How Does The Government Calculate the Cost of Living Adjustment (COLA) on your retirement benefits like Social Security?

I recently received the following question from Jerry:

What formula does the government uses to figure out COLA based on inflation for retired people each year?

That is a great question!

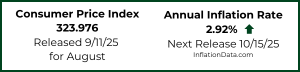

Social Security benefits are indexed for inflation to protect beneficiaries from the loss of purchasing power due to inflation. The government uses a complex averaging system to take the average CPI index for the 3rd quarter of the previous year versus the average CPI index for the current year and calculate the inflation rate based on that.

Cost of Living adjustments are calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) rather than the more typical Consumer Price Index for All Urban Consumers (CPI-U). The indexes are very similar but use different percentages. For instance the CPI-U assumes that a consumer spends 15.1 percent of his income on food and beverages and 42.2 percent on housing but the CPI-W assumes he spends 16.8 percent of his income on food and beverages and 39.3 percent on housing.

Rather than calculate the inflation rate between a specific month of this year and the same month last year, they take the average index of an entire quarter and compare it to the same quarter last year. They chose the 3rd quarter. This helps prevent accusations of fudging the numbers by them adjusting a single month. It also helps prevent them over or under paying due to some short term anomaly.

Here are the calculations for 2011 based on 2010 data:

No COLA

There will be no increase in Social Security benefits payable in January 2011, nor will there be an increase in SSI payments.

How is a COLA calculated?

The Social Security Act specifies a formula for determining each COLA. According to the formula, COLAs are based on increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). CPI-Ws are calculated on a monthly basis by the Bureau of Labor Statistics.

A COLA effective for December of the current year is equal to the percentage increase (if any) in the average CPI-W for the third quarter of the current year over the average for the third quarter of the last year in which a COLA became effective. If there is an increase, it must be rounded to the nearest tenth of one percent. If there is no increase, or if the rounded increase is zero, there is no COLA.

COLA Computation

The last year in which a COLA became effective was 2008. Therefore the law requires that we use the average CPI-W for the third quarter of 2008 as the base from which we measure the increase (if any) in the average CPI-W. The base average is 215.495, as shown in the table below.

Also shown in the table below, the average CPI-W for the third quarter of 2010 is 214.136. Because there is no increase in the CPI-W from the third quarter of 2008 through the third quarter of 2010, there is no COLA for December 2010.

| CPI-W for | ||

| 2008 | 2010 | |

| July | 216.304 | 213.898 |

| August | 215.247 | 214.205 |

| September | 214.935 | 214.306 |

| Third quarter total | 646.486 | 642.409 |

| Average (rounded to the nearest 0.001) | 215.495 | 214.136 |

Good article. I certainly love this site. Stick with it!

Really 3 dollars what can that buy? You people should be ashamed of yourself. I’m sure that you people live better. This should be looked into as the increase is a real joke.

Thank you very much for explaining this. If I may, I’d like to ask a related question, because it seems to me that something must still be missing from the equation. How it can be the cost of food, fuel, medical care/prescription drugs, and almost everything else went up dramatically during those years when there was no COLA? I’ve often wondered if the government re-defined the meaning of the phrase “cost of living”.

Thanks,

JG

It cannot be explained by any logical conclusion. It is however, a way of stealing money from the people of America who have paid into the social security fund, which gives no interest on their money. Meanwhile the government generously takes a large cut of the funds, without ever putting it back, and calls it an entitlement.

I might add that all disabled military veterans also have no COLA as this flawed formula hits them as well.