Inflation and Savings When the average person thinks about inflation, the first thing that comes to mind an increase in the Cost of Living i.e. that items they purchase regularly keep getting more and more expensive. While this is true, an even greater concern regarding inflation is its impact on savings and financial planning. Inflation Hurts Savings Buying Power Inflation hurts consumer buying power, because increased costs mean spending more to purchase the same items. What you put into a savings account today, at current interest rates (which are approximately 1% APR at the time of this writing), will only buy half as much in 20 years as it does now if you figure the inflation … [Read more...]

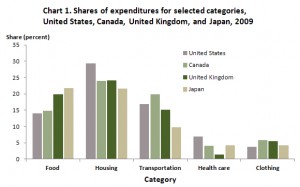

Cost of Living: How Much of Your Budget Goes to Food?

Cost of Living: Food Knowing what percentage of our cost of living is spent on food is always a good thing to know. We recently published an article by Lynn Carpenter on her Cost of Living- Real Basket of Goods in it she compares the cost of several ordinary food items over the decades. Her weekend meal basket included "one loaf of bread, one pound of coffee, one dozen eggs, three pounds of mid-price beef, one box of Corn Flakes or Cheerios, five pounds of potatoes and one Hershey bar." In this article she determined that over the years a minimum wage earner would have to work 9.25 hours in 1938 to buy this food. But by 1961 a minimum wage earner only had to work 3.75 hours to buy the same … [Read more...]

How Inflation Affects Personal Debt Consolidation

What is the effect of inflation? As a result of inflation, the value of tomorrow’s money decreases with regards to today’s money. In other words, you can purchase less with the same amount of money. This is commonly seen as prices having increased. This can make the situation appear more appealing for borrowers because they can buy today and pay back with less valuable dollars. But lenders and creditors don't appreciate receiving less valuable dollars. So, in order to offset the declining value lenders and creditors increase the interest rates they charge. Thus inflation in general results in increased financial problems all around. It not only results in rising commodity prices but … [Read more...]

How Does Inflation Affect You?

When people go the the grocery store and see ever higher prices they know how inflation affects them. But when they are feeling more philosophical they might reason that if all wages and prices increased at the same rate it would all balance out in the end right? Well theoretically yes but in reality it never works that way. Prices of various items all increase at different rates so some people are benefiting while others suffer. Those on fixed incomes suffer the most because the cost of things they are buying increases but their income stays the same. This is where COLA or "Cost Of Living Allowance" comes in it is an adjustment that is made to compensate for the increase in prices due … [Read more...]

Can You Really Get a Free Credit Report?

Anyone who has surfed the web long enough has probably seen offers for "Free Credit Reports" but when you go there you usually find that it is just a scam that requires you to register or buy something first. Well, I recently found the one true source of free credit reports and actually was able to verify it with the Federal Trade Commission! I strongly recommend that before you sign up for any free credit report that you check it with the FTC. (See the end of this article for a link to the FTC). -- editorIn the United States, there are three main credit reporting companies they are Equifax, Experian, and Trans Union. They are strictly monitored by the Federal Government and are required … [Read more...]

The Real Basket of Goods

I recently received the following from Ed Devol, "When I try to educate people about the impact of inflation, I find putting it in terms of time worked for something is a good way of explaining inflation". Thanks, Ed. I agree, when I am deciding whether to purchase something, I like to think of it in terms of how many hours I have to work to buy it. (It helps keep it "real"). In addition economists often link how many hours the average person has to work to eat. A poor country might require eight hours of work a day just to eat. While a rich country might require only 1 hour a day. So you might like the following article by Lynn Carpenter as she tracks prices and earnings over the last 60 … [Read more...]

How to Calculate the Social Security Cost of Living Adjustment

How Does The Government Calculate the Cost of Living Adjustment (COLA) on your retirement benefits like Social Security? I recently received the following question from Jerry: What formula does the government uses to figure out COLA based on inflation for retired people each year? That is a great question! Social Security benefits are indexed for inflation to protect beneficiaries from the loss of purchasing power due to inflation. The government uses a complex averaging system to take the average CPI index for the 3rd quarter of the previous year versus the average CPI index for the current year and calculate the inflation rate based on that. Cost of Living adjustments are … [Read more...]

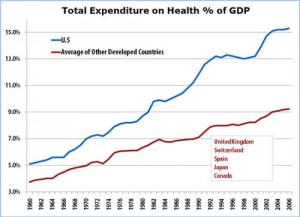

Healthcare Is Killing America

by Bud Conrad, Editor, The Casey Report Healthcare is the biggest segment of our economy. In the debate over who should pay for what or, increasingly, for whom, most people don't stop to understand just how large a portion of our society's money is dedicated to healthcare. For some perspective, as a share of GDP, the U.S. spends about twice that of other advanced nations. This is an important reason why the U.S. is increasingly uncompetitive in global manufacturing. It is, for instance, the most important factor (besides poor management) that General Motors and Chrysler are going bankrupt. Going forward, the situation is guaranteed to get worse. The Obama administration is committed … [Read more...]

Cheaper Fuel (Gas) Prices Ahead

By Andrew Gordon The stimulus package has come and gone. And retail sales are once again feeling the pinch. So, should the government put together a second package for exhausted consumers? After all, if the government can afford to throw $300 billion at Freddie and Fannie, certainly the government can spend another $145 billion to boost spending going into the holidays, right? But with gas prices going down, maybe we don’t need another stimulus package. I was asked yesterday by CNBC if lower gas prices would help spending and boost the economy. I said it wouldn’t help much. A quick look at the numbers might suggest otherwise. After all, every penny increase for a gallon of gas … [Read more...]

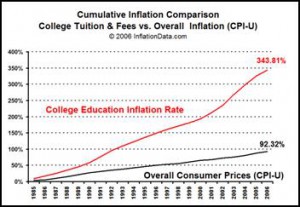

8 Steps to Cut Education Costs

By Gordon H. Wadsworth Economists predict the cost of attending state colleges will soar to $120,000 by 2015. How can you cut those costs? The following steps can help students and parents avoid the student loan nightmare: STEP ONE: The time to take advantage of available college monies starts in the 7th or 8th grade. Parents should begin preparing their students for college by encouraging them to take the SAT or ACT along with a test prep class to bolster results. With proper direction, even the average student can score well on the national achievement tests and secure a place in line for merit scholarships and grants. Check out the Princeton Review web site at Practice Test or … [Read more...]