real … [Read more...]

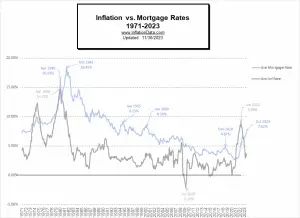

Inflation Adjusted Mortgage Rates

The interesting thing about borrowing money long-term is that inflation actually helps you repay the loan with cheaper money... At 7% inflation, prices double roughly every 10 years, which is only 1/3rd of the way through your 30-year mortgage. So, if your budget was stretched initially to make your mortgage payment, after 10 years (assuming your salary kept up with inflation) that same mortgage would only have half the impact on your budget. Thus, to get the true impact of mortgage rates, we need to adjust them for inflation. It has been a while since we addressed the issue of “Inflation Adjusted Mortgage Rates,” primarily because inflation and mortgage rates have been at historically … [Read more...]

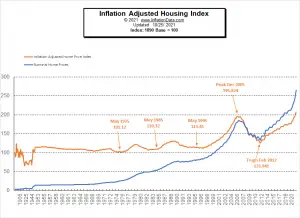

Do Housing Prices Always Go Up?

In the last few years, housing prices have skyrocketed, and investors are once again jumping on the housing bandwagon as an excellent way to make money. The same sentiment existed in the early 2000s as housing prices were rising rapidly then as well. These periods both created the impression that “housing prices always go up”. But is that actually true? If we look at the “nominal” prices of houses, i.e., the cost in dollars BEFORE adjusting for inflation, it does appear that housing prices go up fairly consistently. In the following chart, we see housing prices since 1890. The blue line is the nominal housing price, and we can see a very gradual increase up through the early 1970s. Prices … [Read more...]

Ways Inflation Affects the Real Estate Market Pt. 2

In Part 1 of this series on Real Estate and Inflation, we discussed how monetary inflation creates price inflation which affects materials costs, creates a shift into rentals and a surge in foreclosures. But on the flip side, being a commodity itself, home ownership can provide protection against inflation and through the use of a mortgage allows you to pay off an appreciating asset with depreciating dollars. This time we will look at a few more effects of Inflation on the average home buyer. In a period of high inflation, a dollar's value decreases rapidly. On average, a 2 percent inflation rate means that what costs $1 in 2017 would cost roughly $1.02 in 2018. Although inflation is … [Read more...]

Ways Inflation Affects the Real Estate Market

Inflation from January 2007 through December 2016 was extremely low, averaging only 1.77% per year in the U.S. and 2009 was actually negative (i.e. falling prices = deflation). Although 2017 has seen a bit more inflation it is still low by historical standards. In times of low inflation, inflation is a vague term that economists throw around when they’re trying to make one point or another. However, when inflation begins rising and hitting your pocket, the reality begins to set in. And it can have a quite noticeable effect on, not only the goods you buy at your favorite big box store, but even on real estate. Let’s take a quick look at some ways rising (or sinking) prices get their tentacles … [Read more...]

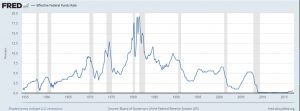

How Much Has Inflation Affected Mortgage Rates in the Last 5 Years?

In some ways, mortgage rates are a reflection of the overall health of the American economy. As we can see in the chart below from "FreddieMac", often both mortgage rates and inflation rates peak during recessions and tend to fall or are stable during better times. How has inflation impacted mortgage rates recently? The FED Rate According to the St. Louis FED website: "The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with … [Read more...]

Australia- Iron Ore, Housing and Unemployment

Speculation Mounts Over RBA October Meeting As the RBA heads towards it October meeting, there are a number of important issues on the agenda. The price of iron ore which was one of the major topics of the September meeting have now seen a 26% resurgence in price and the world’s fourth biggest exporter of iron ore, Fortescu Metals, has announced that its US$4.5-billion debt deal will now enable it to refinance any outstanding deals. The central banks in Europe and the United States have announced their intentions to fight off inflation and stimulate asset prices by printing unlimited money while China will be contributing a $150-billion package to the mix. Unemployment Despite … [Read more...]

30 Year Fixed Rate Mortgages, Nope Not at 3.25%!

Fixed Rate Mortgages So is it true 30 year fixed rate mortgages are at 3.25%? Well that depends on how you look at. The answer is yes if you willing to invest discount points to purchase your interest rate down, so long as your financial profile is completely flawless. Otherwise for the 99.9% us, 30 year mortgages are trailing between 3.5% to 4.25%. That's been the reality of the mortgage bond market over the last few weeks since the 30 year fixed rate mortgage hit an all-time record of 3.53% on July 19, 2012. 30 year mortgage rates you see on television and the internet are not the best barometer of where rates truly are... Here's why: the bond market is moving all day long in … [Read more...]

Housing Prices and Inflation

Average Housing Prices- By Jared Diamond The great recession of 2008 has been a source of enormous anxiety in the financial world. The American economy survived a total meltdown, but just barely. As American society struggles to recover, a major beast looms on the horizon: inflation. There are already increases at the gas station and the possibility of a poor harvest could result in skyrocketing food prices. The housing industry has been buffeted by the financial whirlwinds and is only now beginning to recover from years of deflated prices. Even though average housing prices have dropped along with sales, there still is a question about whether or not housing will experience a near … [Read more...]

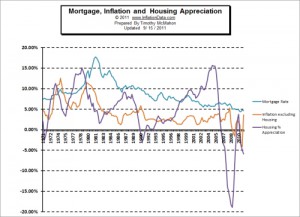

Real Mortgage Rates

What is the Real Mortgage Rate? At InflationData we are constantly talking about "real rates" typically by that we mean the inflation adjusted price. For instance we publish the inflation adjusted price of Oil, the inflation adjusted price of Gold, inflation adjusted stock prices and even the inflation adjusted cost of getting an education. But today when we are talking about Real Mortgage Rates we are not talking simply about the inflation adjusted price of a mortgage. To calculate the real cost of your mortgage you must also take the appreciation of your house into account. So for example if your mortgage rate is 5% but your house appreciates 5% your real mortgage rate is zero. The … [Read more...]