Confusion Continues

The bad news is markets tend to get jittery when the Fed is preparing for a new interest rate cycle. The good news is the primary reason the Fed is contemplating raising interest rates is a strengthening U.S. economy. The question in the short run is:

The bad news is markets tend to get jittery when the Fed is preparing for a new interest rate cycle. The good news is the primary reason the Fed is contemplating raising interest rates is a strengthening U.S. economy. The question in the short run is:

Will the economy be strong enough to offset the negative impact of higher rates?

The odds of the answer being “yes” increased Thursday. From Reuters:

Gross domestic product expanded at a 4.2 percent annual rate instead of the previously reported 4.0 percent pace, the Commerce Department said on Thursday. Both business spending and exports were revised higher, while a buildup in business inventories was smaller than previously estimated – a mix of growth that provides a stronger underpinning for the remainder of the year.

Investment Implications – The Weight Of The Evidence

As of Thursday’s close, the S&P 500 was up 8 points for the week. Therefore, despite some hesitation near the overly-talked-about S&P 500 level of 2000, the bigger picture has improved this week. We continue to hold a mix of U.S. stocks (SPY), leading sectors, such as healthcare (XLV), and a relatively small complimentary stake in bonds (TLT). Friday’s economic calendar tells us to keep an open mind about how stocks close out the week:

- European Inflation Data

- Personal Income and Outlays

- Chicago PMI

- Consumer Sentiment

Friday’s Sleeper?

Since it could impact the European Central Bank’s next move, we should not overlook Friday morning’s report on European prices. From MarketWatch:

The euro-zone consumer-price index due Friday morning is not only expected to come in at a multi-year low, but could also hold the key for future monetary easing from the European Central Bank. ECB President Mario Draghi already hinted last Friday that full-on asset purchases could be in store if the euro-zone doesn’t move out of the low-inflation danger zone.

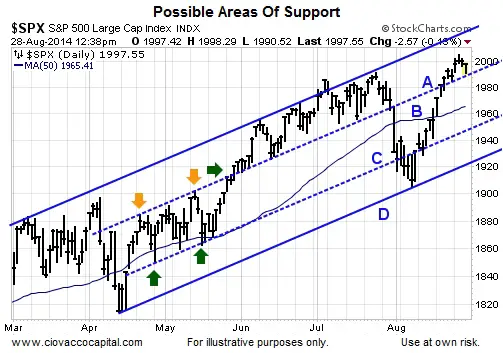

Levels A, B, C, and D on the chart of the S&P 500 below may attract buyers if Friday’s data brings out the bears.

This article originally appeared here.

Leave a Reply