Updated 12/11/2021

I frequently receive this question in one form or another: Why doesn’t the government consider food and energy and just tracks core inflation?

The core inflation rate is frequently quoted in the popular press, and this gives the general public the impression that the “government” doesn’t care about (or track) the rise in the prices of food and energy.

Actually, this isn’t true. The core inflation rate is simply a component of the overall inflation rate. Economists use it because seasonal factors often skew the inflation rate.

For instance, a drought might cause fruit crops to fail, causing fruit prices to rise. But this rise actually has nothing to do with inflation (i.e., price inflation caused by an increase in the money supply). It is simply a result of the forces of nature.

Another example of forces of nature causing price increases is when a hurricane causes refineries or drilling rigs to shut down. This might cause a temporary decrease in oil supply, and if supplies are tight, it could result in a temporary increase in oil prices.

Economists want to eliminate this volatility from their calculations, and so they use the “core” inflation rate to eliminate the two most volatile components from the calculation.

And so, for some reason, when “cub” reporters are assigned to report on inflation, they choose the “core” since it sounds cool or something, and people get the idea that the government has stopped tracking the entire range of goods and is only tracking the “core” inflation rate.

But I can assure you that the Bureau of Labor Statistics is still tracking about 10,000 different items every month. It publishes this information as the CPI-U or Consumer Price Index for all Urban Consumers. This is used in calculating what is commonly called the “Inflation Rate“.

This number pertains more to the average consumer because it more closely resembles what you might spend. As you might guess, since it includes 10,000 different items, some of them are food, and some are energy. It also includes clothing, beverages, rent, recreation, medical care, and even some strange things like bedroom furniture, college tuition, postage, telephone services, and computer software.

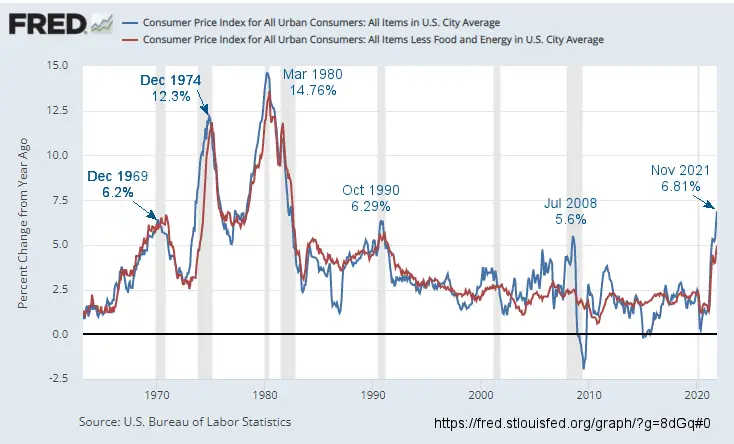

This chart from the St. Louis FED shows both the Core CPI and the Full CPI, so you can see how they compare. You can see that the CPI with Food and Energy (blue line) has been much more volatile in recent years than the Core CPI (red line), but food and energy are still major components of the CPI.

Component Weighting

Obviously, you aren’t going to buy bedroom furniture and computer software every month, so your individual inflation rate will be somewhat different from the one the government calculated. Still, the numbers are weighted based on how often the average consumer buys these items. So at least you can rest easy knowing that the two things that everyone needs (food and energy) have been included and are weighted much more heavily in the final calculation than bedroom furniture. The BLS Consumer Price Index released every month includes the current weighting of each component. For instance, in November 2021 the BLS calculated that food comprised 13.995% of the average household’s budget. They further calculated that 7.733% was Food at home and 6.262% was food away from home. Energy comprised 7.469% of the average household’s budget and Shelter was 32.425%.

You might also like:

- What is inflation?

- Inflation vs CPI

- What is Deflation

- What is Disinflation

- What is Stagflation

- What is Hyperinflation

- BLS Consumer Price Index

an idea for the economists or gov’t reporters –publish food and energy inflation prices separately and do a comparison what has happened over the last 3-4 years and it will be a wake up call to the public. hiding the food and energy pprices allows the corporate fat cats to raise prices hidden from the truth to the public and get away with price goughing and critisiisim they deserve. ps it should be said over and over many times.

The Government does publish it separately (and together) and all the various components, and seasonally adjusted and unadjusted. It is available here:

https://www.bls.gov/news.release/cpi.t01.htm

I would think with the advent of AI and super computers the only challenge is inputting the data to include energy and food. So why don’t they? I’m retired and the last 3 years has hurt.

