The media and the Central Bank (i.e. The U.S. Federal Reserve aka. the "FED") tells us that a little bit of inflation is a good thing. Inflation gets the ball rolling, greases the wheels of commerce, and stimulates the economy. The FED sets as a goal 2% inflation, so inflation must be good for us, right? Two Forms of Inflation Well, it is good for someone but not necessarily for you i.e. the consumer. The first problem comes because there are two different types of “inflation” and by interchanging them we end up with a form of Orwellian “double-speak”. The first kind of inflation is “monetary inflation” i.e. an increase in the overall money supply. This is accomplished by a complex process … [Read more...]

Effect of Inflation on Bonds Part 2

Effect of Inflation on Bonds While inflation has hardly taken center stage among our economic woes of late, there are some credible voices in economics who are already warning of its dangers down the road. Since the FED has already locked itself into rock-bottom interest rates for the foreseeable future, if the economy does not surprise us with a great rebound in the next few years the Fed will have to resort to its one remaining tool, i.e. an expansionary monetary policy, adopting more aggressive quantitative easing, debt monetizing, and other stimulating (but also inflationary) measures. In short, the FED will have to print more money. At that time, the threat of inflation will be real … [Read more...]

The Effects of Quantitative Easing

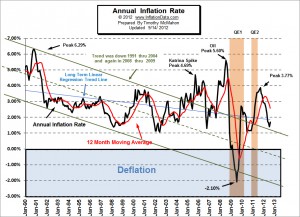

Quantitative Easing Effects- You have probably heard that the massive inflation of the money supply through Quantitative Easing is going to result in hyperinflation or at least massive inflation. But so far that hasn't happened. As a matter of fact since the end of QE2 in June of 2011 inflation rates have fallen from 3.63% in July 2011 to 1.41% in July 2012. How is that possible? The first reason is that the FED is playing a game with the banks. The FED loans money to the Banks at nearly Zero percent interest the Banks turn around and loan the money to the Government at 3% interest to finance the deficit. This gives the banks plenty of profit to shore up their sagging balance sheets. But … [Read more...]