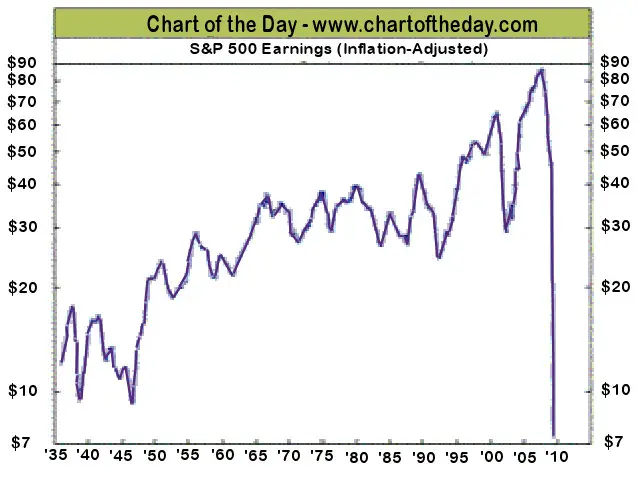

Editor's Note: Earnings are what fuel market gains... without them the market is just running on fumes. To the right is a chart that shows S&P 500 earnings adjusted for inflation.

Over the last few months investors have turned from 2008's fearfulness to fearlessly investing into an environment where earnings are virtually non-existent.

This brings to mind a famous quote from none other than legendary investor Warren Buffett, "Aim to be fearful when others are greedy, and greedy when others are fearful."

So is this a time to be greedy or fearful? I would vote for fearful. But a time is coming when the tide will turn. In this article by Andy Gordon you will see how three forward looking men put aside fear and went against the trend to make huge fortunes.

Keep your powder dry and wait for the opportunity to act when others are quaking in their boots. And Andy provides a good recipe for what to buy.

History Repeats Itself

Native Tennessean John Templeton saw Hitler’s army roll up

one Central European country after another and then take aim at Western Europe.

Companies left and right were falling into bankruptcy. Stocks were nose-diving,

many going for under historic lows.

So what did John do at the height of

this nightmarish free-fall?

He was so sure that what he was doing couldn’t

fail that in 1939 he borrowed $10,000 from his boss. He then carefully selected

104 stocks on the New York Stock Exchange to invest in.

By the time the war

was over, 100 of the 104 stocks had zoomed up in the post-war market surge.

Templeton made a 500 percent profit in four years. He repaid his boss and had

$40,000 left over.

By striking when the iron was hot, Templeton went on to

become one of America’s most successful and rich investors.

And he

wasn’t the only one...

At the same time that John was seeing his bets

pay off, a WWII-bomber borrowed money from the Seagram’s family to buy a struggling

charter airline for $60,000. The Air Force vet, by the name of Kirk Kerkorian, built

the fleet on the cheap with surplus Air Force bombers which began carrying freight

back and forth between America and Europe. The small nearly worthless charter airline

grew as trade between America and Europe exploded.

Kerkorian eventually sold

his company for $104 million and went on to become a billionaire – investing

in everything from autos to gambling, including majority shares in MGM.

At

the same time, high-school dropout David Murdoch was seeing the same historic opportunity

in this rock-bottom market and borrowed $1,800 to buy a diner. He flipped it for

a small gain and bought another property at a huge discount. He made a bigger gain.

The gains kept getting bigger and bigger until David parlayed them into a $4.4 billion

fortune.

Three men. Three fortunes. But what does this mean to you?

Let’s now fast-forward to the present. They don’t call this rally

a “sucker’s rally” for nothing. It rose on fumes. It certainly

didn’t rise on earnings. Take a look at the S&P’s earnings in the

past 20 months. They’ve nosedived from $80 to $7 – the biggest drop

ever recorded.

Market-Earnings Have Dropped Like a Rock

The S&P earnings performance in the 1940’s was bad. Today the S&P

is doing even worse..

We saw a severe bear market in the 1940s and we’re

seeing one today that is just as serious..

The same thing also happened in

the 1920s. By 1921, the stock market had fallen by 45.6 percent. While many people

were standing around wondering what to do with their money, some individuals were

busy making a fortune off of the stock market..

