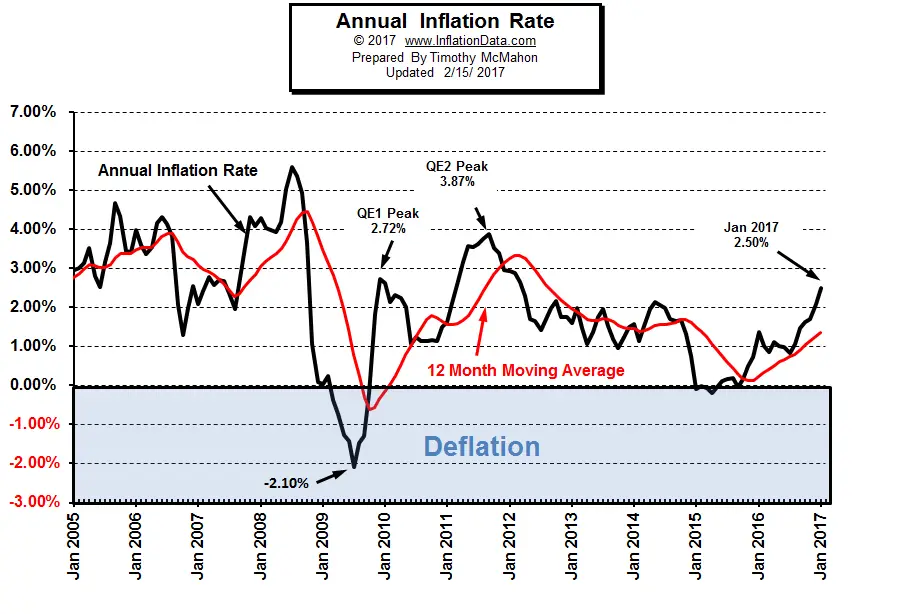

January 2017 saw a 0.6 percent hike in the Consumer Price Index, which pushed the annual inflation rate to 2.5 percent. This is the highest inflation rate in five years. The rate is higher than what many economists had anticipated. After several years of economists worrying that prices might fall, inflation has officially come back for the first time since the peak created by the massive second round of “Quantitative Easing” i.e. QE2 in 2011.

QE 1 and QE 2

The first round of Quantitative Easing (QE1) resulted in an inflation rate of 2.72% in 2010 but as soon as the monetary spigot was turned off, the inflation rate fell, so the FED instituted QE2 which then resulted in an inflation rate of 3.87% but once again when the spigot was turned off, the inflation rate fell.

What is interesting this time is that the current increase in inflation is not the result of a massive money printing campaign. The Fed has publicly stated that their target inflation rate is 2% and although they have bemoaned the “deflationary pressures” of the last few years, inflation bounced between 1% and 2% from 2012 – late 2014. But then it took another dive toward deflation causing massive “hand wringing” and concern.

Consumer Prices are Rising

Consumer Prices are Rising

But according to the U.S. Bureau of Labor Statistics (BLS), consumer prices have been rising in recent months. Most upper middle class and well-off households may be able to shrug off paying several dollars more for groceries. However, the effect of rising inflation will be felt most by low-income households. Those living paycheck to paycheck may find the coming months to be particularly difficult if inflation is not contained.

However, some working households are already experiencing rising wages due to increased competition for jobs as the unemployment rate has fallen. That seems to be offsetting some of the burden of rising consumer prices, at least for now. Retail businesses may be struggling, but retail sales were up this January by a significant 0.4 percent. Shopping was largely driven by the bargain sales of the post-holiday season.

Many industries are seeing price jumps, including apparel and transportation. Regardless, consumer confidence began rising immediately after the results of the election were announced despite all the anti-Trump riots.

Is Another Recession Around the Corner?

Inflation usually leads to an ominous outcome: recession. This time, however, economists assuaged fears that another recession might be possible anytime soon. Though current inflation rate is higher than it has been recently, it’s not as high as what was seen leading to the 2008 recession. The rising prices are very likely manageable. Typically rates above 5% become troublesome to the economy and the Fed is hinting at a rate hike intended to curb inflation should it continue rising.

Protecting Investments against Inflation and the Aftermath

Inflation drives up overall costs and reduces profits for businesses in the long term. Certain investments, like bonds, suffer most when inflation is high and the FED raises interest rates which results in falling bond prices. More worryingly, inflation can lead to bubbles that eventually burst leaving investors with worthless paper. So, the conventional advice for inflationary times is to invest in gold.

Precious metals like gold are inversely proportional to the dollar exchange rate. This means that as other currencies appreciate against the dollar, gold will increase in Dollar terms since the gold market is world-wide and currency independent. So gold can protect against currency fluctuations. More importantly, diversifying an investment portfolio with gold will hedge overall wealth against potential economic crises. Many advisers recommend to buy gold in coins, bars or bullion to protect against economic uncertainty, inflation, and currency fluctuations. The typical recommendation is that you hold from 5% to 10% of your portfolio’s value in gold. Due to gold’s inverse relationship with paper investments, this has the effect of reducing the overall volatility of your portfolio.

Inflation rose as money flows increased. The overall level of prices in 2017 will be much higher than in 2016. Then they will fall going into 2018.