Recently our good friends at Casey research published the following chart comparing the inflation adjusted Gold returns to stocks and bonds for the period 1971 through the present. From this chart we can see that as bonds fell during the late 1970’s gold rose equivalently and stocks were basically flat. During the 1980’s bonds rose and gold fell while while stocks rose slightly. During the 1990’s stocks rose sharply gold fell and Bonds were volatile but basically flat to slightly up. During the 2000’s gold was up sharply, stocks were volatile and bonds were pretty flat.

Inflation Adjusted Gold, Stocks, Bonds

So what does that give us? Each decade had it’s star performer, a lackluster performer and a loser. And it was always a different actor. So a balanced portfolio of all three would lessen volatility and provide a greater total return. If we had a Crystal ball and could tell which one of the three would be the star our portfolio could really shine.

In the article Ben Graham’s Curse on Gold Casey Research editor David Galland shows us why legendary investor Warren Buffet’s mentor Ben Graham basically ignored gold. Ben Graham is known as the “father of value investing” and modern portfolio theory is based on his work.

Graham recommended switching between stocks and bonds when one or the other became over or under valued. But what happens if both stocks and bonds stagnated or fell together?

See Ben Graham’s Curse on Gold for the answer.

See Also:

- Why Buy Gold?

- What Happens to Gold if We Enter a Recession or Depression?

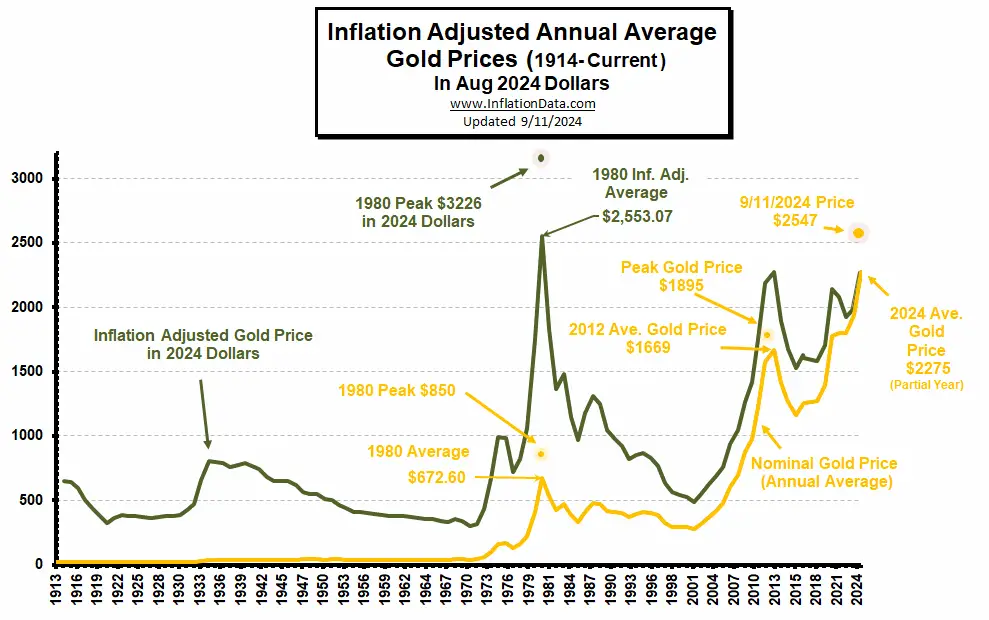

- Inflation Adjusted Gold Price Chart

- Inflation Adjusted Stock Prices

- Why (and How) China is Boosting the Price of Gold

- The Fed Resumes Printing

- How Global Financial Developments are Affecting the Price of Gold

- Gold vs Oil Chart

- Iran Says “Gold Is Money”

- What is the Definition of “Spot Gold“?

You have taken the price of gold out of historic perspective. The huge spike in price from 1971 to about 1980 was clearly related to two events: (1) Nixon allowing private ownership again after 38 years of gold being as illegal as heroin and (2) the abandonment of the gold standard for the U.S. dollar that occurred as a weening off over the period from 1971 to 1976. The spike in gold pricing had absolutely nothing at all to do with stock and bond markets.

Anahin (www.anahin.net) gives a complete Graham analysis for all 4000 stocks listed on the NYSE.

(Ben Graham was the mentor of Warren Buffett and the pioneer of value investing)