By Doug Casey, The Casey Report Here at Casey Research, our view of the Great Depression of the 1930s is a little different from that of most people. In our eyes, Franklin Roosevelt wasn’t a hero, he was a villain. Nearly everything he did served to extend and deepen the economic downturn. With the exception of supporting the 21st Amendment for the repeal of Prohibition, Roosevelt’s involvement in the economy was an unmitigated disaster. But in popular memory, that failure is obscured by U.S. success in WW2, over which Roosevelt presided. Today, unfortunately, Obama and his minions are taking Roosevelt as a model and are straining to repeat his mistakes. Because the distortions in … [Read more...]

Depression Within a Depression

By James Quinn, Contributor, The Casey Report Regular Casey Report contributor James Quinn is the head of strategic planning for one of the world's most prestigious business schools and the host of TheBurningPlatform.com blog. In this article, he is presenting historical indicators that may tell us what’s in store for the U.S. economy. In recent months, worshippers at the altar of Keynes have been hyperventilating over the possibility Congress will run a deficit of “only” $1.5 trillion in 2010. They have issued dire proclamations about a replay of the 1937-1938 Depression within the Great Depression. White House favorite and #1 Keynesian on the planet, Paul Krugman, declared that not … [Read more...]

Deflation is Everywhere: What it means for you

The mainstream media couldn't predict the biggest bear market in 100 years; how do you expect them to anticipate what will unfold next? Watch this quick video clip from financial analyst and sought-after speaker Steven Hochberg about what triggers a deflation, why you should challenge the consensus view for inflation, and how debt is sucking the life out of the economy. Then access the full 20-minute video, FREE. Watch the full presentation, FREE. Click Here! … [Read more...]

If Deflation Wins, What Will Gold Stocks Do?

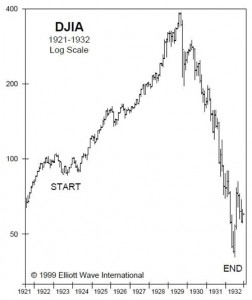

By Jeff Clark, Senior Editor, Casey’s Gold & Resource Report The talk of a possible double dip is now common banter on TV investment programs. And indeed, deflationary forces seem to have the stronger grip right now than inflationary ones. So if deflation is the next reality we have to face, what happens to our favorite stock investments? There’s lots of data about what gold does during periods of high inflation, but less so with deflation, partly because we don’t see a true deflation all that often. But of course we’ve got the biggie we can look at, and the seriousness of the Great Depression can give us a big clue as to how gold stocks behave in a true deflationary … [Read more...]

What is the Ultimate Status Symbol in a Deflationary Depression?

Deflationary Depression: Ultimate Status Symbol The Biggest House? No. The Most Expensive Car? Try Again. By Robert Jay Ostentatious display defined the "Gilded Age" in the latter part of the 19th century. Most of the upper class in that period believed that if you had a big bank account, you should make sure everyone knew it. A century later -- during the bull market of the 1980s-1990s -- "McMansions" with BMWs in the garage became more common. Pulling out the plastic and enjoying instant gratification became pervasive. In most decades of the past century, families had to save for big ticket items, perhaps even save all year to ensure holiday presents under the tree. To take … [Read more...]

The Primary Precondition of Deflation

By Robert Prechter, CMT Elliott Wave International The following was adapted from Bob Prechter’s 2002 New York Times and Amazon best seller, Conquer the Crash – You Can Survive and Prosper in a Deflationary Depression. Deflation requires a precondition: a major societal buildup in the extension of credit (and its flip side, the assumption of debt). Austrian economists Ludwig von Mises and Friedrich Hayek warned of the consequences of credit expansion, as have a handful of other economists, who today are mostly ignored. Bank credit and Elliott wave expert Hamilton Bolton, in a 1957 letter, summarized his observations this way: In reading a history of major depressions in the U.S. … [Read more...]

What is so bad about Deflation?

By Tim McMahon The average annual inflation rate dropped again this month. At a monthly rate of -1.01% October's drop was touted as "the largest monthly drop on a seasonally adjusted basis since 1947 when the Bureau of Labor Statistics first started tracking seasonal adjustments" and it brought the annual inflation rate off its highs and down to a more reasonable 3.66%. November's monthly rate was almost twice as large at but it was hardly mentioned in the news. This month the annual inflation rate has dropped down virtually zero-- 0.09% with a monthly drop slightly larger than the one two months ago. Just a few months ago the annual inflation rate was 5.6% and now it is … [Read more...]

Deflation or Hyperinflation?

By Tim McMahon, Editor The monthly inflation rate dropped like a rock for the second month in a row. Journalists touted last month's drop as "the largest monthly drop on a seasonally adjusted basis since 1947 when the Bureau of Labor Statistics first started tracking seasonal adjustments". What are they going to say this month when it is almost twice as large? Largest drop since last month? This is real live deflation on a monthly basis (although not on an annual basis... yet). Basically, deflation is falling prices (or more accurately a decrease in the money supply that results in falling prices) while disinflation is a slowing of the rate of increase in prices. Are we in a … [Read more...]

Take action in a Deflationary Environment

Editor’s Note: In the following article Robert Prechter shows you how to prepare for a deflation. By Robert Prechter, CMT The ultimate effect of deflation is to reduce the supply of money and credit. Your goal is to make sure that it doesn’t reduce the supply of your money and credit. The ultimate effect of depression is financial ruin. Your goal is to make sure that it doesn’t ruin you. Many investment advisors speak as if making money by investing is easy. It’s not. What’s easy is losing money, which is exactly what most investors do. They might make money for a while, but they lose eventually. Just keeping what you have over a lifetime of investing can be an achievement. That’s … [Read more...]

Making Preparations and Taking Action in Today’s Deflationary Environment

Editor’s Note: In the following article Robert Prechter shows you how to prepare for a deflation. By Robert Prechter, CMT The ultimate effect of deflation is to reduce the supply of money and credit. Your goal is to make sure that it doesn’t reduce the supply of your money and credit. The ultimate effect of depression is financial ruin. Your goal is to make sure that it doesn’t ruin you. Many investment advisors speak as if making money by investing is easy. It’s not. What’s easy is losing money, which is exactly what most investors do. They might make money for a while, but they lose eventually. Just keeping what you have over a lifetime of investing can be an achievement. That’s … [Read more...]