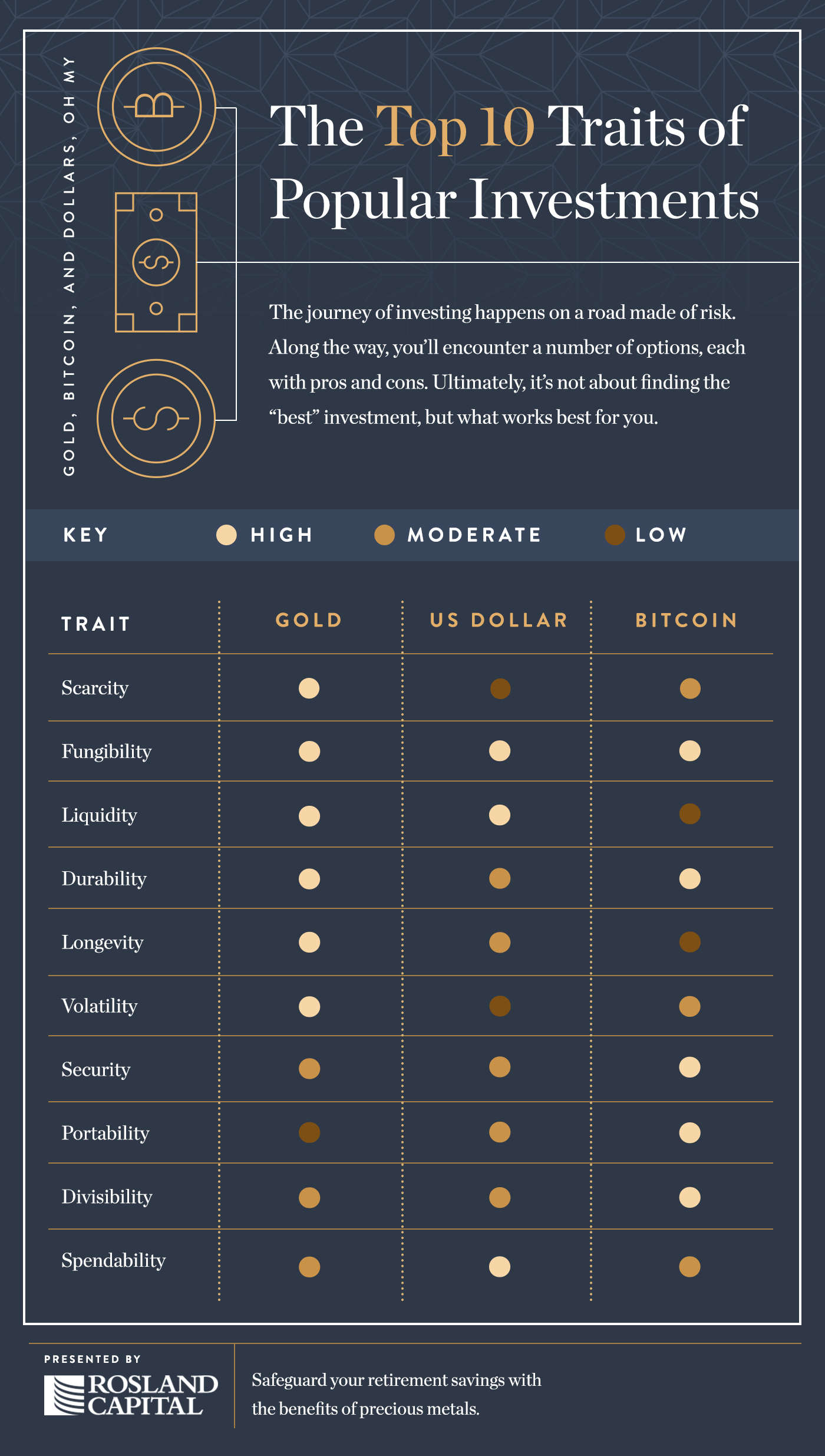

Rosland Capital recently produced an interesting infographic comparing the ten most important traits of an investment or more precisely of a store of value or currency.

They offer physical gold and precious metals backed IRAs as a method to add stability to the mix. Including gold and other precious metals in your portfolio lowers your risk by diversifying from paper assets, thus hedging against the economy and inflation.

The infographic compares Gold, the U.S. Dollar and Bitcoin showing how each ranks for these 10 characteristics on a scale of “High”, “Moderate” or “Low”.

The ten important traits are:

- Scarcity- Being in short supply or rare. This is important because in order for something to be valuable it has to be in relatively short supply. Obviously trying to use sand at the beach or snow in Siberia as a store of value isn’t going to work very well. A good store of value has to be relatively scarce. We all know that price is a function of supply and demand. If the supply is too high the price will go down. Gold is rare because it requires first locating it and then mining which is either equipment or labor intensive. Dollars are only as scarce as the government decides they will be. Bitcoin scarcity is based on a function of the algorithm that created it. The protocol allows for a maximum of 12.5 bitcoins total for all miners (at the time of writing) to be produced every tenth minute, this reward is cut in half at regular intervals, and with this algorithm there will never be more than 21 million coins. To “mine” bitcoins the algorithm requires “proof of work” which requires computing power, internet capacity and electricity.

