By David Galland, Managing Editor, The Casey Report

While everyone else has been focused on the banks’ stress tests and how much government is spending to bail out troubled “too big to fails,” a disturbing trend on the other side of the equation is now emerging: how much (or rather, how little) the U.S. government is receiving in tax revenues.

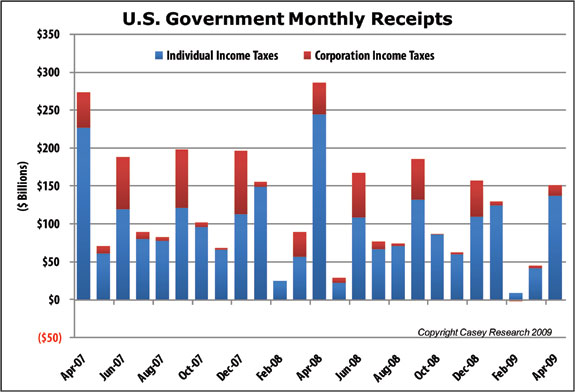

After combing through the past 25 editions of the “Monthly Treasury Statement of Receipts and Outlays of the United States Government,” which is compiled and published by the Treasury Department’s Financial Management Service, we created the following chart.

Here’s what’s going on:

- In 2007 and 2008, government tax revenues averaged about $633.15 billion per quarter. For the first quarter of 2009, however, the numbers just in tell us that tax receipts totaled only about $442.39 billion — a decline of 30%.

- Looking to confirm the trend, we compared the data for April – the big kahuna of tax collection months – to the 2007-2008 average, and found that individual income taxes this year were down more than 40%. The situation is even worse for corporate income taxes, which were down a stunning 67%!

- When you add in all revenue from all sources (including Social Security revenue, government fees, etc.), the fiscal year-to-date – October through April – revenue shortfall comes to 19%, vs. the 14.6% projected in Obama’s budget. If, however, the accelerating shortfall apparent year-to-date, and in April in particular, continues, the spread between projected and actual tax receipts will widen considerably.

Tellingly, for the first time since 1983, the U.S. government posted a deficit in April. That’s a big swing in the wrong direction, as the bump in personal tax collections in April historically results in a big surplus — on average about $68 billion.

What are the implications of this tanking tax revenue?

For starters, it means the federal government deficit is going be as bad or worse than the $2.5 trillion Bud Conrad, chief economist of Casey Research, projected it to be last year.

If the shortfall in individual and corporate tax revenue persists — and we expect it will — then the deep hole the government is already digging for itself will be that much deeper.

Using the government’s own expense projections, the revenue shortfall, even if it doesn’t worsen further, would push the fiscal 2009 budget deficit up to about $1.958 trillion. For reasons we’ve discussed at some length in The Casey Report, those expense projections are likely to be significantly understated.

Leave a Reply