The market climbed 495 percent

over the next decade..

In the early 1940s – when Templeton, Kerkorian and Murdoch were taking

advantage of ridiculous low-prices – the market climbed 170 percent over the

next decade..

And like the 1920s and 1940s, stock prices will be dropping

to irresistible bargain prices once again..

The two main takeaways here are

that....

- You should buy when assets are priced as if the world is about to end. You should buy when assets are priced as if the world is about to end.

- Our current “Great Recession” has given you a gift of a lifetime.

I’ve Waited 30 Years for This Moment

Finally, the opportunity to capture oversized profits is resurfacing again....

John Templeton bought into a few companies that washed out of the market. You

should do it a little differently. The market has been beating up companies indiscriminatingly –

the big with the small ... the strong with the weak. You don’t have

to buy small and risky stocks, not with some of the market’s biggest companies

going for 40-50 cents on the dollar..

If these “best of the best”

companies just go back up with the market, you’ll pocket over four times your

investment in the next two years. But they should do much better than merely track

the market..

This recession in not only a gift to us, it’s also a gift

of a lifetime for these big “global industrial merchants” for these

three reasons...This recession in not only a gift to us, it’s also a gift

of a lifetime for these big “global industrial merchants” for these

three reasons...

- They can take advantage of the dollar’s weakness by selling their products overseas cheaper than usual.

- They have the flexibility to pick and choose what markets to target from dozens of countries around the world. The world’s economies may have fallen in lockstep, but they’re rebounding at various rates. For example, Korea, Brazil, and China are showing a little more bounce in their step than many countries.

- This is the biggest reason: These companies have turned into bullies.

In times like these, I love big companies that ruthlessly take customers away

from weaker companies cutting back...

I love big companies that are coming

out with newer and better products (the iPhone 3G S, for example) while other companies

are reducing R&D...

And I love big companies that scoop up their small

nearly broke rivals for pennies on the dollar.

Investing in the market bullies

makes sense, especially when the market has beaten up so many of the smaller companies

to a pulp. It makes it easy for these bullies to finish them off.

Of course,

these companies aren’t immune to the effects of a bad economy. Their sales

are off. Plus they’re watching how they spend money.

But a bully losing

10 pounds is not the same as a 95-pound weakling losing 10 pounds. These companies

are big and strong. Many of them have no cash worries and have actually increased

dividends into the teeth of this recession.

Dividend hikers used to outnumber

slashers 15-1. Now the slashers rule. They outnumber hikers by a 4:3 margin.

These corporate bullies are using this period as a launching pad to increase

market share and dominate the competition in the future. Investors should be pouring

into these companies. But they’re not. And, for the most part, their prices

are way down.

THIS IS THE PERFECT SET-UP.

As the market goes down and pushes prices to lows not seen in decades, you should

be adding these big companies to your portfolio.

Bullies may not be likable.

But they make great long-term investments. In a horrible global market, they’re

the ones getting bigger and stronger.

Invest well,

Andrew

This investment news is brought to you by Investor’s Daily Edge. Investor’s Daily Edge is a free daily investment newsletter that is delivered by email before the market opens. It’s published by Fourth Avenue Financial, a subsidiary of Early To Rise (an affiliate company of Agora Publishing). In each weekday issue you’ll receive practical strategies for protecting your portfolio and multiplying your money. You’ll also learn about undiscovered opportunities in emerging sectors and markets, deeply discounted stocks, recommendations for bonds, cash, commodity and real estate investing, and top ETFs. To view archives or subscribe, visit Investor's Daily Edge.

Our NYSE - ROC (Rate of Change) chart tracks the nominal rate of change in the NYSE and gives an excellent visual presentation of stock market nominal rates of return thus making it easier to determine when you should be in the market and when you should be on the sidelines.

For more information on the effects of cumulative inflation go to Cumulative Inflation by Decade for a full description.

When inflation is high and commodity prices are rising on what seems like an almost daily basis... have you ever wondered how that might affect the price of stocks? If so you might find Is There a Correlation Between Inflation and the Stock Market interesting.

Use our custom search to find more articles like this

Share Your Thoughts