- Fungibility- The ability to exchange one item for another like item. Since no two paintings are the same (even by the same artist) artwork would rank very low on the fungibility scale. A $20 bill, an ounce of 24 karat pure gold, and a bitcoin are all very fungible since people don’t care which $20 bill, ounce of gold or bitcoin they get.

- Liquidity- How willing are other people to accept it as payment? Once again artwork and real estate rank very low on the liquidity scale since it takes time to find the right buyer for them. Widely traded stocks are fairly high on the liquidity scale while “thinly traded” stocks are less liquid. Cash is the most liquid since you can go anywhere and spend it, gold and bitcoins are less liquid since you need to find a seller willing to accept them or you have to exchange them for cash first. But since there is an established worldwide market for gold it is only slightly less liquid than cash. Bitcoins have a small worldwide footprint so liquidity is lower but they can generally be exchanged for cash rather quickly. However, if you suddenly wanted to sell $1 million in bitcoins it might take a while to sell them all and you could drive the price down in the process.

- Durability- How long does it last? A diamond is very durable and lasts virtually forever. A paper dollar according to the U.S. Federal Reserve only lasts on average 5.8 years. Almost all the gold ever mined is still available so it is very durable. Bitcoins exist only as computer code and that code is backed up millions of times throughout the world so it is considered very durable.

- Longevity- How long something has been alive. In this case longevity refers to how long something has been used as a store of value. Obviously, gold is one of the oldest stores of value and bitcoins are one of the newest.

- Volatility- How rapidly does the value change? During low inflation periods the value of a dollar changes very little, while during periods of hyperinflation it may change daily or even hourly. Low volatility makes for a better store of value. Back when gold was money its value was pegged for many years. From 1880-1914 the U.S. dollar official gold price was $20.67 per ounce, today the price of gold is determined by the market and may fluctuate very little in a given month or may jump (or fall) significantly in a single day. Bitcoin prices are also quite volatile based on market demand. Over the last 12 months bitcoins have traded as low as $220 and as high as $745. So from low to high bitcoins have more than tripled. I would rank that as high volatility not moderate as the chart says. Gold on the other hand had a low of $1046 and a high of $1374 over the last 12 months or a 31% i.e. one tenth the volatility of bitcoin. While over the last year the dollar has inflated less than 1% according to the U.S. Bureau of Labor Statistics.

- Security- How easily can it be stolen? Security is a function of fungibility and liquidity. If an item is highly liquid and one is much like another, if someone gets their hands on it, it isn’t secure. In this sense bitcoin does have some safeguards in place and so Rosland Capital gave bitcoin a bit of an advantage over gold and dollars because of the security protocols built into the transfer. I might disagree a bit with their call on this one because selling gold to a dealer usually requires showing an ID and providing an address. Security also depends on where you keep it. In a safety deposit box? Under the bed? In a storage facility? There has been some question regarding how secure are some of the servers that store bitcoin wallets.

- Portability- How easily can you carry it around? The infographic gives gold a low rating, dollars a medium and bitcoin a high rating.

At first glance that makes sense since gold is heavy, paper is light and bitcoins are weightless and easily moved across borders. But a lot depends on the amount of value you are trying to carry. A single 1 oz gold coin is currently worth around $1350 and is about the size of a silver dollar and obviously weighs 1 troy ounce which is roughly 10% heavier than a regular ounce. So you can easily carry $1300 in your pocket amongst your change. That same value would require 13 $100 bills, 26 $50 bills or 65 $20 bills. Even the hundreds will take up more space than a single gold coin (see picture).

To carry $100,000 in gold will require about 75 gold coins which will easily fit in a woman’s purse and weigh a little over 5 pounds. $100,000 in $100 bills will obviously require 1000 bills. A single bill (no matter the denomination) is 0.0043 inches thick and weighs 1 gram or 1/454th of a pound. So 100 bills are 0.43 inches thick and 1000 of them are 4.3 inches thick (when new) weighing 2.2 pounds. $100,000 in $20 bills would require 5000 of them or a stack almost 2 feet tall weighing about 11 pounds. So gold is less portable than $100 bills but more portable than $20 bills and roughly as portable as $50 bills. - Divisibility- How easy is it to “make change”? In dollars it is easy to divide a $1 bill into 4 quarters or 10 dimes or 100 pennies so it is readily divisible. The problem might come in when you go to the store and they are having a sale 3 pizzas for $10. But you only want one. Rather than paying $3.33 the first pizza will cost you $3.34 since pennies aren’t divisible. Bitcoins on the other hand are almost infinitely divisible down to 1/100,000,000th of a bitcoin which incidentally is called a “satoshi”. Currently 1 bitcoin is worth a little over $600. so you could make change down to $0.000006. During goldrush days panning for gold resulted in gold being found from small flakes to large nuggets, so change was made using a scale.

- Spendability- How easy is it to walk into a store and buy something? Right now you can enter a store in most parts of the world and spend U.S. dollars (acceptability depends primarily on the prevalence of counterfeit dollars in the area) but spending gold or bitcoins in most instances would probably require you going through an intermediary first.

Leave a Reply