When a natural disaster hits, it's expected that the surrounding region will have difficulties. What's less expected, though, is that the price of fuel goes up everywhere. Even though it happens every time there is a disaster, it's still hard to understand the logic behind the price hikes. Below are three of the reasons why the price of fuel tends to go up everywhere when a natural disaster strikes. Shipping Woes When a disaster strikes, roads are blocked, electric lines get knocked down, emergency services are pushed to the limit, bottled water is in short supply. Even the internet might be gone for days. When this happens, it becomes much harder for fuel companies to ship their products … [Read more...]

58 Facts About The U.S. Economy From 2015 That Are Almost Too Crazy To Believe

There are a variety of ways to look at things and putting the pieces together is almost like looking through a kaleidoscope as we try to piece the facts together in order to get an accurate picture of the economy. Some of the pieces appear to indicate that the economy is getting better and some appear to indicate that the economy is getting worse. And just like the kaleidoscope the pieces change on a constant basis. At the moment the economy is clearly better than it was at the bottom of the crash in March of 2009 when the NYSE was near 4800. So the current levels of 10,000 looks good but... we have to remember that back in 2007 the NYSE was also at 10,000. So if we adjust 2007 … [Read more...]

Economy vs. Fed Rate Hikes

Confusion Continues The bad news is markets tend to get jittery when the Fed is preparing for a new interest rate cycle. The good news is the primary reason the Fed is contemplating raising interest rates is a strengthening U.S. economy. The question in the short run is: Will the economy be strong enough to offset the negative impact of higher rates? The odds of the answer being “yes” increased Thursday. From Reuters: Gross domestic product expanded at a 4.2 percent annual rate instead of the previously reported 4.0 percent pace, the Commerce Department said on Thursday. Both business spending and exports were revised higher, while a buildup in business inventories was smaller than … [Read more...]

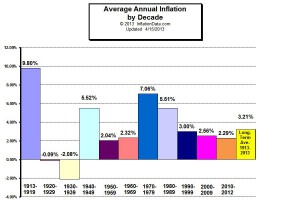

Unique Inflation Characteristics of the Decades in the Early 1900’s

The Beginning of Inflation Tracking in the U.S. Contrary to popular belief the U.S. didn't begin tracking inflation in 1913. Inflation tracking actually began in 1917 but once the index was constructed inflation rates and the Consumer Price Index for the prior years were reconstructed back to 1913 from price data available at the time. In 1917 the U.S. joined World War I and one of the prime motivators for developing the CPI was rapidly rising prices due to the war effort. The government was pumping money into the shipping centers and the workers were demanding cost-of-living adjustments for wages. Total cumulative inflation for the period of 1913 through 1919 was an astronomical … [Read more...]

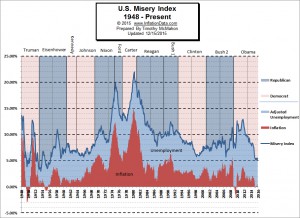

What is the Misery Index?

The misery index was created by economists in an effort to quantify how bad the economy is based on cold hard numbers. In many ways, it can be argued that suffering is not quantifiable, after all how do you measure the pain associated with starvation, sickness, disease, homelessness, war, lawlessness and all the evils of society? But in economic terms economist Arthur Okun developed a simple but brilliant method of determining how miserable people were economically. The Misery Index and Unemployment The first component is unemployment. Okun reasoned that if a lot of people were unemployed, that would make the country as a whole feel poorer and so they would be less well off. Also a side … [Read more...]

Economists Are (Still) Clueless

Thoughts from the Frontline: Economists Are (Still) Clueless By John Mauldin Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is past the ocean is flat again. - John Maynard Keynes, A Tract on Monetary Reform There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present. - John Kenneth Galbraith Hitler must have been rather loosely educated, not having learned the lesson of … [Read more...]

The Economics of Disasters Like Hurricane Sandy

Many people believe the fallacy that wars and disasters are good for the economy, perhaps because some people like defense contractors and home-builders benefit. But it is important to understand how wealth works. If you build a house from raw materials you are richer. For instance suppose you take $50,000 worth of raw materials and add $50,000 worth of labor and come out with a house worth $150,000. in that case you created $50,000 worth of wealth out of thin air. But if someone comes along and knocks your house down and you rebuild it: 1) Are you better off? 2) Worse off? 3) The Same? ~ Tim McMahon, editor In this article Kerk Phillips looks at "hurricane economics". Even Economically, … [Read more...]

The World Is in the Grip of a Bear Market–Have You Noticed?

Global Markets, Economies Mired in Early Stages of Biggest Disaster Ever By Elliott Wave International The following is a sample from Elliott Wave International's new 40-page report, The State of the Global Markets -- 2013 Edition: The Most Important Investment Report You'll Read This Year. This article was originally published in Robert Prechter's September 2012 Elliott Wave Theorist. Global markets and economies are mired in the early stages of the biggest disaster ever. Most people think both areas are in the early stages of a prolonged recovery, but in fact they are on the cusp of the second downturn, which will be of epic proportion. The world is in the grip of a bear market. … [Read more...]

Selling Your Scrap Gold During The Economic Downturn

Selling Your Scrap Gold Economic downturns are a fact of life and you never know when you might be caught up in events outside your control. That is why you always have to be prepared for the circumstances life might throw at you. If during good times you have accumulated some gold either as jewelry or coins, then selling your scrap gold is one such step that you can take when times are rough. There are many advantages of having some gold as an insurance policy against tough times. What is "Scrap Gold"? In its simplest terms, scrap gold is any gold that is sent back to the refiner for recycling. Mostly it is broken jewelry that is no longer needed. Gold coins are rarely melted down … [Read more...]

In 1929, Deflation Started in Europe Before Overtaking the U.S.

Marcus Aurelius was the last of the "Five Good" Roman emperors and is also considered one of the most important members of the Stoic philosophers. He ruled Rome from 161 to 180 AD. He brilliantly said, "Look back over the past, with its changing empires that rose and fell, and you can foresee the future, too." Today we may be seeing the beginning of the end of the American Empire. As Americans we don't like to think of ourselves as having an empire but according to Daniel Larison, The U.S. treats several key regions of the world as privileged space where it is supposed to have military and political supremacy, and regional challengers to that supremacy are treated as potential … [Read more...]