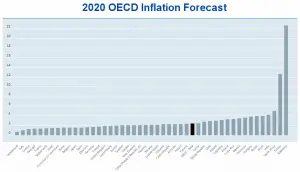

While inflation has been low in most developed countries over the last decade, there are places where it is starting to pick back up, with stronger growth outlooks for several major economies. As we can see from the chart below the OECD is projecting massive inflation in 2020 for both Turkey and Argentina at 12.6% and 22.7% respectively. The average of all OECD countries is a low 2.4%. The OECD Inflation projection for the European Union (EU) is also surprisingly low. Who would have thought that countries like Italy, Spain and Portugal could maintain such low inflation rates, with the highest being Hungary at 3.8%. Back in June 2019, the Telegraph published an article about how the … [Read more...]

Why Does China Want to Lower the Value of Its Currency?

The U.S. Labels China a Currency Manipulator On August 5th, 2019, the U.S. Department of the Treasury designated China as a 'currency manipulator'. China has been on the U.S.'s watch list for quite some time. The U.S. believes that China "engaged in persistent one-sided intervention in the foreign exchange market". So the U.S. is requesting that the International Monetary Fund (IMF) "eliminate the unfair competitive advantage created by China's actions". Why would China want to keep the value of its currency artificially low? How Currency Exchange Rates Affect Businesses Currencies are constantly changing in value against other currencies. This is based on a variety of factors … [Read more...]

How International Inflation and Currency Fluctuations Affect Todays Businesses

With the current low levels of inflation in developed countries, most consumers and even small business owners are largely unaware and unconcerned with the issue of inflation and currency fluctuation. With most currencies more stable than ever in the 21st century, fears of wild inflation seem to be limited only to developing nations and the distant past. However, even small changes in a currencies value can have a ripple effect that causes massive changes in all businesses across the world. Oil the World Over The most readily apparent example of this is in the case of petroleum. For various historical and political reasons, all petroleum in the world today is traded on a dollar-per-barrel … [Read more...]

Is Gold Backwardation Now Permanent?

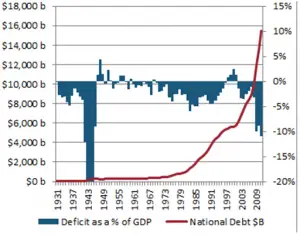

Its Weight in Gold: The Real Prices of Things By Keith Weiner, Casey Research Worldwide, an incredible tower of debt has been under construction since President Nixon's 1971 default on the gold obligations of the US government. His decree severed the redeemability of the dollar for gold and thus eliminated the extinguisher of debt. Debt has been growing exponentially everywhere since then. Debt is backed with debt, based on debt, dependent on debt and leveraged with yet more debt. For example, today it is possible to buy a bond (i.e., lend money) on margin (i.e., with borrowed money). The time is now fast approaching when all debt will be defaulted on. In our perverse monetary system, … [Read more...]

Rick Rule: “Bet against the dollar as a store of value”

In this excerpt from the Casey Summit When Money Dies, seasoned resource investor/broker Rick Rule discusses risk management and explains why the greatest risk you face as an investor is located to the left of your right ear and to the right of your left ear. Listen to Rick's complete summit speech – plus those of nearly 30 other renowned financial experts – from the comfort of your home. More than 20 hours of audio recordings on CD or MP3, including the experts’ top stock picks. Learn more. … [Read more...]

Is the US Monetary System on the Verge of Collapse?

By David Galland, Casey Research Tune into CNBC or click onto any of the dozens of mainstream financial news sites, and you’ll find an endless array of opinions on the latest wiggle in equity, bond and commodities markets. As often as not, you'll find those opinions nestled side by side with authoritative analysis on the outlook for the economy, complete with the author’s carefully studied judgment on the best way forward. Lost in all the noise, however, is any recognition that the US monetary system – and by extension, that of much of the developed world – may very well be on the verge of collapse. Falling back on metaphor, while the world’s many financial experts and economists sit … [Read more...]

Currency Strength Can Sap Returns

The following article by Lynn Carpenter shows an interesting correlation between currency appreciation (or depreciation) and stock market returns. London is a money town. It has been the center of the whole Western world’s currency transactions for three centuries. Until 1945, the British pound sterling was the world’s primary reserve currency. The pound is less popular than the dollar or euro now. But whatever currency is king, London is likely to bank it, trade it and exchange it. London bankers and brokers were old in the business when the New York Stock Exchange was born under a buttonwood tree on Wall Street. London bankers and fund managers were master investors when U.S. stock … [Read more...]

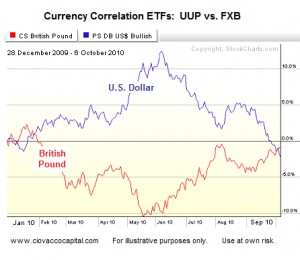

Pressures Mount on Bank of England (BOE) to Devalue Pound

October 7, 2010 By Chris Ciovacco The Bank of England (BOE) is due to make a statement today at noon in London (7:00 a.m. ET U.S.). The BOE’s actions in the next 45 days may be important to investors in the U.S. and global commodity markets. All things being equal, a weak U.S. dollar tends to provide favorable headwinds to both U.S. stocks and commodities, such as oil (USL), copper (JJC), gold (GLD), and silver (SLV). With the BOE facing more bad news on the housing front today, political pressures to join the money-printing parties in the United States and Japan are mounting. As shown below, the U.S. Dollar (UUP) and British Pound (FXB) tend to be negatively correlated. Should the … [Read more...]