Tom,

They don’t need AI they’ve been tracking inflation with and without food and energy for decades. “Core Inflation” is just one of the many ways they slice and dice the inflation numbers to give a different picture (like viewing it from a different angle). It is primarily used by economists to remove the more volatile components so they can see the effect money printing is having on the economy without things like weather and Arabs skewing the numbers.

In reality, food and fuel were removed to HIDE or camouflage government ineptness!

yes and to hide price goughing by corporate AMERICA.

Interesting article, but the REALITY is that those prices do impact purchasing power and so they should be included. If things go back to “normal” the next year it will be reflected in that years inflation statistic.

Reality and economists shouldn’t be used in the same sentence. Economists like to slice and dice reality to generate a certain picture. In this case, by removing food and energy from the equation they can get a picture of what effect government policies regarding the money supply are having on the cost of goods without outside factors like weather and OPEC. Does that mean that it is the whole picture? No, it is a slice of the whole picture but that was what they were looking for… a slice of the whole picture. To get the whole picture you have to take that slice and all the other slices and put them back together. It’s like a person who goes to the doctor with several different ailments and the doctor sends him to a foot specialist. That specialist isn’t going to solve the whole problem but he never intended to either. But he is going to get a better picture of the foot problem.

This article is so enlightening. Now I understand the reasons why food and energy are not included in calculation of the core inflation rate. It is interesting that this article was published in 2008, but so relevant today. It seems that inflation is and will be the most concerned topic now and in the years to come.

Thanks for the explanation Tim. I believe I understand what you are saying but I agree with one commenter who said the government uses the core inflation rate (not just cub reporters) to deceive the public. Of course we need to take into account that much of the media is an arm of the democrat party so reporting depends more on agenda than truth.

We’ll all be watching to see if the “core” doesn’t exceed the predicted 2% in 2021. With the massive infusion into the money supply I don’t see how that’s possible. I do know that lumber and steel have risen dramatically in the last year and fuel prices are way up since the the new admin has taken control. The CPI-u appears to be showing that but I don’t believe the media is widely reporting it.

Very rapidly this site will be famous among all blog viewers, due

to it’s good posts

Très bon article. J’aime énormément votre site

This is all one big joke.

Governments do this so they can keep interest rates low, so they don’t have to pay a higher inflation wages to retirees, pensioners.

They think the people are stupid there is no inflation it’s called super hyper inflation that we have right now

Although the actual inflation rate that you see may be higher than what the government claims, it is far from hyper-inflation. During a hyperinflation you would see prices increasing at least 1% a month. Simply by looking at the price of gasoline we can see that prices are not increasing by 1% a month. According to AAA the average price of gasoline throughout the entire US in July 2015 was $2.763. So if prices increased by even 10% since last year the price of a gallon of gas would be at least $2.75 + 0.27 or $3.02 but instead gasoline was $2.22 in July 2016. This is not a sign of hyperinflation.

Here in eastern TN, last year going out to eat a fast food lunch has increased form four dollars to five dollars, up 25% in one year. My favorite buffet increased from 8 dollars to 10 dollars which is also a 25 % increase. Gas prices are also up 25%. Last year I could buy the common saltine cracker for 98 cents a box. This year that same box is a dollar and fifty nine cents. That is a 61.6 percent increase in a year.

What was the governments official inflation rate for last again?

Flash,

I get this question quite regularly so I wrote a post about it back in 2012. Called “Can We Trust Government Inflation Numbers“

Buying food isnt included…Go figure. And oil prices? That is despite varying factors that may increase of decrease price…

You obviously didn’t read the article. Core inflation is calculated without Food and energy for good reason but it isn’t because it reflects real consumer’s spending. Food and energy are volatile based on other factors other than FED money printing. The Core Inflation more accurately shows FED activity. If you are interested in what’s actually happening to Consumers look at the Consumer Price Index for all Urban Consumers (CPI-U) which DOES include Food and Energy. Or you can look at one of the other indices such as the CPI-W.

There is no good reason to exclude Food and Energy. Doing this gives an improper view of the financial reality facing the majority of Americans. The majority of the populations income is spent on Rent, Food, Energy, and Transportation. If you remove even a portion of any of the necessities than you are misrepresenting the true cost of living. If inflation was not used to determine wages and cost of living than it would not matter but it is in many cases and therefore it is essentially immoral to do so.

Actually there is a very good reason to exclude them if you are an economist. They are the two most volatile components and are often affected by temporary outside forces like weather and other government actions. If you are trying to measure the effect of monetary stimulus by the FED they can mask the effects. However, an ordinary person only concerned with the effects on your own pocket then yes that number doesn’t apply to you. So don’t worry no one uses this number to determine your Cost of Living.

