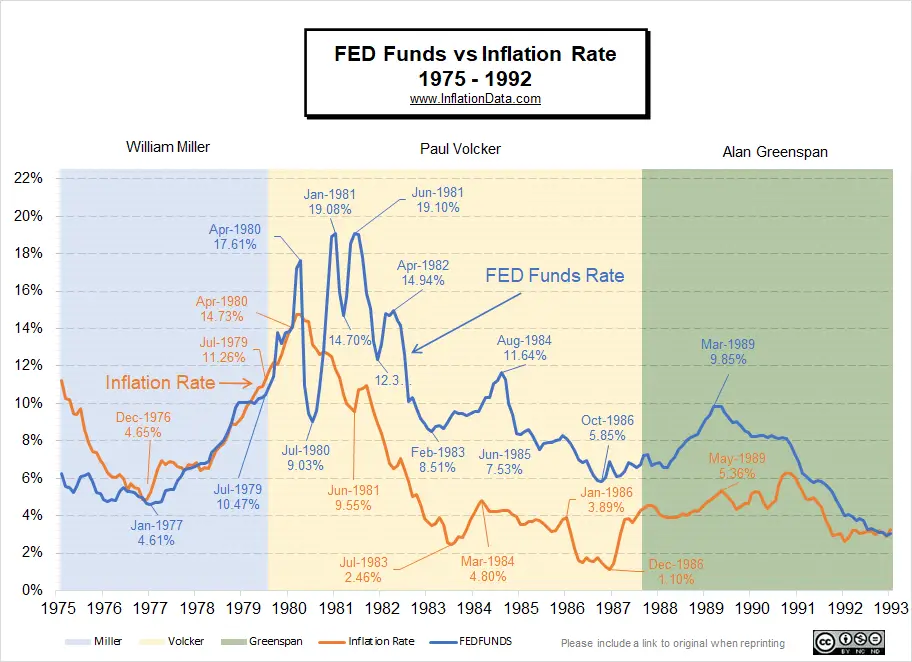

Federal Reserve Chairman Jerome Powell is sounding more and more like former FED Chairman Paul Volcker, who served as the chairman of the Federal Reserve from August 1979 to August 1987. Volcker is best known for his historic fight to vanquish inflation in the early 1980s. Before Volcker took over as the head of the FED, Inflation had risen from a low of 4.65% in December 1976 to 11.26% in July 1979. During that time, FED chairman William Miller raised the FED funds rate from 4.61% to 10.47% in July of 1979.

During Miller’s time, the FED funds rate pretty much tracked the inflation rate, with a couple of month lag. Prior to Volcker, the prevailing monetary theory was that the FED shouldn’t hold FED Funds interest rates too high for too long, so they followed a “Stop-Go Policy,” which alternated between fighting high unemployment and fighting inflation. During the “go” periods, the Fed lowered interest rates to loosen the money supply and target lower unemployment. During the “stop” periods, when inflation mounted, the Fed would raise interest rates to reduce inflationary pressure.

And we can see a continuation of this policy in early 1980 as the FED lowered interest rates to 9.03% in July of 1980 after peaking at 17.61% just a few months earlier due to rising unemployment. This was because the Carter administration initiated a “credit-control program” in early 1980.

End of the Stop-Go Policy

Volcker had the reputation of being a strong inflation fighter during his time as President of the New York Federal Reserve Bank. He felt that inflationary expectation contributed to a high velocity of money which resulted in a sort of self-fulfilling prophecy. And the Stop-Go policy was sending the wrong signal to the people. So as FED Chairman, he wanted to institute a policy that would eliminate inflation (and inflationary expectations).

