Position Yourself for the Rest of "Conquer the Crash" The earlier you prepare, the better To this day, I wonder why Robert Prechter's book Conquer the Crash has not been more widely recognized. It described in advance much of what happened in the 2008 financial crisis. Published in 2002, the book provided detailed descriptions of then-future economic scenarios. They were detailed vs. general. Prechter was specific in a way that would prove right or wrong; there was no gray. This is from the book: There are five major conditions in place at many banks that pose a danger: (1) low liquidity levels, (2) dangerous exposure to leveraged derivatives, (3) the optimistic safety ratings of … [Read more...]

How to Speculate your Way to Success

Everybody Forced to Speculate? According to an interview with Doug Casey, "Everybody is going to be almost forced to be a speculator to try to stay in the same place. Speculating means capitalizing on politically caused distortions in the marketplace." ~editorHow to Speculate your Way to Success Source: JT Long of The Gold Report (4/20/12) So far, 2012 has been a banner year for the stock market, which recently closed the books on its best first quarter in 14 years. But Casey Research Chairman Doug Casey insists that time is running out on the ticking time bombs. Next week when Casey Research's spring summit gets underway, Casey will open the first general session addressing the … [Read more...]

What All Major Depressions Have in Common

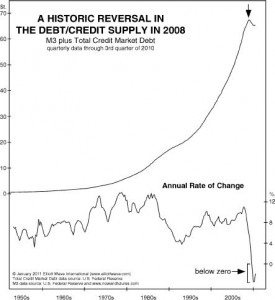

Signs of deflation are visible but the public will be fooled Deflation requires a precondition: a major societal buildup in the extension of credit (and its flip side, the assumption of debt). -- Conquer the Crash, 2nd edition (p. 88)Has the United States met that precondition? Well, consider that total credit market debt as a percent of U.S. gross domestic product was 280 percent in 1929 at the start of the Great Depression 380 percent in 2008 The current build-up of credit goes far beyond major -- it's unprecedented. It's been rising steadily for 60 years. The slope literally looks like the side of a steep mountain. Bank credit and Elliott wave expert Hamilton Bolton … [Read more...]

America’s First Deflationary Depression: Is a Bigger One Ahead?

Social psychology precipitates economic depressions Don't blame Martin Van Buren for America's first deflationary depression. Social mood rode higher in the saddle than did our 8th President, who only stood 5' 6". Elected in 1836, by the time Van Buren assumed office in March 1837 a speculative bubble had burst and a banking crisis was at hand (sound familiar?) -- the national mood had turned south and the "Panic of 1837" followed. Van Buren was known as "The Little Magician," but he could not pull an economic recovery out of the hat. He met defeat seeking a second term. America's first deflationary depression lasted until 1842. Van Buren blamed over-zealous business practices and a … [Read more...]

Markets Fear Deflation

The best way to know the future is to survey millions of people and analyze their responses. That is exactly what the market does every day. And even better Mr. Market knows not only what people say they believe but where they are putting their money as well. In the following article Chris Ciovacco, the Chief Investment Officer for Ciovacco Capital Management shows us how the markets view the current possibility of deflation. Chris has an amazingly simple chart that shows us exactly what the market is thinking right now. That chart is the ratio of Treasuries to Treasury Inflation-Protected Securities (TIPS). Currently the ratio is indicating a deflationary bias in the market. When you think … [Read more...]

It’s All the Same Market in a Deflationary Environment

On September 22, the Dow and S&P opened down over 2.5%. Oil was down, copper was down, and even GOLD was down sharply. Watch this video excerpt from Robert Prechter's special video issue of the August Elliott Wave Theorist where he explains what is causing diverse markets such as these to move together in today's environment. Free Report: Stocks -- Buying Opportunity or Another "Free Fall" Ahead?Find out what these market moves mean to your investments with current analysis from Elliott Wave International. Bob Prechter has just released a FREE report -- with urgent analysis from his August and September 2011 Elliott Wave Theorist market letters, including another video … [Read more...]

Is a Stock Market Crash Inflationary or Deflationary?

Recently a subscriber asked me the question above, he gave quite correct arguments about how the stock market is "a zero sum game" in other words for every buyer there is a seller, so overall everything should stay in balance. But as I'm sure you know there are at least 3 ways to measure money supply M1, M2 and M3. Each one includes increasingly broad definitions. From just cash equivalents up to including all sorts of time deposits and Government debts. But what they don't include is stock valuations, however if the price of your stocks increases you feel richer and are more likely to spend money from your other accounts because you know if you need the money you can always sell your … [Read more...]

How Wealth Can Simply Evaporate

In the following article Bob Stokes of Elliottwave explains why in times of credit expansion money is created out of thin air and in times of credit contraction money can simply disappear... no matter how much the government prints out of thin air. This results in a negative "money multiplier" as more money disappears than is created. See my article on Velocity of Money and the Money Multiplier for more information.~Tim McMahon, Editor Evaporation of Wealth on a Vast Scale How $1-million can disappear By Bob Stokes The bursting of the "debt bubble" which started in 2008 is far from over. It's the financial story of our age and it's happening before our eyes. The full scope is hard to … [Read more...]

Does Deflation Remain a Threat?

From physics we learn that every action has an equal and opposite reaction. From nature we see the pendulum swing to its farthest extreme and then return an equal distance in the opposite direction. Even children know the saying , "what goes up, must come down". But those laws of nature don't apply to debt and credit inflation do they? Can debt creation can go on forever? In this article the editors of Elliottwave International look at the largest credit inflation in history and where it is going now. Will it eventually result in a massive deflation? ~ Tim McMahon, editor A 90-Page "Deflation Survival Guide" Gives the Answer By Elliott Wave International "Every excess causes a … [Read more...]

Escaping the Great Depression – and Extending the Greater Depression

By Doug Casey, The Casey Report Here at Casey Research, our view of the Great Depression of the 1930s is a little different from that of most people. In our eyes, Franklin Roosevelt wasn’t a hero, he was a villain. Nearly everything he did served to extend and deepen the economic downturn. With the exception of supporting the 21st Amendment for the repeal of Prohibition, Roosevelt’s involvement in the economy was an unmitigated disaster. But in popular memory, that failure is obscured by U.S. success in WW2, over which Roosevelt presided. Today, unfortunately, Obama and his minions are taking Roosevelt as a model and are straining to repeat his mistakes. Because the distortions in … [Read more...]