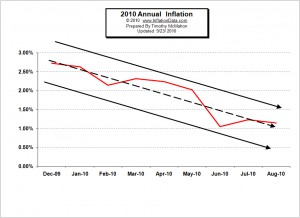

We've had almost a Trillion dollars in "stimulus" and/or "Quantitative Easing" or whatever you want to call it and as of the end of August 2010 we still only have 1.15% annual inflation... Down from 1.24% last month. And the trend has been steadily decreasing for all of 2010. Back in 2009 we had a period of deflation bottoming at -2.10% in July of 2009 and the stimulus kicked the inflation rate from its deflationary moorings all the way up to 2.72% in December of 2009. But as we can see from the chart below the effect didn't last long... and the inflation rate has steadily declined for all of 2010 so far. In the light of all that stimulus, the biggest credit bubble in history is … [Read more...]

Stimulus Up But Inflation at 1.15% and Falling?

By Tim McMahon, editor Consumer prices have risen at a meager 1.15% over the last 12 months-- despite massive stimulus and growing commitments from the U.S. government. So what's going on? Deflationary forces are strengthening. They are being spurred on by high unemployment rates creating an overwhelming need for consumers to liquidate their assets for cash. As this new economic phase is becoming a reality, expectations are compounding the effects as explained in recent commentary from the world's largest technical analysis firm. "The economy is moving into a critical new phase, an outright deflation in which 'prices fall because people expect falling prices.' Obviously, this … [Read more...]

Complimentary 90-page Deflation eBook from Robert Prechter Available Now

New Deflation eBook Available Now: Our friends at Elliott Wave International have just released a complimentary 90-page ebook on deflation from Robert Prechter. As deflation fears are back in the news and most likely also on your mind, it's more important than ever to -- at very least -- give the deflationary scenario a serious look. After all, deflation could pose a serious risk to your wealth if it occurs, and no one has explained the potential threats -- and how you can survive them -- better than Prechter. Even if government stimulus and out-of-control spending have you more convinced than ever that inflation is dead ahead, we recommend that you take a look at Prechter's reasonable … [Read more...]

Free Deflation Video

Get a free 20 minute video from Elliottwave on Deflation. Deflation is Everywhere: What it means for you … [Read more...]

Deflation is Everywhere: What it means for you

The mainstream media couldn't predict the biggest bear market in 100 years; how do you expect them to anticipate what will unfold next? Watch this quick video clip from financial analyst and sought-after speaker Steven Hochberg about what triggers a deflation, why you should challenge the consensus view for inflation, and how debt is sucking the life out of the economy. Then access the full 20-minute video, FREE. Watch the full presentation, FREE. Click Here! … [Read more...]

Which is Stronger- Inflation or Deflation?

By Tim McMahon, editor Why the Printing Press is No Match for Deflationary Forces- A mere two years ago (although it seems like a lifetime) in August of 2008, inflation was roaring in at 5.37% and the world was talking about hyperinflation. But then along came the housing crash which started the domino effect of deflationary forces. Housing prices, stock prices, asset prices all began falling; triggering margin calls and more liquidation until even Gold (the only investment that is not simultaneously a liability) began to feel the deflationary pressure. By July 2009 a mere 11 months later, everyone was no longer afraid of the inflation monster, but now they were fearing deflation. At … [Read more...]

20 Questions with the World’s Leading Deflationist

20 Questions with the World's Leading -- Perhaps Only True -- Deflationist, Robert Prechter Robert Prechter, the world's leading proponent of the deflationary scenario, answers tough questions from noted financial commentator Jim Puplava. Anyone looking to invest in today's environment should read this revealing new 20-page report. Consider these recent forecasts: In 2005, Prechter warned readers of an imminent top in real estate. In October 2007, Prechter warned that stocks and commodities were historically overvalued and due for an immediate crash. In 2008, Prechter maintained that the U.S. dollar would rally throughout the most volatile market environment since the Great … [Read more...]

Deflation: First Step, Understand It

There is still time to prepare if deflation is indeed in our future. "Fed's Bullard Raises Specter of Japanese-Style Deflation," read a July 29 Washington Post headline. When the St. Louis Fed Chief speaks, people listen. Now that deflation -- something that EWI's president Robert Prechter has been warning about for several years -- is making mainstream news headlines, is it too late to prepare? It's not too late. There are still steps you can take if deflation is indeed in our future. The first step is to understand what it is. So we've put together a special, free, 60-page Club EWI resource, "The Guide to Understanding Deflation: Robert Prechter’s most important warnings about … [Read more...]

If Deflation Wins, What Will Gold Stocks Do?

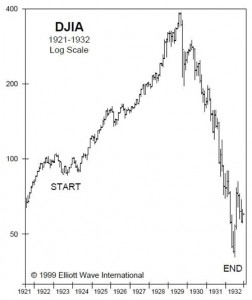

By Jeff Clark, Senior Editor, Casey’s Gold & Resource Report The talk of a possible double dip is now common banter on TV investment programs. And indeed, deflationary forces seem to have the stronger grip right now than inflationary ones. So if deflation is the next reality we have to face, what happens to our favorite stock investments? There’s lots of data about what gold does during periods of high inflation, but less so with deflation, partly because we don’t see a true deflation all that often. But of course we’ve got the biggie we can look at, and the seriousness of the Great Depression can give us a big clue as to how gold stocks behave in a true deflationary … [Read more...]

What is the Ultimate Status Symbol in a Deflationary Depression?

Deflationary Depression: Ultimate Status Symbol The Biggest House? No. The Most Expensive Car? Try Again. By Robert Jay Ostentatious display defined the "Gilded Age" in the latter part of the 19th century. Most of the upper class in that period believed that if you had a big bank account, you should make sure everyone knew it. A century later -- during the bull market of the 1980s-1990s -- "McMansions" with BMWs in the garage became more common. Pulling out the plastic and enjoying instant gratification became pervasive. In most decades of the past century, families had to save for big ticket items, perhaps even save all year to ensure holiday presents under the tree. To take … [Read more...]