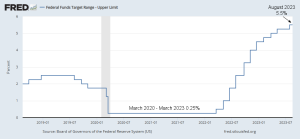

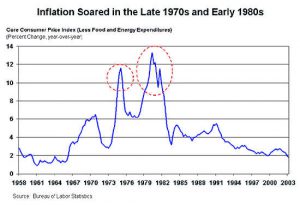

Why Has The FED Been Raising Interest Rates? The Federal Reserve (Fed) started raising interest rates in March 2022 in an effort to combat inflation. As of the end of July 2023, the Fed's target rate limit is 5.5%, the highest level in 15 years. There are a few reasons why the Fed is raising interest rates so aggressively. First, inflation was at a 40-year high. In June 2022, the Consumer Price Index (CPI) rose 9.06% year-over-year, the fastest pace since December 1981. This means that the cost of goods and services was rising rapidly, which was eroding the purchasing power of consumers and businesses. Second, the economy is still strong. The unemployment rate posted a 50-year … [Read more...]

Why is a Little Bit of Inflation Considered Good for the Economy?

The short answer is because the U.S. Federal Reserve Board, i.e., the “FED,” says it is. The longer answer is much more complicated. To determine whether 2% is really best for you, we will have to look at a variety of different factors. First of all, it might surprise you to know that it wasn’t always that way. It wasn’t until January 25th, 2012, that U.S. Federal Reserve Chairman Ben Bernanke set a 2% target inflation rate. Before that, the FED didn’t have a specific inflation target but instead regularly set a target range. This range was often between 1.7% and 2%. But even that range is relatively new, and some economists still believe that Zero percent inflation is optimal. Prior … [Read more...]