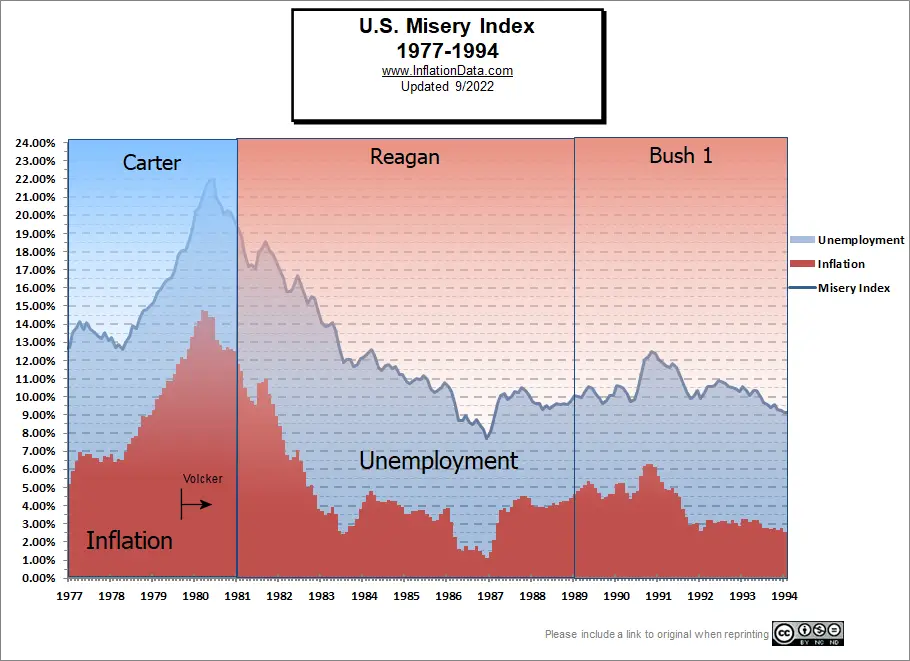

Ronald Reagan was elected in November 1980, and he shared Volcker’s views that inflation needed to be stamped out at any cost. When they saw that inflation was rising again, Reagan encouraged Volcker to do “whatever it takes” to kill inflation. And so Volcker promptly raised rates even higher to 19.08% in January 1981, despite the fact that inflation had already fallen to 11.83% and unemployment was 7.5%. This combination resulted in a “misery index” of 19.33% (down from almost 22% in June of 1980).

Volcker is quoted as saying in 1981, “Failure to carry through now in the fight on inflation will only make any subsequent effort more difficult.” In addition to raising interest rates, Volcker targeted the money supply. In July, the economy officially re-entered recession, and by December 1981, unemployment was at 8.5%, but inflation was down to 8.92% for a combined misery index of 17.42%. Despite repeated calls from Congress to loosen monetary policy Volcker held his ground, ultimately resulting in lower inflation and a foundation for economic growth for many years to follow.

Is Jerome Powell, Paul Volcker 2.0?

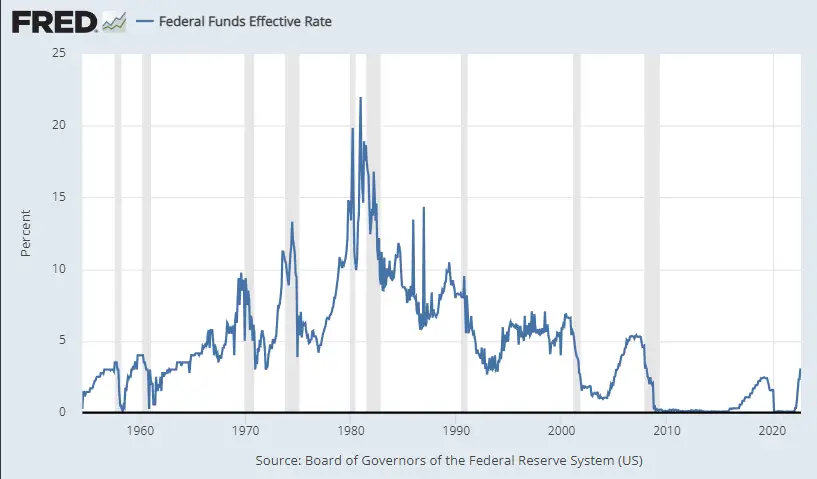

On September 20-21, 2022, the FED held their meeting/press conference, and FED Chairman Powell announced another 75 basis-point (i.e. ¾%) hike to the fed funds rate. During this meeting and at his Jackson Hole address in late August, Powell pointedly used the phrase “Keeping at it,” which not so coincidentally is the title of Paul Volcker’s memoirs. Keeping At It: The Quest for Sound Money and Good Government.

