Let’s face it. With the US economy facing the bitter consequences of extravagance and unscrupulous spending, it has become quite difficult for the US to manage both its public and private debts now. In this phase of post recession hangover and economic meltdown, the U.S. federal government has bumped up against its permitted borrowing limit. According to Alison Fraser, director of the Roe Institute for Economic Policy Studies, America’s debt just crossed $15 trillion, which means presently, the amount owed by the United States government to the world, is equivalent to the amount produced by the American economy per year. All these factors lead to higher prices and intensifying inflation … [Read more...]

Another Way to Measure Inflation

In this article Jeff Clark shows us how to think about prices and purchasing power in a different way. The true measure of inflation is in relation to how much stuff your money can buy and in reality it is also related to the return you can get on your investment. If you can get 10% on your money a 5% inflation rate isn't so bad. But if you own any assets and they are only appreciating at 1% (or worse yet depreciating) and prices are increasing at a 5% rate the value of your assets are declining (i.e. they are being insidiously and secretly being stolen by the government printing presses). In this article Jeff will give you another way to look at the issue of prices and perhaps open your … [Read more...]

Adam Fergusson: “Inflating your economy means playing with fire”

GoldMoney founder James Turk interviews When Money Dies author Adam Fergusson, who discusses the parallels and differences between the Weimar inflation and the situation in the US and Europe today. "I don't see how any of these [Western] economies can grow their way out of the extraordinary debts that they have." … [Read more...]

How Does Inflation Affect You?

When people go the the grocery store and see ever higher prices they know how inflation affects them. But when they are feeling more philosophical they might reason that if all wages and prices increased at the same rate it would all balance out in the end right? Well theoretically yes but in reality it never works that way. Prices of various items all increase at different rates so some people are benefiting while others suffer. Those on fixed incomes suffer the most because the cost of things they are buying increases but their income stays the same. This is where COLA or "Cost Of Living Allowance" comes in it is an adjustment that is made to compensate for the increase in prices due … [Read more...]

Wanna Beat Inflation?

In a recent article entitled Is Gold really a good Inflation Hedge? I showed the history of Gold and how it really was a fear hedge rather than an inflation hedge. Interestingly, I just read an article entitled "Wanna Beat inflation? Forget Commodities!" by newsletter author Dan Ferris. It seems almost like heresy to hear that statement from Dan since he writes commodity and oil-based newsletters. But some of the statistics he presented were very interesting so I thought I would pass them along to you. … [Read more...]

Is a Stock Market Crash Inflationary or Deflationary?

Recently a subscriber asked me the question above, he gave quite correct arguments about how the stock market is "a zero sum game" in other words for every buyer there is a seller, so overall everything should stay in balance. But as I'm sure you know there are at least 3 ways to measure money supply M1, M2 and M3. Each one includes increasingly broad definitions. From just cash equivalents up to including all sorts of time deposits and Government debts. But what they don't include is stock valuations, however if the price of your stocks increases you feel richer and are more likely to spend money from your other accounts because you know if you need the money you can always sell your … [Read more...]

How Wealth Can Simply Evaporate

In the following article Bob Stokes of Elliottwave explains why in times of credit expansion money is created out of thin air and in times of credit contraction money can simply disappear... no matter how much the government prints out of thin air. This results in a negative "money multiplier" as more money disappears than is created. See my article on Velocity of Money and the Money Multiplier for more information.~Tim McMahon, Editor Evaporation of Wealth on a Vast Scale How $1-million can disappear By Bob Stokes The bursting of the "debt bubble" which started in 2008 is far from over. It's the financial story of our age and it's happening before our eyes. The full scope is hard to … [Read more...]

Credential Inflation: Bachelor’s Degree Not Enough

In today's tumultuous economic climate, when we hear the term "inflation" we think money and a failing economy our minds immediately turn to expenses, debt, and money woes. Rarely, however, do our minds turn to college degrees and job prospects. On July 22, 2011 Laura Pappano from The New York Times published an article titled The Master's as the New Bachelor's. Introducing into the public mindset the concept of "credential inflation" and "degree inflation", this article has caused quite the hoopla in the academic world and many a panic attack among 20 somethings throughout the country. Pappano suggests that there is a certain amount of credential inflation occurring throughout the job … [Read more...]

The Long Road to Inflation Perdition

Today David Galland interviews Terry Coxon. Terry has worked hand in hand with the legendary best selling author Harry Browne together they wrote Inflation-Proofing Your Investments published in 1981 . Terry also wrote Keep What You Earn and is an expert in monetary systems and first started writing about inflation during the last major inflationary period of the 1970's. David Galland is editor of The Casey Report. How the Federal Reserve is Locking Up Inflation David Galland: You were involved with Harry Browne during the last great inflation in the U.S. How does the increase in the money supply that kicked off in 2007-2008 compare in terms of scale to what went on leading up to the … [Read more...]

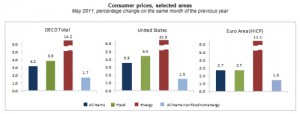

May Inflation Surges to 3.2% in OECD Countries

The Organization for Economic Co-operation and Development (OECD) has finished aggregating the May inflation data provided by its member countries and has released the results. Energy prices were up a whopping 14.2% for the 12 months ending in May while food prices were up by 3.9%. The overall average for all products in all the OECD countries was 3.2% in May. This was up from the 2.9% reported in April. The major components of this increase were mainly a sharp acceleration of inflation in Canada (to 3.7% in May, up from 3.3% in April) and the United States (to 3.6%, up from 3.2%) with high food and energy prices being the main drivers. The following chart breaks the components down by … [Read more...]