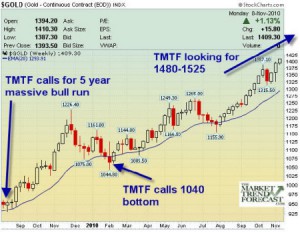

In today's editorial, David Banister takes a look at Gold and where it could be going. He provides an excellent possible scenario that matches with my views and experience exactly. He is projecting a rally to the $1500 range with a pull back from there and a major take-off for the final wave to the blow-off top from there. This is exactly what we would expect based on Elliottwave patterns. Tim McMahon- editor How long and how high for Gold, and how to play it David Banister-www.MarketTrendForecast.com Regular readers of my articles on Gold over the past few years know that I have a theory on this Gold Bull market. In summary, it’s that we are in a 13 Fibonacci year uptrend that … [Read more...]

The Housing Bubble Revisited

What really makes a bubble? Are bursting bubbles inflationary or deflationary? What lessons can we learn from history? In this article Justice Litle addresses these issues. ~Tim McMahon, editor By Justice Litle, Editorial Director, Taipan Publishing Group A burst housing bubble is a harbinger of deflation, not inflation, due to massive debts incurred and massive savings lost. To really get your head around the inflation debate, it helps to understand the late great housing bubble. To that end, this description seems as informative as they come: The smell of Boom was everywhere. It caught even those who were not particularly attracted by it. A former president of Freddie Mac, … [Read more...]

Hyperinflation in Weimar Germany vs. The U.S. Now

Postcards From Weimar Germany Justice Litle, Editorial Director, Taipan Publishing Group Monday, September 20, 2010 The Weimar Republic is perhaps the quintessential example of hyperinflation. But the buildup took longer than one might think. Walter Levy is a German-born oil consultant. His father, a German lawyer, took out a life insurance policy in 1903. Every month he had made the payments faithfully," recounts Levy. "It was a twenty-year policy, and when it came due, he cashed it in and bought a single loaf of bread. Such was life in the German Weimar Republic. Things got so bad there for a while, dentists and doctors stopped asking for currency, seeking … [Read more...]

The Con of the Century

By deepcaster.com “…In essence, these private banks and corporations now own the revenue stream of the Federal government and its taxpayers. Neat con, and the marks will never understand how "saving our financial system" led to their servitude to the very interests they bailed out. … [Read more...]

How Paper Money Fails

About right now, I imagine 90% of our subscribers and most of the analysts in my building think I'm nuts. Truthfully... I feel a little bit like Chicken Little. I've been saying the risk of hyperinflation is a more serious threat to our wealth (and way of life) than a massive deflation. Meanwhile, just about every month it looks more and more like Europe's banking crisis will cause another round of serious deflation in the world's asset prices. I'm starting to look pretty foolish... I thought economic growth would be stronger than expected, not weaker. I thought job growth would be stronger than expected, not weaker. I thought yields on long-term Treasury bonds would move higher, not … [Read more...]

Global Inflation and Double-Dip Recession Prospects

By Martin Hutchinson, Contributing Editor, Money Morning Last week's stock-market meltdown was a worldwide affair, and was touched off by trader fears of a global "double-dip" recession. However, the truth is that the odds of a recessionary reprise are high in just a few countries - primarily those that have experienced excessive fiscal and monetary "stimulus," or that have real inflation problems. The rest of the world is recovering just fine. … [Read more...]

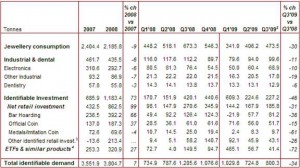

Gold – The Optimal Investment for Inflation and Deflation

History shows that gold is an excellent performer in both inflationary and deflationary economic scenarios. Author: Ronald Stoeferle Posted: Thursday , 24 Jun 2010 VIENNA (Erste Bank) - The central question of whether the next few years will be dominated by inflation or deflation still remains unanswered. In periods of inflation, tangible assets are the preferred asset class, whereas in times of deflation, cash is king. Gold is liquid, divisible, indestructible, and can be easily transported. It has a worldwide market and there is no default risk associated with it, which means it is cash of the highest quality. Therefore gold is the optimal investment both in deflation and … [Read more...]

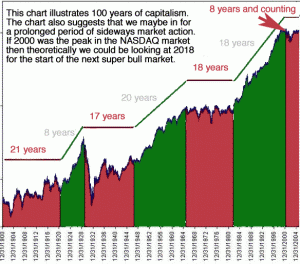

There’s No Quick and Easy Fix for This Economy

By Adam Hewison, President INO.com Regardless of what others might say, there is no quick fix for the economy. To illustrate this point, a friend of mine recently sent me a chart which I would like to share with you. This charts shows that we may be going into a prolonged period of no growth overall in the stock market. The NASDAQ peaked at 5,132.52 on March 10th, 2000. The NASDAQ market is in many ways more important than the DOW, and should be considered more of a leading indicator. If that is truly the case, then we have been in a bear market for the last eight years. … [Read more...]

Men Staring at Goats

What Hollywood can teach us about the Washington, DC establishment … and Obamanomics By Rob Carlson On November 3, 2009, a new movie opened in theatres, starring one of America’s favorite sons -- George Clooney. In the film, Men Who Stare At Goats, the government gathers and trains a group of people with “special” mental capabilities. These men of rare ability are to be trained as Top Secret… Psychic Soldiers. The film was, ostensibly, “based in a top-secret true story.” Employing their special “abilities,” these “Jedi” warrior monks would pass through walls, and see into the future. They would fight – not with guns, but with their minds. Directing their gaze at the enemy, they … [Read more...]

Gold Investing

Gold Is Going Nowhere…But Up By Joshua Burnett My father-in-law recently sent me an article from the Money section of CNN under the title: “Beware The 4 New Asset Bubbles,” written by Shawn Tully, senior editor at large at Fortune. Mr. Tully contends that there are four new balloons in the economy: Treasuries, Oil, Gold, and Stocks. My father-in-law was primarily concerned with gold so let’s look at that. The “Historic Average” of Gold Mr. Tully makes several claims concerning gold. His first indirect statement address all four items: “They’ve already seen huge run-ups that put their prices far above their historic averages, and far above the levels justified by fundamentals.” Au … [Read more...]