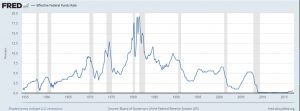

For new home buyers, anything that increases the cost of the purchase (like rising mortgage interest rates) can negatively impact your ability to be able to afford your home. That is why everyone is concerned when the Federal Reserve (i.e. the FED) raises interest rates. The following chart shows how the Fed Funds Rate has performed from January 2015 through July 2019. The FED lowered the FED Funds rate to near zero in response to the market crash in 2008-2009. It kept it there until January 2016 when it began gradually raising rates. However, at their July end meeting, they decided to lower interest rates, reducing the federal funds rate target by 25 basis points, to a range of 2% to 2.25%. … [Read more...]

How Much Has Inflation Affected Mortgage Rates in the Last 5 Years?

In some ways, mortgage rates are a reflection of the overall health of the American economy. As we can see in the chart below from "FreddieMac", often both mortgage rates and inflation rates peak during recessions and tend to fall or are stable during better times. How has inflation impacted mortgage rates recently? The FED Rate According to the St. Louis FED website: "The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with … [Read more...]