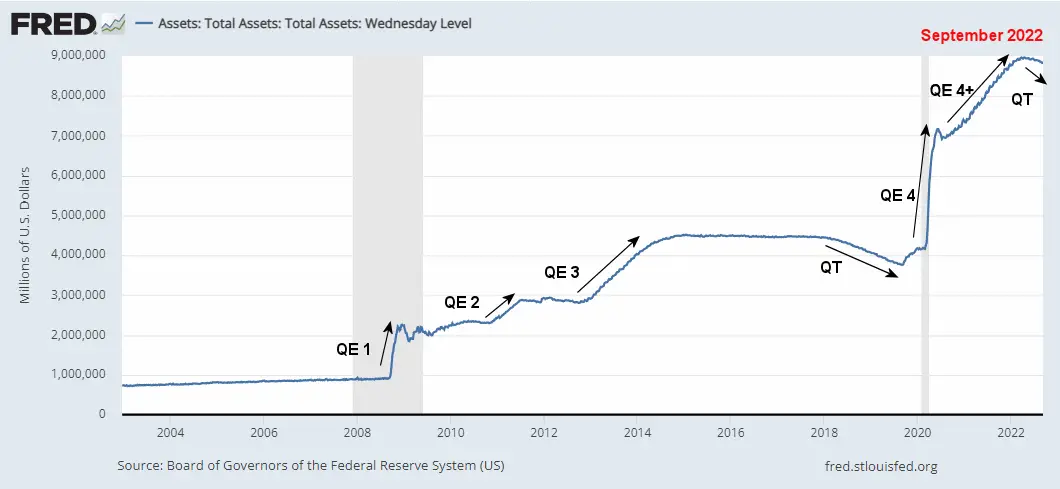

In addition to raising interest rates, Powell is following Volcker’s example by tightening the money supply. In March, FED assets were 8.962 Trillion, and as of this writing, the FED has reduced them to 8.817 Trillion. Based on the big picture, this is only a drop in the bucket, but it is something. Up until recently, the FED’s response was too little… too late.

Even back in 1980, under Carter, the FED had raised interest rates to be equal to the inflation rate. For instance, in September 1978 inflation was 8.31% and the FED funds rate was… 8.45%!

In July 2022, inflation was a similar 8.58%, and Powell had raised rates all the way up to…

wait for it…

2.32%.

As of this writing, with inflation for August at 8.26%, rates are up to 3.08%, so they still have a long way to go to reach 1980 levels.

I can understand his measured approach, had he raised rates from virtually zero to 8% overnight, the markets would have crashed, and there would be riots in the streets.

Up until this recent FED meeting, the market was hoping that a little dose of FED medicine would get inflation under control quickly and relatively painlessly. At this point, the reality is starting to set in, and the markets are starting to reflect the grim reality that we have been saying for a year now. So Powell is talking tough to try and convince the market that he means business and can be just as tough as Paul Volcker. The question still remains to be seen whether he will still be as tough when Congress starts pelting him with demands to start easing as they did with Volcker. At this point, it is still easy, unemployment is historically low, and the only problem is inflation, so fighting it is easy. But what would Powell do if he had 8.26% inflation… AND unemployment at Volcker levels of 7.5% (January 1981) or 8.5% like in December 1981? Would he cave or “Keep at it”?

You might also like:

Leave a Reply