Earlier this month, the internet was flooded with reports, stating that the “50-year petrodollar agreement” between the United States and Saudi Arabia had expired and that the petrodollar was now dead. Over the years we've written on the PetroDollar on several occasions. But this time, just as in the case of Mark Twain, "the Death of the PetroDollar has been greatly exaggerated". Ten years ago, we published an article entitled Oil, Petrodollars and Gold. In that article, I showed how the demonetizing of gold eventually led to Henry Kissinger making a deal in 1973 with Saudi Arabia to denominate all their oil sales in U.S. Dollars in exchange for the Kingdom receiving U.S. military … [Read more...]

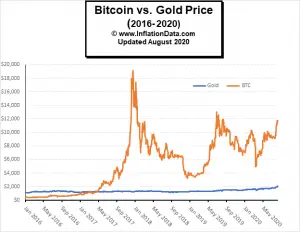

Gold vs. Dollar vs. BitCoin Revisited

Back in 2016, we compared the properties of three types of currency, i.e. Gold, Dollars (Cash), and Bitcoin. Today we'd like to look at how each has fared since then. Back then, we said that there are 10 factors that make up a good store of value. They are: 1. Scarcity- For something to be considered valuable it can’t be too readily available. 2. Fungibility- Things have to be equal. Rare paintings aren’t fungible a Picasso isn’t exactly the same as a Monet. As a matter of fact, one Picasso isn’t even the same as another Picasso. Artwork isn’t fungible. One dollar bill is pretty much the same as another, one ounce of 24 karat gold is the same as another, one bitcoin is the same as … [Read more...]

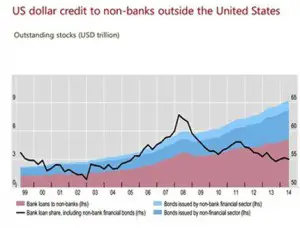

Could a Strong Dollar Actually Cause Problems?

It seems that there is the possibility for danger no matter which way the economy goes. You would think that a strong dollar would be a good thing... after-all it allows us to buy things more cheaply on the global market. If our money goes further we are richer, oil is cheaper, imports cost less, etc. But the flip side is that our products are more expensive on the world market and so we export less. In today's article we look at the inherent risks of a strong dollar. ~Tim McMahon, editor. Outside the Box: How the Rising Dollar Could Trigger the Next Global Financial Crisis By John Mauldin This week’s Outside the Box continues with a theme that I and my colleague Worth Wray have been … [Read more...]

Rick Rule: “Bet against the dollar as a store of value”

In this excerpt from the Casey Summit When Money Dies, seasoned resource investor/broker Rick Rule discusses risk management and explains why the greatest risk you face as an investor is located to the left of your right ear and to the right of your left ear. Listen to Rick's complete summit speech – plus those of nearly 30 other renowned financial experts – from the comfort of your home. More than 20 hours of audio recordings on CD or MP3, including the experts’ top stock picks. Learn more. … [Read more...]

If the Dollar Goes, What Happens to Your Portfolio?

By Jeff Clark, BIG GOLD Have you considered what will happen to your portfolio and all the other areas of your life if the dollar fails? The ramifications will be widespread, painful, and inescapable if you’re not properly diversified. Last month, I attended the Global Currency Expo sponsored by EverBank®. The overarching theme, as you might expect, was that diversification out of one's home currency is paramount. While there were plenty of traders on hand, it was the big-picture talks that had the most pressing messages. I came away feeling that I needed to reexamine my exposure to the dollar. Have you considered what will happen to your portfolio?and all the other areas of your … [Read more...]

Uncle Scam

by David Galland, Partner, Casey ResearchThe latest data on global gold trends, Q2 2010, just popped into my email box from the World Gold Council. The bad news is that the higher nominal price of gold has caused a 5% decrease in jewelry sales over the prior year. If you’re thinking “Hey, that’s not that bad!”, you’d be right. On this date last year, gold closed at $950… which is $286 below where it trades as I write. In other words, a 30% rise in price has resulted in a decrease of just 5% in jewelry sales. And even that number is skewed, because the currency value of the gold purchased is up – way up. For example, India – the 800-pound gorilla in the global gold jewelry market – … [Read more...]

How does the “Falling Dollar” and the exchange rate affect Inflation?

With all the recent talk about the "falling dollar" will that affect the inflation rate? Let's start with the basics. 1) Price inflation is primarily caused by monetary inflation. In other words as the money supply increases things cost more. See What is Inflation? for a full explanation. 2) The government controls the money supply to a certain extent through tightening or loosening credit. 3) The economy is extremely complex and many other factors come into play. Such as international exchange and the supply and demand for goods and services. At first blush it might appear that the falling dollar would cause deflation because the dollar is going down. But if the dollar is … [Read more...]