Proponents of the digital cryptocurrency Bitcoin are touting it as the latest Inflation hedge... perhaps better than gold... but is it? Although gold may fluctuate significantly in the short run, this precious metal has fared relatively well as a hedge against inflation over the long term. One of gold's significant benefits is that it is a commodity that if held in physical form is neither paper, nor government-controlled, nor another person's liability. Gold's other major advantage is its limited supply (i.e., requiring quite a bit of effort and energy to mine). Recently, Bitcoin has arrived on the scene and become a "digital commodity" independent of the government, which has gained … [Read more...]

Safe-Haven Investments that Protect Your Capital From Rising Inflation

How the Pandemic Created Inflation Given the current state of affairs and how the Covid-19 pandemic has impacted the global economic outlook, an unconventional recession has emerged, prompting many governments to inflate the money supply to counteract the artificially suppressed economic activity. In many countries, this inflated money supply has resulted in consumer price inflation and resulted in investors seeking a safe haven investment. When there's a high level of inflation, economic uncertainty, or financial markets are in turmoil investors flock to safe-haven assets. The rationale is that in times of crisis when most traditional investments are losing value, safe-haven assets tend … [Read more...]

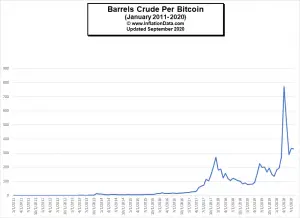

The Price of Oil Denominated in Bitcoin

Over the years we have been saying that it is important to look at prices of various commodities in terms of other commodities. For instance, we have looked at not only the Inflation Adjusted Gasoline Prices but also the Price of Oil Compared to Gold. Because of the recent volatility of Bitcoin we thought it might be interesting to look at the price of oil denominated in Bitcoin. Back in 2016, we compared Gold vs. U.S. Dollar vs. Bitcoin and recently we published Gold vs. Dollar vs. BitCoin Revisited. Often, depending on the currency that you are accustomed to using and you earn your wages in your view of the price of a commodity can be vastly different. For instance, if your currency is … [Read more...]

How has Venezuela’s Bitcoin experiment Fared?

In early 2018, in an effort to fight a collapsing economy and hyperinflationary currency Venezuela decided to jump on the BitCoin bandwagon and create its own cryptocurrency called the Petro. On December 3rd 2017, Venezuelan president Nicolás Maduro announced the petro in a televised address, stating that it would be backed by Venezuela's reserves of oil, gasoline, gold, and diamonds. Other reports claimed that the initial issue price would be based on the price of oil i.e. 1 Petro = 1 Barrel of Venezuelan oil. On 5 January 2018, Maduro announced that Venezuela would issue 100 million tokens of the petro, for a total value of just over $6 billion. The government stated the pre-sale raised … [Read more...]

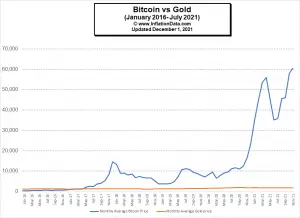

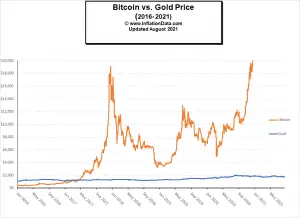

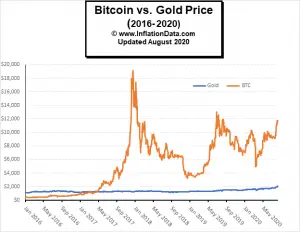

Gold vs. Dollar vs. BitCoin Revisited

Back in 2016, we compared the properties of three types of currency, i.e. Gold, Dollars (Cash), and Bitcoin. Today we'd like to look at how each has fared since then. Back then, we said that there are 10 factors that make up a good store of value. They are: 1. Scarcity- For something to be considered valuable it can’t be too readily available. 2. Fungibility- Things have to be equal. Rare paintings aren’t fungible a Picasso isn’t exactly the same as a Monet. As a matter of fact, one Picasso isn’t even the same as another Picasso. Artwork isn’t fungible. One dollar bill is pretty much the same as another, one ounce of 24 karat gold is the same as another, one bitcoin is the same as … [Read more...]

Cryptocurrencies and Inflation

The current fascination with "Crypto" has led to questions about how cryptocurrencies and inflation relate. In our article, What is the Real Definition of Inflation? we explained that there is a major difference between the cause and the effect of Inflation and unfortunately both are loosely called "Inflation". More accurately the cause is "monetary inflation" i.e. an increase in the money supply and the effect is "Price Inflation" i.e. an increase in the cost of goods and services. Can Cryptocurrencies "Cure" Inflation Since the dawn of money, there has been a fear of debasement. In the early years, when gold and silver were the primary forms of currency it was possible that another … [Read more...]

Choosing the Right Investment: Gold vs. U.S. Dollar vs. Bitcoin

Rosland Capital recently produced an interesting infographic comparing the ten most important traits of an investment or more precisely of a store of value or currency. They offer physical gold and precious metals backed IRAs as a method to add stability to the mix. Including gold and other precious metals in your portfolio lowers your risk by diversifying from paper assets, thus hedging against the economy and inflation. The infographic compares Gold, the U.S. Dollar and Bitcoin showing how each ranks for these 10 characteristics on a scale of "High", "Moderate" or "Low". The ten important traits are: Scarcity- Being in short supply or rare. This is important because in order … [Read more...]