Earlier this month, the internet was flooded with reports, stating that the “50-year petrodollar agreement” between the United States and Saudi Arabia had expired and that the petrodollar was now dead. Over the years we've written on the PetroDollar on several occasions. But this time, just as in the case of Mark Twain, "the Death of the PetroDollar has been greatly exaggerated". Ten years ago, we published an article entitled Oil, Petrodollars and Gold. In that article, I showed how the demonetizing of gold eventually led to Henry Kissinger making a deal in 1973 with Saudi Arabia to denominate all their oil sales in U.S. Dollars in exchange for the Kingdom receiving U.S. military … [Read more...]

Can the Dollar Retain Its Ultimate Currency Status?”

The following article by Ryan McMaken, author of Breaking Away: The Case of Secession, Radical Decentralization, and Smaller Polities and Commie Cowboys: The Bourgeoisie and the Nation-State in the Western Genre, looks at what makes a global reserve currency and if the U.S. Dollar has what it takes to keep that position. ~Tim McMahon, editor How the Dollar Became the World's Top Global Currency By Ryan McMaken In March 2009, in the midst of a recession, then Treasury Secretary Timothy Geithner was pressed to respond on the question of whether or not another currency—possibly the IMF’s special drawing rights (SDRs)—might displace the US Dollar as the dominant global reserve currency. … [Read more...]

How To Invest In Cryptocurrency: 4 Tips For Beginners To Get Started

Despite bouts of volatility that tend to scare away risk-averse investors, cryptocurrency is more popular than ever, with millennials hoping to cash in on its explosive growth. While legacy coins such as Bitcoin and Ethereum are still the most popular currencies in the world of crypto, other emerging altcoins are gaining momentum and popularity. If you have been living under a rock and have no idea where to get started in your crypto journey, keep reading to find four steps to get started: 1. Pay Attention to What You're Investing In In addition to having your finances in order, when investing in crypto, be mindful that, unlike stocks, most cryptocurrencies are not backed by any … [Read more...]

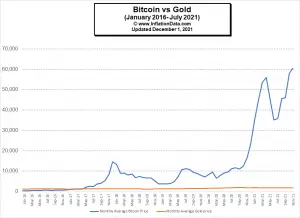

Is Bitcoin a Better Inflation Hedge Than Gold?

Proponents of the digital cryptocurrency Bitcoin are touting it as the latest Inflation hedge... perhaps better than gold... but is it? Although gold may fluctuate significantly in the short run, this precious metal has fared relatively well as a hedge against inflation over the long term. One of gold's significant benefits is that it is a commodity that if held in physical form is neither paper, nor government-controlled, nor another person's liability. Gold's other major advantage is its limited supply (i.e., requiring quite a bit of effort and energy to mine). Recently, Bitcoin has arrived on the scene and become a "digital commodity" independent of the government, which has gained … [Read more...]

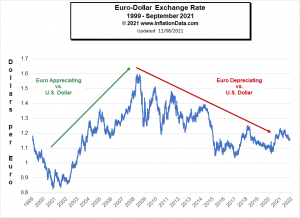

How Foreign Currencies Act as an Inflation Hedge

One method investors can use to hedge against inflation is investing in a variety of foreign currencies. The key of course is which currencies you choose as an inflation hedge. You need to invest in those countries' currencies, which will provide you with better protection from exchange rate changes to be successful at hedging against inflation. Inflation in the United States has been relatively tame since the 1980s but it is currently at risk due to massive money creation by the FED via Quantitative Easing. However, inflation risk can be mitigated with the help of investment diversification. One method investors who are looking to protect their money against inflation would use is to … [Read more...]

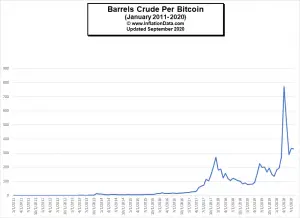

The Price of Oil Denominated in Bitcoin

Over the years we have been saying that it is important to look at prices of various commodities in terms of other commodities. For instance, we have looked at not only the Inflation Adjusted Gasoline Prices but also the Price of Oil Compared to Gold. Because of the recent volatility of Bitcoin we thought it might be interesting to look at the price of oil denominated in Bitcoin. Back in 2016, we compared Gold vs. U.S. Dollar vs. Bitcoin and recently we published Gold vs. Dollar vs. BitCoin Revisited. Often, depending on the currency that you are accustomed to using and you earn your wages in your view of the price of a commodity can be vastly different. For instance, if your currency is … [Read more...]

How has Venezuela’s Bitcoin experiment Fared?

In early 2018, in an effort to fight a collapsing economy and hyperinflationary currency Venezuela decided to jump on the BitCoin bandwagon and create its own cryptocurrency called the Petro. On December 3rd 2017, Venezuelan president Nicolás Maduro announced the petro in a televised address, stating that it would be backed by Venezuela's reserves of oil, gasoline, gold, and diamonds. Other reports claimed that the initial issue price would be based on the price of oil i.e. 1 Petro = 1 Barrel of Venezuelan oil. On 5 January 2018, Maduro announced that Venezuela would issue 100 million tokens of the petro, for a total value of just over $6 billion. The government stated the pre-sale raised … [Read more...]

How the Currency Exchange Rate Can Affect Business

In finance, an exchange rate is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country's currency in relation to another currency.~Wikipedia Currency depreciation happens when a nation’s currency exchange rate (e.g. the Chinese Yuan) decreases in value in comparison to another country’s currency (e.g. the U.S. Dollar). So, if the dollar increases in value compared to the Yuan, it means U.S. based businesses or individuals could receive more for their money from an overseas supplier than they did previously, even if the price in the foreign currency is unchanged. On the other hand, Chinese companies will pay more for … [Read more...]

Why Does China Want to Lower the Value of Its Currency?

The U.S. Labels China a Currency Manipulator On August 5th, 2019, the U.S. Department of the Treasury designated China as a 'currency manipulator'. China has been on the U.S.'s watch list for quite some time. The U.S. believes that China "engaged in persistent one-sided intervention in the foreign exchange market". So the U.S. is requesting that the International Monetary Fund (IMF) "eliminate the unfair competitive advantage created by China's actions". Why would China want to keep the value of its currency artificially low? How Currency Exchange Rates Affect Businesses Currencies are constantly changing in value against other currencies. This is based on a variety of factors … [Read more...]

How High Inflation Drives Countries Towards Crypto

What is CryptoCurrency? A cryptocurrency (aka. Crypto), is an alternative form of payment created electronically rather than through government fiat (decree). The idea behind it is that an algorithm creates a limited amount of currency that is available to individuals to use instead of cash, checks or credit cards. The technology behind it allows you to send it directly to others without going through a 3rd party like a bank. Initially, the untraceable nature of cryptocurrency led governments to suspect that it was being used for nefarious purposes. And some notable cases of purchases on the "dark web" were prosecuted like the "Silk Road" case which operated from 2011-2013. Since then … [Read more...]