The question of "Should You Invest in Inflation Indexed Bonds?" depends on your personal situation and the current inflationary environment. If you want to have a low risk investment that will keep up with inflation you might consider investing in inflation indexed bonds. Inflation Indexed Bonds When Inflation Rates are High, you might be worried about what's going to happen to your savings. Inflation series bonds are one option to consider. These unique investments have the ability to fight inflation and protect your savings from total devastation. Types of Inflation Indexed Bonds There are two different types of inflation indexed bonds issued by the U.S. Treasury one is called the … [Read more...]

What are I bonds?

I- Bonds: A brief overview: In the current shaky economy, everyone is looking for safe and secure investments. Investors might have a chance at high rewards with stocks and corporate bonds, but there’s also a huge risk to putting money in either. The snowballing crises in Europe aren’t making foreign investments look any more tempting. Where can investors trust their finances if they want a solid risk free return on their investment? Well, for those of you who want to play it cool and safe with your investments, you might consider: I bonds. What are I-Bonds? First of all, I-Bonds are officially called Series I Savings Bonds. According to the U.S. Department of Treasury, I bonds … [Read more...]

Protect Yourself From Inflation

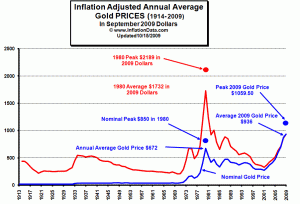

Inflation Warning!!! How do you protect yourself now? In a recent article, I discussed how Gold was not strictly an inflation hedge but more a crisis hedge against worry of all sorts. See How has Gold fared as an Inflation hedge? In another article, How the Iraq War will affect the U.S. economy, I discussed how a wartime economy almost guarantees future inflation. So naturally several readers wrote to ask, “What is the best way to protect against inflation?” … [Read more...]