I am Sorry Tim, The government only Talks about CPI to the public. They use this index to incorrectly calculate the amount it will pay to Pensioners. Its intentionally done, otherwise they would use CPI-W. Empirically stating Food has increased around 30% in the last few years. It is among the largest cost for a family. Weather is always inconstant. But Taken on a world economic scale, food is produced all over the world so that bad weather in one place does not necessarily mean anymore that there will be large scale run ups and down in food cost.

As for oil, At one point we all though that we were at point of PEAKED OIL. But someone discovered Fracking and we find oil prices settling around $50 a barrel. It is now so abundant, that it will provide stable oil price for an extended period. The USA has alone, has enough energy to supply the rest of the world until Fusion will be in full production, in 10 to 15 years. Just as our next small ice age starts.. Its only the uneducated government who have no working knowledge about about how weather form. Its only the particulates that are a problem.

In short I am saying that the points you say about stable core prices, is no longer factual as so many factors have changed to the point that they do not accurately reflect core cost. My premise is that 5 years ago you would be right, but now too things have changed significantly.

I think that you should build a new model, feed in the current information variables, and then see if those values have changed.

Our biggest economic problem is the government. Its their policy’s that change all factors.

I am not an economist. I am an educated consumer. Food and energy price increases except for the current lull in gasoline prices have accellerated far greater than the published CPI. Furniture stores for example frequently have 1/2 off on everything in the store. When was the last time you saw a super market w/50% reduction of prices on everything in the store?

So what you’re saying is that the economist are lazy and don’t want to do their jobs if they change every hour then you change the numbers every hour I have things on my job that change and makes more work for me but I don’t say leave it out

No! that is not what I am saying at all. What I am saying is that there are different ways to look at things. Sometimes you want to look at the forest and sometimes you want to look at only pine trees. So they calculate the whole index (the forest) and they calculate all the individual components (Pine trees, Oak Trees, Apple Trees, etc. ). And sometimes they want to look at the effect of 2 trees (food and energy) and sometimes you want to look at all the trees except food and energy. This is more work to calculate all the different combinations not less.

Gee Tim – I’m so confused – Did you read your article? First you say food and gas are in the cpi then you say they aren’t but go to the CPI-U to get food and gas into the proper CPI equation which is one affector to inflation but then you say it’s not – that only a change in the money supply causes inflation.

You should be a politician Tim.

Zeke,

Sorry you’re so confused. Perhaps it’s because you are mixing your terms. CPI=Consumer Price Index which includes all 10,000 items. Core Inflation is a subset of CPI that excludes Food and Energy so Economists can track the items that inflate due to Monetary influences (printing money) rather than outside influences i.e. OPEC and Weather which tend to make Oil and Food more volatile. Hope this helps clear up your confusion.

If the government wanted to really figure the Social Security inflation rate correctly for seniors they would ONLY include the major expenses for seniors; namely the cost of food, eating out, transportation, rent, healthcare, yard maintenance, and insurance which have all gone up in price at least twice as fast as the governments CPI. Sampling across the whole United States would minimize any spot shortage bias caused by storms etc. and if the shortage is bad enough to affect the whole country, then the cost increase should definitely be included in the calculation instead of being dropped as has been the practice going all the way back to the Reagan Administration that chose to drop oil, food, and housing from their calculations because “they have too much volatility in their price”. The oil cartel caused the price of oil to skyrocket and mortgage rates to go thru the roof due to the treasury setting rates high to encourage the oil catrtel countries to invest their money back into US by their buying treasuries and to keep our government from going broke but seniors and everyone else had to pay those higher prices for oil, housing, and food. To elimate them was nothing more than a sham.

Actually, the government is experimenting with a Consumer Price Index for the elderly called the CPI-e unfortunately it is still in the experimental stages (and has been for a very long time). I mention it in our article on Cost of Living Adjustments COLAs I agree that it would be great if they calculated SS increases based on that rather than the CPI-U or CPI-W, especially since the CPI-e is higher than the regular CPI-U in most years. The major factor is that Seniors tend to spend more on Healthcare and so the CPI-e weights Healthcare higher than the CPI-U or CPI-W does. But as I said in this article, contrary to common belief, the Social Security COLAs calculations are based on the CPI-W which DOES include Gasoline, Food, Fast Food, housing, and everything else, it is just that the weighting is based on the average Urban Worker. Not rural people, not Senior Citizens, not Military Personnel they will all have slightly different inflation rates based on their personal consumption habits. It is a poor choice for the index to use but it is what it is.