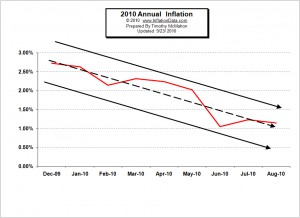

We've had almost a Trillion dollars in "stimulus" and/or "Quantitative Easing" or whatever you want to call it and as of the end of August 2010 we still only have 1.15% annual inflation... Down from 1.24% last month. And the trend has been steadily decreasing for all of 2010. Back in 2009 we had a period of deflation bottoming at -2.10% in July of 2009 and the stimulus kicked the inflation rate from its deflationary moorings all the way up to 2.72% in December of 2009. But as we can see from the chart below the effect didn't last long... and the inflation rate has steadily declined for all of 2010 so far. In the light of all that stimulus, the biggest credit bubble in history is … [Read more...]

Stimulus Up But Inflation at 1.15% and Falling?

By Tim McMahon, editor Consumer prices have risen at a meager 1.15% over the last 12 months-- despite massive stimulus and growing commitments from the U.S. government. So what's going on? Deflationary forces are strengthening. They are being spurred on by high unemployment rates creating an overwhelming need for consumers to liquidate their assets for cash. As this new economic phase is becoming a reality, expectations are compounding the effects as explained in recent commentary from the world's largest technical analysis firm. "The economy is moving into a critical new phase, an outright deflation in which 'prices fall because people expect falling prices.' Obviously, this … [Read more...]

Complimentary 90-page Deflation eBook from Robert Prechter Available Now

New Deflation eBook Available Now: Our friends at Elliott Wave International have just released a complimentary 90-page ebook on deflation from Robert Prechter. As deflation fears are back in the news and most likely also on your mind, it's more important than ever to -- at very least -- give the deflationary scenario a serious look. After all, deflation could pose a serious risk to your wealth if it occurs, and no one has explained the potential threats -- and how you can survive them -- better than Prechter. Even if government stimulus and out-of-control spending have you more convinced than ever that inflation is dead ahead, we recommend that you take a look at Prechter's reasonable … [Read more...]

20 Questions with the World’s Leading Deflationist

20 Questions with the World's Leading -- Perhaps Only True -- Deflationist, Robert Prechter Robert Prechter, the world's leading proponent of the deflationary scenario, answers tough questions from noted financial commentator Jim Puplava. Anyone looking to invest in today's environment should read this revealing new 20-page report. Consider these recent forecasts: In 2005, Prechter warned readers of an imminent top in real estate. In October 2007, Prechter warned that stocks and commodities were historically overvalued and due for an immediate crash. In 2008, Prechter maintained that the U.S. dollar would rally throughout the most volatile market environment since the Great … [Read more...]

Deflation: The Black Swan Has Been Spotted

By Nico Isaac Up until recently, the mainstream experts put the likelihood of deflation transpiring in the United States at whatever the current odds are of Mel Gibson finding a date; i.e. nill to none. Their catchphrase for the rare and unexpected nature of a deflationary event was "Black Swan." And as the following news items from 2008-2010 show, very few imagined this "bird" migrating onto the economic shore: Oct. 20, 2008: "Central banks of the world know how to stop deflation. You just print enough money." (Reuters) Jan. 19, 2009: "US Deflation Unlikely. The tremendous stimulus from the US administration... should prevent the recession from dragging on long enough for deflation … [Read more...]

20 Questions with Robert Prechter: Long Decline Ahead

Long Decline Ahead July 2, 2010 By Elliott Wave International The following article is an excerpt from Elliott Wave International’s free report, 20 Questions With Deflationist Robert Prechter. It has been adapted from Prechter’s June 19 appearance on Jim Puplava’s Financial Sense Newshour. Jim Puplava: I want to come back to government spending, but first I want to move onto the stock market. In your last two Elliott Wave Theorist issues, you laid out a scenario that would put the Dow and S&P, which in your opinion may have peaked on April 26, as the top from here. You feel that this top is the biggest top formation of all time, a multi-century top and we could head straight down … [Read more...]

The Primary Precondition of Deflation

By Robert Prechter, CMT Elliott Wave International The following was adapted from Bob Prechter’s 2002 New York Times and Amazon best seller, Conquer the Crash – You Can Survive and Prosper in a Deflationary Depression. Deflation requires a precondition: a major societal buildup in the extension of credit (and its flip side, the assumption of debt). Austrian economists Ludwig von Mises and Friedrich Hayek warned of the consequences of credit expansion, as have a handful of other economists, who today are mostly ignored. Bank credit and Elliott wave expert Hamilton Bolton, in a 1957 letter, summarized his observations this way: In reading a history of major depressions in the U.S. … [Read more...]